The Property Share REIT IPO GMP is a key topic of discussion as India’s first Small and Medium Real Estate Investment Trust (SM REIT) prepares for its public offering. With a strong focus on income-generating commercial properties, this IPO has captured significant investor interest. Here’s a detailed look into the offering.

Property Share REIT IPO Details

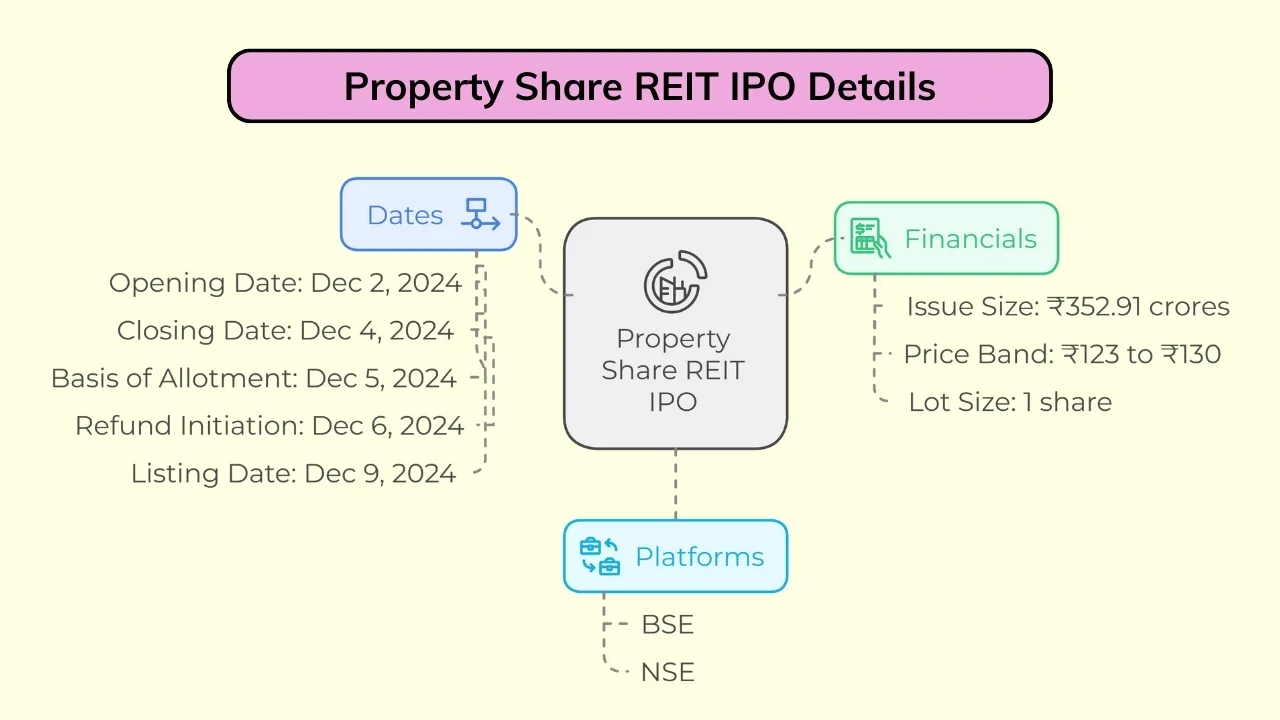

The Property Share REIT IPO is set to launch in early December 2024, offering investors a chance to participate in a professionally managed real estate trust.

| Details | Information |

|---|---|

| Opening Date | December 2, 2024 |

| Closing Date | December 4, 2024 |

| Issue Size | ₹352.91 crores |

| Price Band | ₹123 to ₹130 per share (expected) |

| Lot Size | 1 share |

| Listing Platforms | BSE and NSE |

| Basis of Allotment Date | December 5, 2024 |

| Refund Initiation Date | December 6, 2024 |

| Listing Date | December 9, 2024 |

Subscription Details

The Property Share REIT IPO allows participation across three investor categories:

- Qualified Institutional Buyers (QIBs)

- Non-Institutional Investors (NIIs)

- Retail Individual Investors (RIIs)

Retail investors can apply for a minimum of 1 lot. Based on the price band, the minimum investment ranges from ₹123 to ₹130.

Property Share REIT IPO GMP Today

The Property Share REIT IPO GMP stands at ₹0. This neutral premium reflects cautious market sentiment as investors await further clarity on pricing and the broader market environment.

Business Overview

The Property Share REIT is a regulated trust focused on acquiring completed, revenue-generating commercial properties. Managed under the PropShare Platina scheme, the REIT offers transparency and stability.

Key Features

- Targeted Investments: Prioritizes premium, income-generating commercial real estate, reducing the risks associated with under-construction assets.

- Technology Integration: Utilizes advanced tools for real-time monitoring and efficient asset management.

- Experienced Team: Managed by PropShare Investment Manager Private Limited, known for its expertise in real estate fund management.

Strategic Advantage

Being the first SM REIT in India, the Property Share REIT IPO is well-positioned to tap into the growing demand for professionally managed real estate investments. Its focus on urban commercial properties like those in Bangalore ensures a steady rental income stream.

Financial Overview

The Property Share REIT IPO emphasizes income stability through rent-generating assets. While detailed financial metrics like Earnings Per Share (EPS) and Return on Net Worth (RoNW) are yet to be disclosed, the trust’s focus on operational properties reduces uncertainty.

Review

Strengths

- First-mover advantage as India’s first SM REIT.

- SEBI-regulated structure ensuring transparency and governance.

- Experienced management team with a strong track record.

- Focus on revenue-generating properties minimizes risks.

Risks

- The current Property Share REIT IPO GMP of ₹0 suggests cautious sentiment.

- Regulatory changes could impact operations.

- Dependence on urban commercial property performance.

Allotment Details

| Event | Date |

|---|---|

| Basis of Allotment | December 5, 2024 |

| Refund Initiation | December 6, 2024 |

| Shares Credited to Demat | December 8, 2024 |

| Listing Date | December 9, 2024 |

FAQs

What is the Property Share REIT IPO?

It is India’s first Small and Medium Real Estate Investment Trust (SM REIT) raising ₹352.91 crores to acquire revenue-generating commercial properties.

What is the opening and closing date for the IPO?

The IPO opens on December 2, 2024, and closes on December 4, 2024.

What is the price band for the IPO?

The expected price band is between ₹123 and ₹130 per share.

What is the minimum investment for the Property Share REIT IPO?

Retail investors can apply for a minimum of 1 lot, requiring an investment between ₹123 and ₹130.

What is the current Property Share REIT IPO GMP?

As of today, the Property Share REIT IPO GMP is ₹0, reflecting neutral market sentiment.

What makes the REIT unique?

As India’s first SM REIT, it offers exposure to professionally managed, income-generating real estate under SEBI regulation.

When will the shares be allotted?

The allotment date is December 5, 2024, with refunds initiated on December 6, and shares credited to demat accounts on December 8.

Where will the shares be listed?

The shares will be listed on the BSE and NSE on December 9, 2024.

What are the potential risks of this IPO?

Key risks include cautious GMP, regulatory challenges, and reliance on urban commercial property performance.

How does this REIT benefit investors?

The REIT offers stable rental income, potential capital appreciation, and professional asset management.

Conclusion

The Property Share REIT IPO GMP may currently reflect cautious optimism, but the offering presents a significant opportunity for investors to enter the real estate sector. With its focus on revenue-generating properties, experienced management, and SEBI-regulated structure, the IPO aligns with the needs of both conservative and growth-oriented investors. As listing day approaches, monitoring market sentiment and GMP trends will be essential for informed decision-making.