NTPC Green Energy Share Price Target has become a key focus for investors as the company plans to expand its renewable energy operations. With India’s growing emphasis on clean and sustainable energy, NTPC Green Energy is in a strong position to capitalize on this trend. In this blog, we will break down the share price target year by year, including projections for 2024, 2025, 2026, 2030, and 2040.

NTPC Green Energy IPO Details

NTPC Green Energy is all set to launch its IPO, which is expected to raise significant capital for the company’s green energy expansion. With its focus on solar, wind, and hybrid energy solutions, the IPO is one of the most anticipated in the renewable energy sector.

| IPO Detail | Value |

|---|---|

| IPO Issue Size | ₹1,500 – ₹1,800 Crore |

| Issue Price | ₹100 – ₹120 per share |

| Face Value | ₹10 per share |

| Opening Date | To be announced |

| Closing Date | To be announced |

NTPC Green Energy Share Listing Price

The share listing price of NTPC Green Energy is expected to reflect the growing demand for clean energy investments. Given the company’s potential and NTPC’s backing, experts predict a premium listing.

| Listing Price Estimate | Expected Range |

|---|---|

| Initial Listing Price | ₹125 – ₹145 per share |

| First Day Gain | 15-20% above issue price |

NTPC Green Energy Company Information

NTPC Green Energy, a subsidiary of NTPC Limited, is committed to the development and expansion of renewable energy projects, including solar, wind, and hybrid power generation. The company aims to contribute significantly to India’s renewable energy goals by 2030.

| Company Overview | Details |

|---|---|

| Parent Company | NTPC Limited |

| Industry | Renewable Energy |

| Key Focus | Solar, Wind, Hybrid Power |

| Revenue Growth | Strong, expected to grow rapidly |

| Future Plans | Expansion of renewable energy projects |

NTPC Green Energy Business Overview

NTPC Green Energy plans to expand its renewable energy capacity to meet growing demand. The company is on track to diversify its energy generation mix, focusing heavily on solar and wind energy solutions.

| Business Aspect | Details |

|---|---|

| Renewable Energy Capacity | Target of 25 GW by 2030 |

| Expansion Plans | New solar and wind projects |

| Market Demand | Growing interest in clean energy |

| Government Support | Strong backing through policies |

NTPC Green Energy Shareholding Pattern

NTPC Green Energy’s shareholding pattern shows strong institutional backing, with NTPC Limited holding the majority of the shares. This provides the company with a solid financial foundation to scale its operations.

| Shareholding Category | Percentage |

|---|---|

| Promoters (NTPC Limited) | 75% |

| Public & Retail Investors | 25% |

NTPC Green Energy Financials

The financial outlook for NTPC Green Energy is robust, with significant growth expected as the company ramps up its renewable energy projects. These projects will drive revenue growth and position the company as a major player in India’s green energy transition.

| Financial Indicator | 2024 (Forecasted) | 2025 (Forecasted) | 2026 (Forecasted) |

