Sagility India Limited is gearing up for its initial public offering (IPO) with dates set for November 5-7, 2024. With an offer price band between ₹28-30 per share, this IPO could attract a variety of investors, especially those interested in the healthcare sector. In this blog, we’ll cover all you need to know about the Sagility India IPO, from important dates to the financials and current Sagility India IPO GMP today.

Sagility India IPO Details

Sagility India, previously known as Berkmeer India, is a healthcare services company with a strong focus on technology. Here’s a quick look at the IPO details:

| IPO Component | Details |

|---|---|

| Opening Date | November 5, 2024 |

| Closing Date | November 7, 2024 |

| Price Band | ₹28-30 per share |

| Lot Size | 500 shares |

| Minimum Investment | Approximately ₹15,000 (500 shares) |

| Total Issue Size | ₹2,107 crore (70.22 crore equity shares) |

| Allocation for QIBs | 75% |

| Allocation for NIIs | 15% |

| Allocation for Retail | 10% |

| Employee Reservation | 1.9 million shares at a ₹2 discount |

| Allotment Date | November 8, 2024 |

| Listing Date | November 12, 2024 |

| Stock Exchanges | BSE and NSE |

This IPO is purely an offer-for-sale (OFS) by Sagility B.V., meaning that all proceeds from the IPO will go to the selling shareholder, not Sagility India itself.

Sagility India IPO Subscription

Investors are showing keen interest in the healthcare services sector, and Sagility India IPO subscription could see strong demand due to its established market position and client base. Here’s a breakdown of the investor quota for subscription:

- Qualified Institutional Buyers (QIBs): 75%

- Non-Institutional Investors (NIIs): 15%

- Retail Investors: 10%

For retail investors, the minimum application is for 500 shares, or one lot, costing approximately ₹15,000 at the higher end of the price band. The maximum investment for retail investors is capped at ₹2 lakh.

Important Subscription Dates

- Anchor Investor Bidding: November 4, 2024

- Public Bidding Period: November 5-7, 2024

Sagility India IPO GMP Today

One of the hottest topics for investors is the Sagility India IPO GMP today. The grey market premium (GMP) reflects investor interest before the shares are listed on the stock exchange. The Sagility India IPO GMP today is ₹0.30 per share, meaning there hasn’t been a noticeable price movement in the unlisted shares. This neutral GMP suggests a cautious approach from investors, likely as they wait to see the final subscription figures.

Sagility India Business Overview

Sagility India provides essential business process management (BPM) services, focusing on the healthcare sector in the U.S. Here’s a quick overview of its core services:

- Claims Administration: Manages insurance claims to streamline processing and reduce errors.

- Clinical Services: Supports clinical operations such as case management and patient engagement.

- Provider Solutions: Helps hospitals, physicians, and diagnostic firms improve their operations.

- Payment Integrity: Ensures accurate payments from health insurers to providers.

- Analytics: Uses data analytics to support decision-making and boost operational efficiency.

The company has built strong, long-term relationships with clients, including five of the largest U.S. health insurers, with an average client tenure of 17 years. In recent years, Sagility India has added 20 new clients, further expanding its reach.

