Rosmerta Digital Services Limited is about to launch its highly anticipated Initial Public Offering (IPO). This IPO is set to open on November 18, 2024, and is generating a lot of attention in the market. In this blog, we’ll explore everything you need to know about the Rosmerta Digital Services IPO GMP (Grey Market Premium), the subscription details, financial performance, and much more.

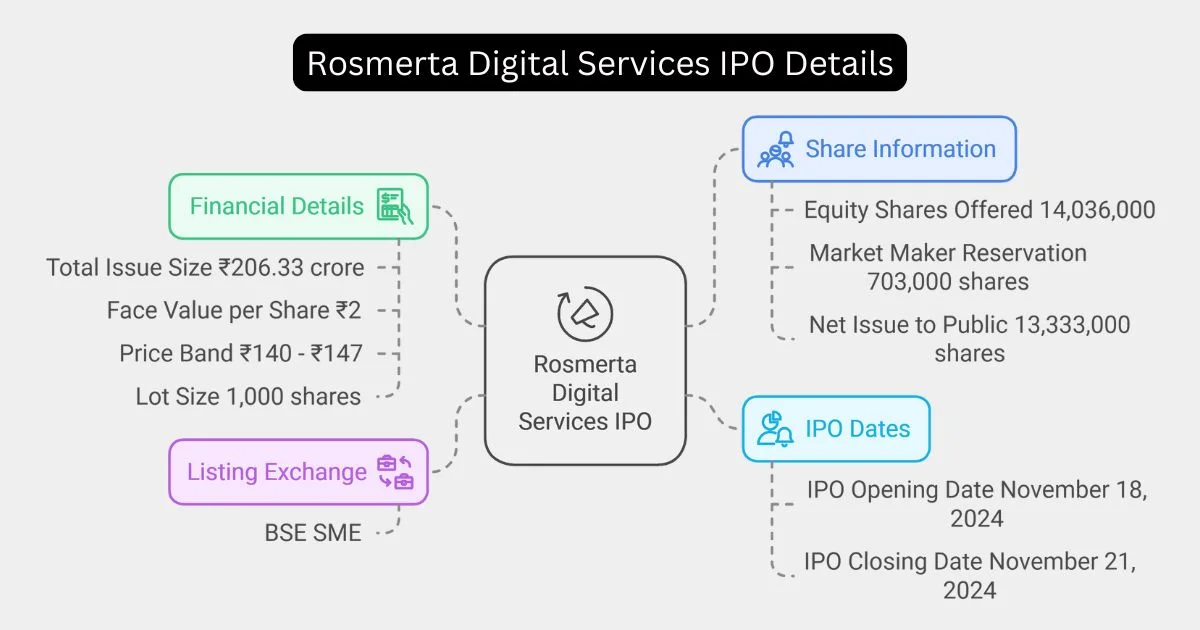

Rosmerta Digital Services IPO Details

The Rosmerta Digital Services IPO is expected to bring up to ₹206.33 crore, with around 14,036,000 equity shares available for sale. Below are the key details:

| IPO Element | Details |

|---|---|

| Total Issue Size | ₹206.33 crore |

| Equity Shares Offered | 14,036,000 |

| Face Value per Share | ₹2 |

| Price Band | ₹140 – ₹147 |

| Market Maker Reservation | 703,000 shares |

| Net Issue to Public | 13,333,000 shares |

| IPO Opening Date | November 18, 2024 |

| IPO Closing Date | November 21, 2024 |

| Listing Exchange | BSE SME |

| Lot Size | 1,000 shares (₹140,000 – ₹147,000 approx.) |

This IPO is set to make up about 26.44% of Rosmerta Digital Services’ post-issue paid-up equity.

Rosmerta Digital Services IPO Subscription

The subscription for the Rosmerta Digital Services IPO will be open to several investor categories. A total of 703,000 shares are reserved for market makers, and the remaining 13,333,000 shares are available for the public. This distribution looks to attract a mix of investors:

- Qualified Institutional Buyers (QIBs): Up to 50% of the net offer.

- Retail Individual Investors (RIIs): At least 35% of the net issue.

- Non-Institutional Investors (NIIs): At least 15% of the net issue.

Investors can apply in lots of 1,000 shares, which translates to a minimum investment of approximately ₹147,000 at the upper end of the price band.

Rosmerta Digital Services IPO GMP Today

As of today, November 3, 2024, the Rosmerta Digital Services IPO GMP is reported to be around ₹22 per share. This figure gives potential investors an indication of how the IPO is perceived in the grey market. A positive GMP shows a favorable sentiment, suggesting that investors expect the stock to perform well post-listing.