|---|---|---|---|

| Revenue (₹ Crore) | ₹2,500 | ₹4,000 | ₹5,500 |

| Net Profit (₹ Crore) | ₹200 | ₹400 | ₹650 |

| EBITDA Margin | 18% | 22% | 25% |

NTPC Green Energy Share Price Target

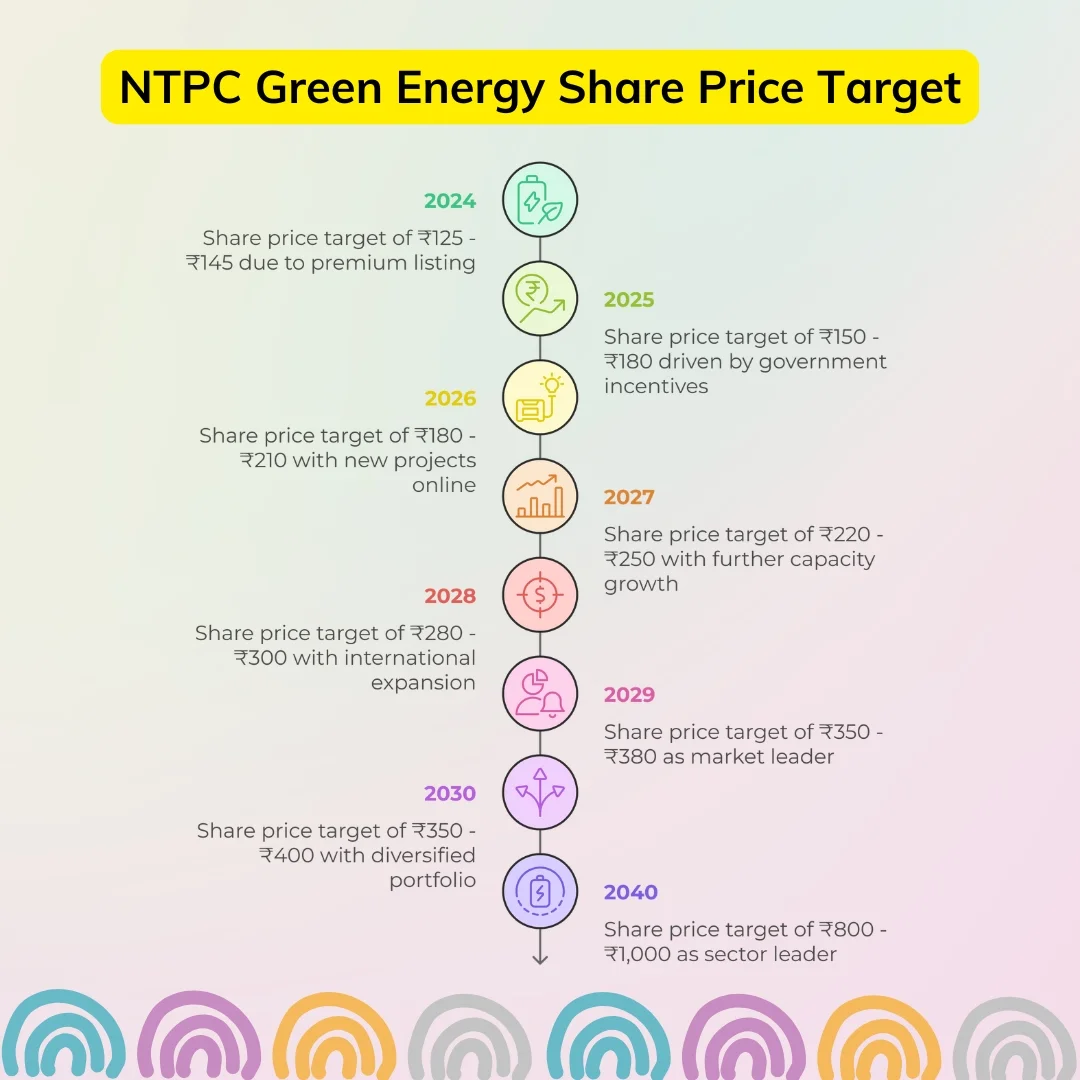

The NTPC Green Energy share price target reflects the company’s strong growth potential, especially in the renewable energy sector. The price target is projected year by year based on the company’s expansion, market demand, and government initiatives to support clean energy.

| Year | Share Price Target (₹) | Reason |

|---|---|---|

| 2024 | ₹125 – ₹145 | The company is expected to list at a premium, driven by the growing demand for renewable energy stocks. |

| 2025 | ₹150 – ₹180 | Strong growth driven by increased capacity and government incentives for green energy. |

| 2026 | ₹180 – ₹210 | More renewable projects come online, increasing revenue and market share. |

| 2027 | ₹220 – ₹250 | Further growth due to increased capacity and energy demand. |

| 2028 | ₹280 – ₹300 | Expansion into newer regions and international markets. |

| 2029 | ₹350 – ₹380 | Dominance in the Indian renewable energy market. |

| 2030 | ₹350 – ₹400 | By 2030, NTPC Green Energy is expected to have a substantial market share with its diversified energy portfolio. |

| 2040 | ₹800 – ₹1,000 | Long-term growth as the company becomes a leader in India’s renewable energy sector. |

NTPC Green Energy Share Price Target 2024 to 2040 Breakdown

NTPC Green Energy Share Price Target 2024: ₹125 – ₹145

NTPC Green Energy’s listing price is expected to be in this range. The demand for clean energy will boost the stock, with early investors likely to see a good return.

NTPC Green Energy Share Price Target 2025: ₹150 – ₹180

The company’s renewable energy projects are expected to come online, contributing significantly to revenue growth. Government policies supporting green energy will also play a crucial role.

NTPC Green Energy Share Price Target 2026: ₹180 – ₹210

As more solar and wind projects begin generating revenue, NTPC Green Energy’s share price is expected to rise further. The company’s strong financials and market position will attract more investors.

NTPC Green Energy Share Price Target 2030: ₹350 – ₹400

By 2030, NTPC Green Energy aims to have 25 GW of renewable energy capacity. As the country’s energy transition progresses, the company’s share price is expected to see substantial growth.

NTPC Green Energy Share Price Target 2040: ₹800 – ₹1,000

In the long run, NTPC Green Energy will likely emerge as a leader in India’s renewable energy sector. The company’s long-term growth is expected to be robust, with a projected share price in this range as it continues to expand its operations and dominate the market.

FAQs About NTPC Green Energy

1. What is NTPC Green Energy’s primary focus?

NTPC Green Energy focuses on renewable energy sources such as solar, wind, and hybrid power. It aims to contribute significantly to India’s clean energy goals.

2. How will NTPC Green Energy’s IPO affect its share price?

The IPO will likely lead to an initial listing at a premium, driven by strong investor interest in green energy stocks and NTPC’s backing.

3. What is the NTPC Green Energy share price target for 2024?

The NTPC Green Energy share price target for 2024 is expected to be between ₹125 and ₹145, with strong demand driving its early performance.

4. What is NTPC Green Energy’s long-term share price target?

By 2040, NTPC Green Energy’s share price is expected to reach ₹800 – ₹1,000, driven by its leadership in the renewable energy market.

Final Words

NTPC Green Energy’s focus on clean energy projects, strong government backing, and its connection to NTPC Limited make it a promising company for investors. The NTPC Green Energy share price target reflects the potential for substantial growth in the coming years, driven by expanding renewable energy capacity and the country’s shift toward sustainable energy. Whether in 2024, 2030, or 2040, NTPC Green Energy presents an exciting investment opportunity for those looking to capitalize on India’s green energy revolution.