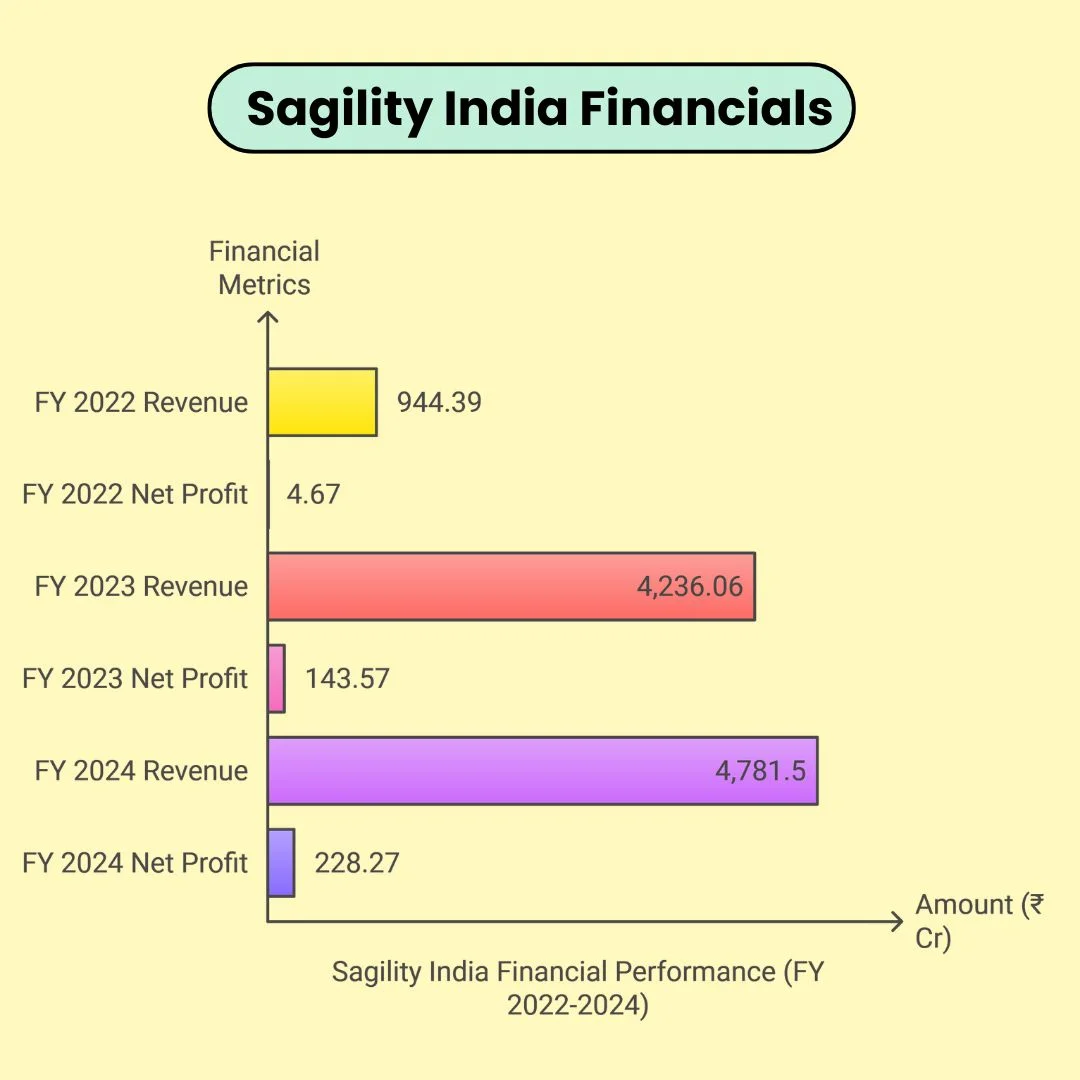

Sagility India Financials

Financial Performance Snapshot

For the fiscal year ending March 31, 2024:

- Revenue: ₹4,781.5 crore

- Net Profit: ₹228.27 crore

For the quarter ending June 30, 2024:

- Revenue: ₹1,257.76 crore

- Net Profit: ₹22.29 crore

| Period | Revenue (₹ Cr) | Expenses (₹ Cr) | Net Profit (₹ Cr) | Assets (₹ Cr) |

|---|---|---|---|---|

| FY 2022 | 944.39 | 733.82 | 4.67 | 10,096.28 |

| FY 2023 | 4,236.06 | 3,191.20 | 143.57 | 10,590.48 |

| FY 2024 | 4,781.5 | 3,665.47 | 228.27 | 10,664.2 |

Sagility’s revenue has shown a steady increase over recent years, supported by long-term client relationships and continuous growth in customer acquisition.

Key Financial Ratios

- EBITDA Margin: 22.9%

- PAT Margin: 12.4%

- Debt to Equity Ratio: 0.34

- Return on Net Worth (RoNW): 3.54%

Sagility India IPO Review

Sagility India offers investors an opportunity to invest in a company with a strong market presence in U.S. healthcare services. The IPO proceeds will go to the existing shareholders as it’s entirely an offer-for-sale (OFS) by the promoters.

While the Sagility India IPO GMP today remains flat, the company’s fundamentals and steady financials could make it an attractive choice for those interested in long-term growth in the healthcare services sector. Sagility’s focus on technology-driven services and a robust client base in the U.S. healthcare market are positive indicators for future growth.

Sagility India IPO Allotment and Listing Details

Key Dates for IPO Allotment and Listing

- Basis of Allotment: November 8, 2024

- Refund Initiation: November 9, 2024

- Credit of Shares to Demat Accounts: November 11, 2024

- Listing Date: November 12, 2024 (BSE and NSE)

Allotment Quotas

Sagility India’s IPO includes allocations for different investor categories as follows:

- QIBs: 75% of the offer

- NIIs: 15%

- Retail Investors: 10%

Additionally, the company has reserved 1.9 million shares for its employees at a discounted rate of ₹2 per share.

Sagility India IPO FAQs

Here are answers to some common questions on the Sagility India IPO.

1. What is the Sagility India IPO GMP today?

- Sagility India IPO GMP today is ₹0.30, meaning there’s currently no significant movement in grey market prices.

2. What are the IPO opening and closing dates?

- The IPO opens on November 5, 2024, and closes on November 7, 2024.

3. What is the price band for the IPO?

- The price band is set at ₹28-30 per share.

4. What is the minimum investment required?

- The minimum investment for one lot is approximately ₹15,000 for 500 shares.

5. How much is Sagility India aiming to raise?

- The IPO aims to raise around ₹2,107 crore through an offer-for-sale by Sagility B.V.

6. Who are the lead managers for the IPO?

- The book-running lead managers include ICICI Securities, IIFL Securities, Jefferies India, and JP Morgan India.

7. When will the shares be listed?

- The listing date is expected on November 12, 2024.

8. Is there a reservation for employees?

- Yes, 1.9 million shares are reserved for eligible employees at a ₹2 discount per share.

9. What are the key financial metrics?

- EBITDA Margin: 22.9%, PAT Margin: 12.4%, Debt to Equity: 0.34, RoNW: 3.54%.

10. What are the key services Sagility India provides?

- Sagility provides BPM services, claims administration, clinical support, and analytics, primarily to U.S. healthcare payers and providers.

Disclaimer

The Sagility India IPO is anticipated to be an exciting opportunity for investors interested in the healthcare BPM sector. The company’s steady growth, established U.S. healthcare client base, and technology-driven approach position it well for future success. Keep an eye on the Sagility India IPO GMP today and other important dates as the subscription period approaches.