Investors keen on NHPC are often interested in its daily price movements, with an eye on the NHPC share price target tomorrow as well as its long-term growth potential. NHPC, a major player in hydroelectric and renewable energy in India, benefits from strong government support, fueling its projects and market performance. In this blog, we’ll explore NHPC’s monthly share price targets for the upcoming years 2024, 2025, 2026, 2030, and 2040. From detailed month-by-month projections to an overview of NHPC’s financial performance, this guide covers it all. Let’s dive into the NHPC share price targets for each year, along with an analysis of its growth outlook.

NHPC Share Price Target Tomorrow and Overview

NHPC’s robust plans in renewable energy, paired with increasing government backing for green projects, suggest promising future returns. Whether you’re interested in the NHPC share price target tomorrow or the projected share prices over the coming years, our analysis covers expected trends and factors influencing these targets.

NHPC Share Price History

Historically, NHPC has delivered significant returns, underscoring its value in the renewable sector:

- 52-week high: ₹118.40

- 52-week low: ₹48.40

- Price as of July 26, 2024: ₹104.55

NHPC Share Price Target 2024

| Month | Minimum Target (₹) | Maximum Target (₹) | Average Target (₹) |

|---|---|---|---|

| November | 90 | 120 | 105 |

| December | 92 | 125 | 108.5 |

Analysts forecast the share price for November and December 2024 could range between ₹90 and ₹125, backed by NHPC’s clean energy initiatives and government support for hydro projects.

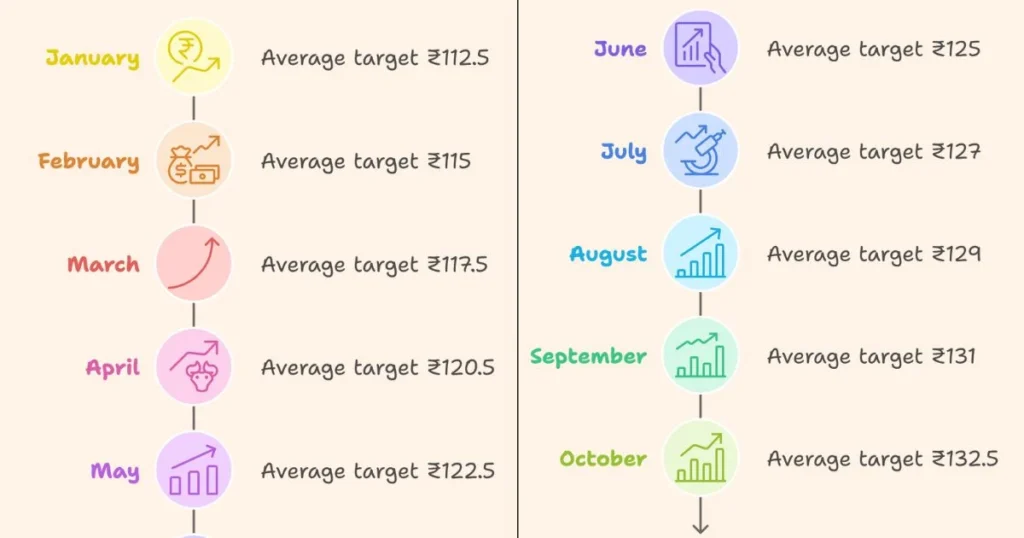

NHPC Share Price Target 2025

| Month | Minimum Target (₹) | Maximum Target (₹) | Average Target (₹) |

|---|---|---|---|

| January | 95 | 130 | 112.5 |

| February | 98 | 132 | 115 |

| March | 100 | 135 | 117.5 |

| April | 103 | 138 | 120.5 |

| May | 105 | 140 | 122.5 |

| June | 108 | 142 | 125 |

| July | 110 | 144 | 127 |

| August | 112 | 146 | 129 |

| September | 114 | 148 | 131 |

| October | 115 | 150 | 132.5 |

| November | 116 | 152 | 134 |

| December | 118 | 155 | 136.5 |

For 2025, NHPC’s share price target shows gradual growth, potentially reaching ₹155 by December as NHPC continues to invest in clean energy.

