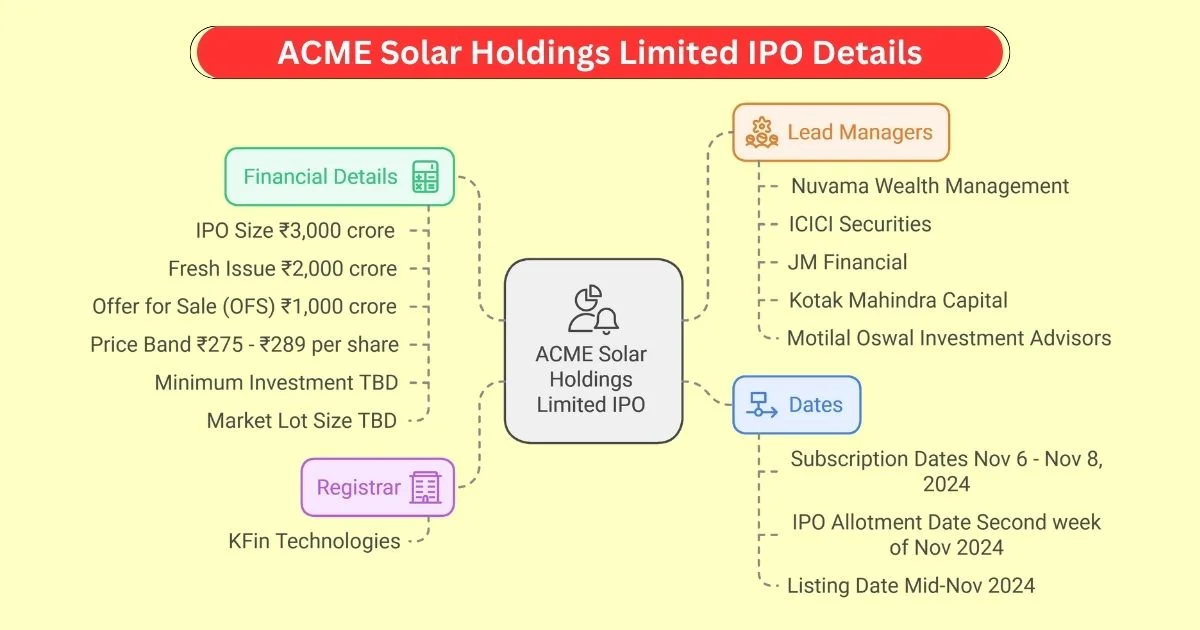

ACME Solar Holdings Limited, a prominent name in India’s renewable energy sector, is ready to launch its much-anticipated IPO. This initial public offering aims to raise around ₹3,000 crore, drawing substantial interest from investors. With a fresh issue of equity shares worth ₹2,000 crore and an Offer for Sale (OFS) of about ₹1,000 crore from its promoters, this IPO could be a big player in the renewable energy sector. In this blog, we’ll take a close look at ACME Solar Holdings Limited IPO GMP today, along with key details, subscription information, business overview, financial performance, allotment process, and frequently asked questions.

ACME Solar Holdings Limited IPO Details

Let’s start with an overview of the essential IPO details, including the issue size, price band, subscription dates, and more. Here’s a table summarizing the key information on ACME Solar Holdings Limited IPO GMP today.

| Particulars | Details |

|---|---|

| IPO Size | ₹3,000 crore |

| Fresh Issue | ₹2,000 crore |

| Offer for Sale (OFS) | ₹1,000 crore |

| Price Band | Expected to be between ₹275 and ₹289 per share |

| Subscription Dates | November 6 to November 8, 2024 |

| Minimum Investment | TBD |

| IPO Allotment Date | Expected in the second week of November 2024 |

| Listing Date | Mid-November 2024 |

| Registrar | KFin Technologies |

| Book Running Lead Managers | Nuvama Wealth Management, ICICI Securities, JM Financial, Kotak Mahindra Capital, Motilal Oswal Investment Advisors |

| Market Lot Size | TBD |

This IPO is generating attention due to ACME Solar’s leading role in India’s renewable energy drive. Investors should keep an eye on ACME Solar Holdings Limited IPO GMP today for an indication of market sentiment closer to the listing date.

ACME Solar Holdings IPO Subscription

The subscription window for the ACME Solar IPO is set from November 6 to November 8, 2024. Given the company’s rapid growth and expansion in renewable energy, the subscription rates across Qualified Institutional Buyers (QIBs), Non-Institutional Investors (NIIs), and Retail Individual Investors (RIIs) are expected to be robust.

As of now, here is the allocation breakdown for each category:

- QIBs: 75% of the total shares

- NIIs: 15% of the total shares

- RIIs: 10% of the total shares

ACME Solar Holdings Limited IPO GMP Today

The Grey Market Premium (GMP) serves as a useful metric to gauge market sentiment prior to an IPO’s debut on the stock exchange. Currently, ACME Solar Holdings Limited IPO GMP today is ₹0, indicating a neutral investor sentiment. GMPs can fluctuate as the IPO date nears, so checking updates on ACME Solar Holdings Limited IPO GMP today will be crucial for investors who want a closer look at the IPO’s potential demand.

