Enviro Infra Engineers Limited is set to launch its Initial Public Offering (IPO) on November 22, 2024, with subscription closing on November 26, 2024. This IPO has generated significant interest, with an estimated Grey Market Premium (GMP) providing investors insight into anticipated listing performance. Below, we cover essential details, subscription, Enviro Infra Engineers IPO GMP today, business overview, financial highlights, and allotment information.

Enviro Infra Engineers IPO Details

| Particulars | Details |

|---|---|

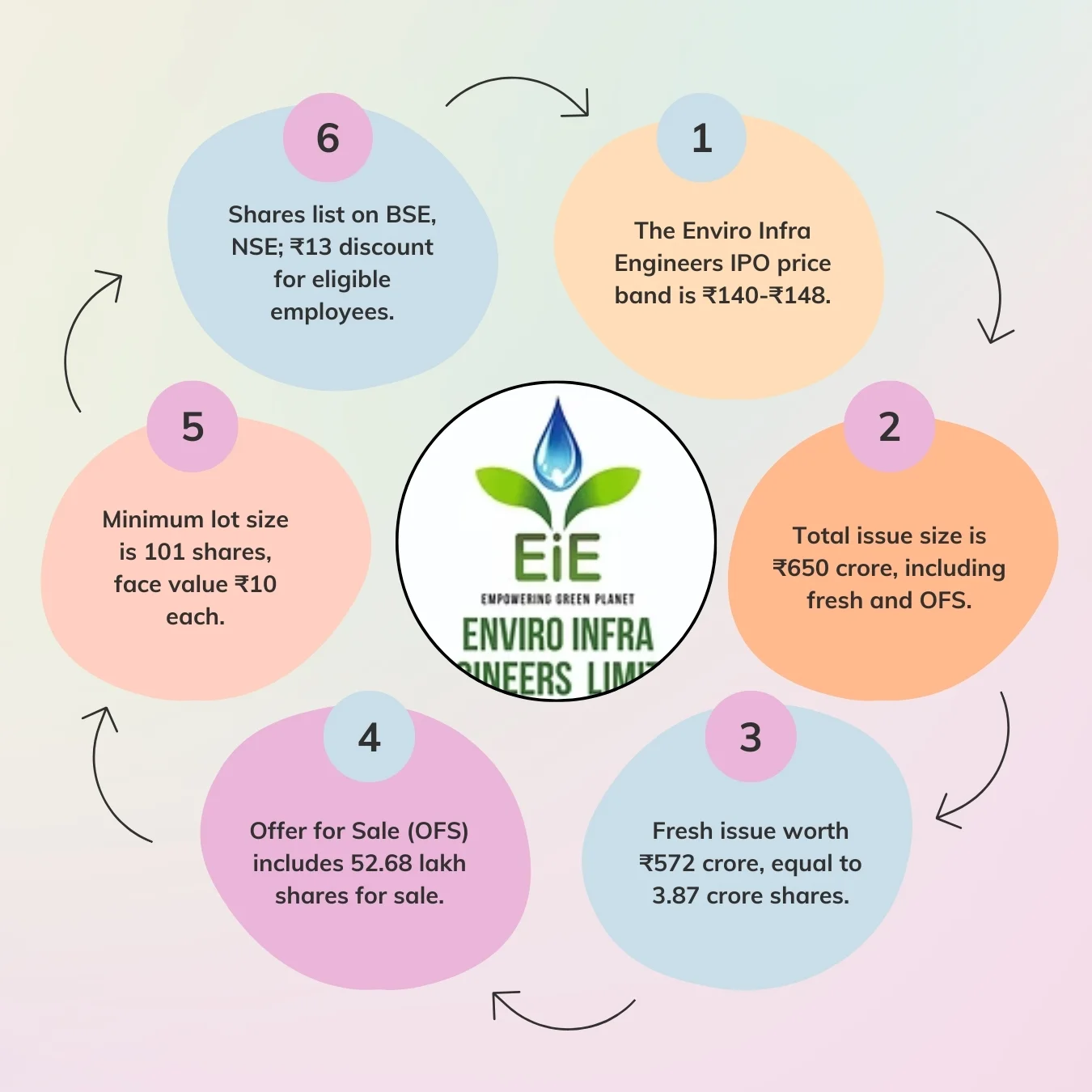

| Price Band | ₹140 to ₹148 per equity share |

| Issue Size | ₹650 crore |

| Fresh Issue | ₹572 crore or 3.87 crore shares |

| Offer for Sale (OFS) | 52.68 lakh shares |

| Lot Size | Minimum 101 shares |

| Face Value | ₹10 per share |

| Listing | BSE and NSE |

| Employee Discount | ₹13 per share for eligible employees |

Enviro Infra Subscription Breakdown

The Enviro Infra Engineers IPO allocates shares across investor categories as follows:

| Category | Percentage Allocation |

|---|---|

| Qualified Institutional Buyers (QIB) | 50% |

| Non-Institutional Investors (NII) | 15% |

| Retail Investors | 35% |

With a portion reserved for employees and a set discount, this IPO aims to attract diverse investor participation.