NHPC Share Price Target 2026

| Month | Minimum Target (₹) | Maximum Target (₹) | Average Target (₹) |

|---|---|---|---|

| January | 120 | 157 | 138.5 |

| February | 122 | 160 | 141 |

| March | 125 | 163 | 144 |

| April | 128 | 165 | 146.5 |

| May | 130 | 168 | 149 |

| June | 132 | 170 | 151 |

| July | 135 | 172 | 153.5 |

| August | 137 | 174 | 155.5 |

| September | 140 | 176 | 158 |

| October | 142 | 178 | 160 |

| November | 144 | 180 | 162 |

| December | 145 | 183 | 164 |

In 2026, NHPC’s share price is expected to continue its growth path, likely reaching a maximum of ₹183 by December due to increased renewable energy capacities.

NHPC Share Price Target 2030

With long-term projections based on NHPC’s growth in renewable energy, these targets are influenced by NHPC’s diversification efforts, operational improvements, and government support.

| Month | Minimum Target (₹) | Maximum Target (₹) | Average Target (₹) |

|---|---|---|---|

| January | 150 | 190 | 170 |

| February | 155 | 195 | 175 |

| March | 160 | 200 | 180 |

| April | 165 | 205 | 185 |

| May | 170 | 210 | 190 |

| June | 175 | 215 | 195 |

| July | 180 | 220 | 200 |

| August | 185 | 225 | 205 |

| September | 190 | 230 | 210 |

| October | 195 | 235 | 215 |

| November | 200 | 240 | 220 |

| December | 205 | 245 | 225 |

Analysts anticipate NHPC’s share price could be around ₹245 by December 2030, as NHPC capitalizes on renewable energy growth.

NHPC Share Price Target 2040

| Month | Minimum Target (₹) | Maximum Target (₹) | Average Target (₹) |

|---|---|---|---|

| January | 490 | 550 | 520 |

| February | 500 | 560 | 530 |

| March | 510 | 580 | 545 |

| April | 520 | 600 | 560 |

| May | 530 | 620 | 575 |

| June | 540 | 640 | 590 |

| July | 560 | 660 | 610 |

| August | 580 | 680 | 630 |

| September | 600 | 700 | 650 |

| October | 800 | 850 | 825 |

| November | 1000 | 1100 | 1050 |

| December | 1050 | 1200 | 1125 |

For 2040, NHPC’s share price could potentially reach a peak of ₹1200 by December due to long-term commitments to renewable energy.

NHPC’s Financials and Business Overview

NHPC’s financial growth has been steady over recent years:

- Revenue (2023): ₹117,353 million (11.4% increase from FY2022)

- Net Profit (2023): ₹42,347 million (12.2% increase from FY2022)

- 5-Year Return: Approximately 365.7% from 2019 to 2024

This financial performance reflects NHPC’s strong foundation and growth trajectory in hydro and renewable energy.

FAQs on NHPC Share Price Targets

Q1: What is the NHPC share price target tomorrow?

A1: The NHPC share price target tomorrow varies based on market conditions but is generally aligned with trends in renewable energy and government policies.

Q2: What is the expected NHPC share price target for 2025?

A2: In 2025, monthly targets range from ₹95 in January to ₹155 in December, reflecting gradual growth.

Q3: What is NHPC’s long-term price target for 2040?

A3: For 2040, NHPC’s share price could range between ₹1050 to ₹1200 by December, driven by expansion into renewable energy.

The NHPC share price target tomorrow and monthly projections offer insights into its promising growth potential. With NHPC’s ongoing focus on renewable energy, these forecasts indicate a positive future for both short- and long-term investors.