ACME Solar Holdings Limited Business Overview

ACME Solar, established in 2015, has become a powerhouse in India’s renewable energy space, especially within solar energy. Their portfolio includes a mix of solar, wind, and hybrid projects, with a current operational capacity of 1,320 MW (1,802 MWp) and another 2,220 MW under construction. Here’s a breakdown of their portfolio:

- Solar Power: ACME Solar’s primary focus, holding a large share of their total capacity.

- Wind Power: Includes a project of 150 MW.

- Hybrid and FDRE Projects: Provides a reliable and consistent power supply with a combination of solar, wind, and other technologies.

Through their power purchase agreements (PPAs), ACME Solar supplies electricity to state and central government-backed entities, making their revenue stream relatively secure.

ACME Solar Holdings Limited Financials

The financial performance of ACME Solar has shown impressive growth over the last few years. Here’s a detailed look at key metrics from their financial records.

| Metric | FY 2024 (₹ million) | FY 2023 (₹ million) | FY 2022 (₹ million) |

|---|---|---|---|

| Total Revenue | 14,751.60 | 8,972.13 | 11,013.84 |

| Profit After Tax (PAT) | 934.42 | 192.15 | 997.44 |

| Net Profit | 698.22 | -3.15 | 62.23 |

| Total Expenses | 1,305.48 | 1,416.21 | 1,789.86 |

Revenue Growth: In FY24, ACME Solar’s revenue reached approximately ₹14,751.60 million, showing a substantial rise from the previous fiscal year.

Profit Recovery: Net profit for FY24 surged to ₹698.22 million after a loss of ₹3.15 million in FY23. ACME Solar managed this by optimizing expenses and securing high-yield projects.

Expense Management: Total expenses dropped to ₹1,305.48 million in FY24, helping ACME Solar improve its profitability.

ACME Solar Holdings IPO Review

Investors are particularly interested in ACME Solar’s IPO due to:

- Renewable Energy Expansion: With the Indian government’s push toward sustainable energy, ACME Solar is positioned well to benefit from this policy shift.

- Financial Resilience: Recovering from a past net loss to become profitable demonstrates effective financial management.

- Strategic Land Assets: ACME Solar has acquired over 15,000 acres for project expansion, which will allow it to scale further as energy demand grows.

However, it’s important to consider the risks outlined in the Draft Red Herring Prospectus (DRHP), including project location concentration, regulatory challenges, and the potential volatility in PPA agreements.

ACME Solar Holdings Ltd IPO Allotment

Allotment of shares for ACME Solar IPO is anticipated in the second week of November 2024. Investors can check their allotment status through:

- Angel One: Log in to the Angel One app, access the IPO section, and view individual order details for allotment status.

- Registrar (KFin Technologies): Enter the application ID or PAN number on KFin Technologies’ website to view allotment status.

Allotment confirmation will be shared via push notifications, email, and SMS as well.

Frequently Asked Questions (FAQs)

1. What is the ACME Solar Holdings Limited IPO GMP today?

- As of now, ACME Solar Holdings Limited IPO GMP today is ₹0. This means there’s currently no premium in the grey market, indicating neutral demand.

2. What is the ACME Solar Holdings Limited IPO size?

- The total IPO size is ₹3,000 crore, with ₹2,000 crore from fresh issue shares and ₹1,000 crore as an Offer for Sale (OFS) from promoters.

3. When will the ACME Solar IPO open for subscription?

- The IPO is open for subscription from November 6 to November 8, 2024.

4. How do I apply for the ACME Solar IPO?

- You can apply through banks, brokers, or online trading apps, completing the application with PAN and bank details.

5. What is the ACME Solar IPO price band?

- The price band is expected to be between ₹275 and ₹289 per share.

6. When will shares be allotted, and how do I check the allotment?

- Shares are expected to be allotted in the second week of November 2024. You can check the status on Angel One or KFin Technologies’ website.

7. When will ACME Solar Holdings be listed on stock exchanges?

- The expected listing date is mid-November 2024 on both BSE and NSE.

8. What are the main risks in ACME Solar IPO?

- Key risks include regulatory changes, dependency on a limited number of clients, and concentration in specific states.

9. How much of the IPO is allocated to each investor category?

- 75% for QIBs, 15% for NIIs, and 10% for RIIs.

10. What are ACME Solar’s growth plans?

- With ongoing expansion and significant investments in renewable projects, ACME Solar aims to capitalize on the rise in demand for sustainable energy.

Conclusion

The ACME Solar Holdings Limited IPO is a landmark offering in the renewable energy sector, drawing attention for its robust business model and growth potential. For investors tracking the ACME Solar Holdings Limited IPO GMP today, current figures indicate neutral sentiment, though this may change as the IPO date nears.