Enviro Infra Engineers IPO GMP Today

The current GMP for Enviro Infra Engineers IPO stands at ₹56. This premium indicates expected listing prices of ₹204 per share, based on the upper price band of ₹148. Enviro Infra Engineers IPO GMP reflects the positive sentiment among investors and highlights its potential post-listing demand.

Enviro Infra Engineers Business Overview

Enviro Infra Engineers Limited specializes in water and wastewater treatment facilities through turnkey projects. Established in 2009, the company has completed over 28 successful projects, including water supply and sewage treatment plants (STPs). These projects play a crucial role in sanitation and clean water supply, addressing pressing public and industrial needs.

Enviro Infra’s Core Services

| Service Type | Description |

|---|---|

| Turnkey Projects | Comprehensive management from design to operations. |

| Sewage Treatment | Plants critical for addressing sanitation needs. |

| Water Supply Projects | Vital to increasing clean water access across regions. |

Enviro Infra Engineers Financials

Enviro Infra Engineers IPO GMP is bolstered by strong financials:

| Financial Year | Revenue (₹ crore) |

|---|---|

| FY 2024 (9 months) | 428.25 |

| FY 2023 | 338.10 |

| FY 2022 | 223.53 |

| FY 2021 | 124.12 |

| EBITDA Margin | 24.16% |

Enviro Infra’s Order Book

As of June 2024, Enviro Infra Engineers held an order book valued at around ₹1,906.3 crore, showcasing a robust pipeline.

Use of IPO Proceeds

Funds from the IPO will be directed towards:

| Purpose | Amount (₹ crore) |

|---|---|

| Working Capital Requirements | 181 |

| New STP Construction in Mathura | 30 |

| Debt Repayment | 120 |

| Inorganic Growth and General Purposes | Remaining funds |

These allocations show the company’s focus on financial stability and expansion.

Review of Enviro Infra Engineers IPO GMP

Enviro Infra IPO GMP indicates a strong interest due to a well-balanced portfolio and demand for sustainable infrastructure. With a healthy revenue trajectory, good EBITDA margin, and strong project pipeline, this IPO stands out as a solid option for long-term investment in India’s water management sector.

Important Dates

| Event | Date |

|---|---|

| IPO Open Date | November 22, 2024 |

| IPO Close Date | November 26, 2024 |

| Allotment Date | November 27, 2024 |

| Credit to Demat | November 28, 2024 |

| Listing Date | November 29, 2024 |

With these dates, investors can plan for both the subscription and potential stock listing.

Allotment Information

| Event | Date |

|---|---|

| Allotment Date | November 27, 2024 |

| Refunds Initiated | November 28, 2024 |

| Credit to Demat Accounts | November 28, 2024 |

| Listing Date | November 29, 2024 |

With these dates, investors can plan for both the subscription and potential stock listing.

Frequently Asked Questions (FAQs)

What is Enviro Infra Engineers IPO GMP?

Enviro Infra Engineers IPO GMP today is estimated to be ₹56 per share.

When does Enviro Infra Engineers IPO open?

The IPO opens for subscription on November 22, 2024, and closes on November 26, 2024.

What is the price band for the IPO?

The price band is ₹140 to ₹148 per equity share, with a minimum lot size of 101 shares.

How is the IPO allocated?

| Category | Allocation |

|---|---|

| QIB | 50% |

| NII | 15% |

| Retail Investors | 35% |

Eligible employees can benefit from a ₹13 discount per share.

What is the allotment date?

The allotment date for the Enviro Infra Engineers IPO is November 27, 2024.

When is the IPO listing date?

The shares are expected to list on November 29, 2024 on both BSE and NSE.

How will IPO proceeds be used?

The funds will be used for working capital, debt repayment, and constructing new projects.

Final Words

This expanded guide provides an in-depth look at the Enviro Infra Engineers IPO, focusing on key aspects such as subscription, GMP, financials, and business overview. Investors looking to participate should keep a close eye on the GMP, as it could indicate potential post-listing performance.