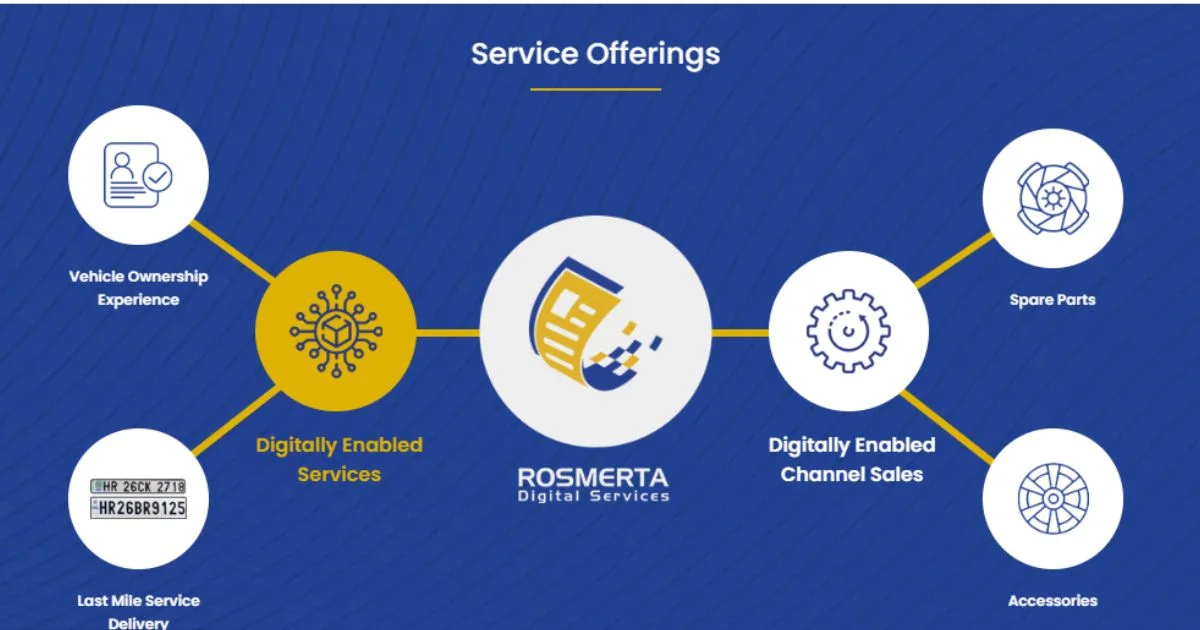

Rosmerta Digital Services Business Overview

Rosmerta Digital Services Limited operates in the digital solutions market, specifically focusing on digital identity, electronic payment systems, and data management services. They offer:

- Digital Identity Solutions: They provide secure digital identity services, essential for both government and private sectors.

- Electronic Payment Systems: Their electronic payment platforms support the growing trend of cashless transactions in India.

- Data Management: Their data management services help businesses and institutions use data effectively to make informed decisions.

By investing heavily in R&D and technological advancements, Rosmerta Digital Services aims to enhance India’s digital economy while ensuring security and ease of use.

Rosmerta Digital Services Financials

Rosmerta Digital Services has demonstrated solid growth in recent years, making the Rosmerta Digital Services IPO GMP a strong point of interest. Let’s look at their recent quarterly and annual financials:

Quarterly Financials (As of September 30, 2024)

- Total Assets: ₹10,013.07 lakh

- Revenue: ₹9,253.57 lakh

- Profit After Tax (PAT): ₹1,483.72 lakh

- Net Worth: ₹7,099.34 lakh

Annual Financials

| Financial Year | Total Assets (₹ lakh) | Revenue (₹ lakh) | Profit After Tax (₹ lakh) | Net Worth (₹ lakh) | Reserves and Surplus (₹ lakh) | Total Borrowing (₹ lakh) |

|---|---|---|---|---|---|---|

| FY 2024 | 3,744.53 | 8,419.07 | 1,056.52 | 1,221.32 | 1,220.32 | 1,499.01 |

| FY 2023 | 1,932.43 | 2,978.91 | 161.87 | 159.16 | 158.16 | 1,318.28 |

| FY 2022 | 557.14 | 202.70 | -3.01 | -2.01 | -3.01 | 439.21 |

Key financial indicators for Rosmerta Digital Services include a significant rise in both revenue and profitability. Here’s a quick summary of their ratios:

- Return on Equity (ROE): 20.72%

- Return on Capital Employed (ROCE): 28%

- Profit Margin (PAT): 16.08%

- Debt-to-Equity Ratio: 1.2

These metrics suggest a favorable outlook and efficient capital use, helping explain the Rosmerta Digital Services IPO GMP.

Rosmerta Digital Services IPO Review

Pros

- Rapid Revenue Growth: Strong revenue growth, especially from ₹202.7 lakh in FY 2022 to ₹9,253.57 lakh in September 2024.

- High PAT Margin: A profit margin of 16.08% reflects effective cost management.

- Market Potential: Digital identity and payment solutions are high-growth sectors, aligning well with India’s digital initiatives.

Cons

- High P/E Ratio: The IPO’s P/E ratio of approximately 54.33 might indicate an overvaluation.

- Market Volatility for SME Listings: SME stocks can experience more volatility post-listing.

Rosmerta Digital Services IPO Allotment

Key dates for Rosmerta Digital Services IPO allotment are as follows:

| Event | Date |

|---|---|

| IPO Opening Date | November 18, 2024 |

| IPO Closing Date | November 21, 2024 |

| Allotment Date | November 22, 2024 |

| Refunds Initiated | November 25, 2024 |

| Shares Credited to Demat | November 25, 2024 |

| Listing Date | November 26, 2024 |

The shares are expected to list on the BSE SME platform. Investors can check allotment status through the official website of the registrar, Link Intime India Pvt. Ltd, or the BSE website.

Rosmerta Digital Services IPO FAQs

What is the price band for the Rosmerta Digital Services IPO?

The price band for this IPO is set between ₹140 and ₹147 per share.

What is the minimum investment for retail investors?

Investors must apply in lots of 1,000 shares, requiring a minimum investment of around ₹147,000 at the upper price limit.

How is Rosmerta Digital Services IPO GMP trending?

The Rosmerta Digital Services IPO GMP is around ₹22 per share, reflecting a positive outlook.

Who are the lead managers for this IPO?

Narnolia Financial Services Ltd and Beeline Capital Advisors Pvt Ltd are the lead managers for this IPO.

Where will the shares be listed?

The shares will be listed on the BSE SME platform.

With its strong financial growth and a promising sector, the Rosmerta Digital Services IPO GMP shows that this IPO is expected to capture investor interest. However, as with any investment, potential investors should weigh the growth potential against the risks involved, particularly the higher P/E ratio.