Suraksha Diagnostic Limited, a leading diagnostic service provider in Eastern India, has become a key focus for investors following its IPO. Specializing in pathology, radiology, and medical consultation, the company operates in a rapidly growing healthcare sector. This blog explores its IPO details, company overview, financial performance, and yearly month-wise Suraksha Diagnostic share price targets from 2024 to 2040.

Suraksha Diagnostic IPO Details

| Parameter | Details |

|---|---|

| IPO Size | ₹846.25 crore |

| Price Band | ₹420-₹441 per share |

| Lot Size | 34 shares (₹14,994 minimum investment) |

| IPO Opening Date | November 29, 2024 |

| IPO Closing Date | December 3, 2024 |

| Allotment Date | December 4, 2024 |

| Listing Date | December 6, 2024 |

The IPO is entirely an offer for sale and provides an opportunity for investors to gain exposure to the diagnostics sector, which is projected to grow at a CAGR of 10–12% between FY2024 and FY2028.

Suraksha Diagnostic Company Details

| Incorporated | 2005 |

|---|---|

| Headquarters | Kolkata, West Bengal |

| Operational Network | 49 diagnostic centers, 8 satellite labs, 215 customer touchpoints |

| Accreditations | College of American Pathologists (CAP), NABL certified |

Suraksha Diagnostic offers a comprehensive range of diagnostic tests, including over 2,300 pathology and radiology services. Its integrated service model includes pathology, radiology, and medical consultation through associated polyclinics.

Suraksha Diagnostic Business Overview

Suraksha follows a hub-and-spoke business model, with a central reference laboratory supported by satellite labs and customer touchpoints.

| Key Services | Details |

|---|---|

| Pathology Tests | Biochemistry, hematology, histopathology, molecular pathology |

| Radiology Services | X-rays, ultrasonography, CT scans, MRIs |

| Consultation | General and super-specialty medical consultations |

Approximately 94% of its revenue is generated from the B2C segment, primarily catering to individual patients. The company plans to expand its network to underserved areas in West Bengal and neighboring states.

Suraksha Diagnostic Financials

| Metric | FY 2024 (₹ Million) | FY 2023 (₹ Million) | FY 2022 (₹ Million) |

|---|---|---|---|

| Revenue from Ops | 2,187.09 | 1,901.34 | 2,231.93 |

| PAT | 231.27 | 60.65 | 208.24 |

| Total Borrowings | 86.37 | 140.07 | 190.27 |

| ROE (%) | 14.09 | 4.32 | 15.38 |

| EPS (₹) | 4.43 | 1.22 | 3.91 |

Suraksha has demonstrated financial recovery with improved revenue and profitability in FY2024, along with effective debt reduction and stronger return ratios.

Suraksha Diagnostic Shareholding Pattern

| Category | Percentage |

|---|---|

| Promoters | 72.5% |

| Institutional Investors | 15% |

| Retail and Public Investors | 12.5% |

The shareholding pattern highlights strong promoter control, complemented by institutional and public participation.

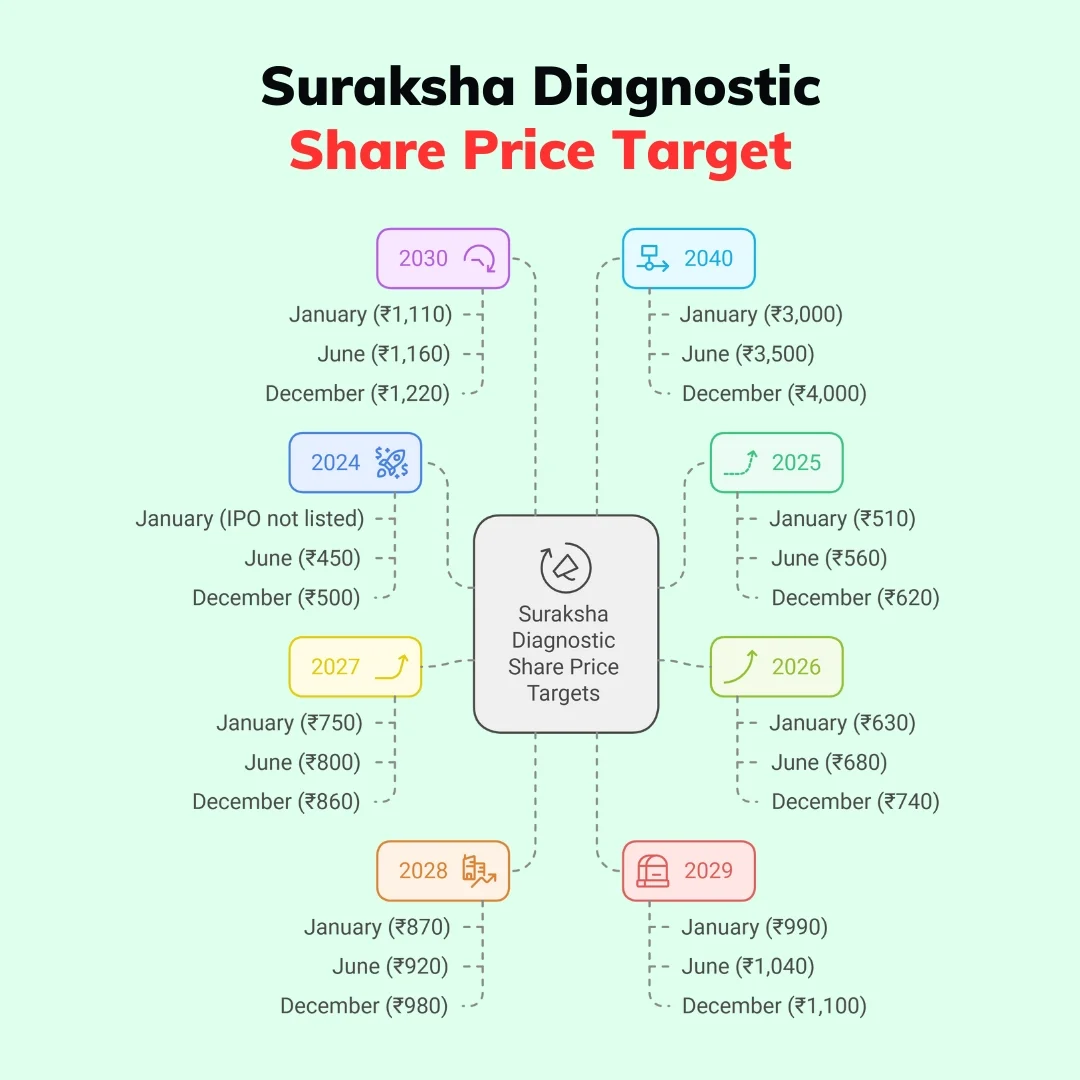

Suraksha Diagnostic Share Price Target 2024 To 2040

Below are the month-wise Suraksha Diagnostic share price targets for 2024, 2025, 2026, 2027, 2028, 2029, 2030 and 2040:

Suraksha Diagnostic Share Price Target 2024

| Month | Price (₹) |

|---|---|

| January | IPO not listed |

| February | IPO not listed |

| March | IPO not listed |

| April | IPO not listed |

| May | IPO not listed |

| June | IPO not listed |

| July | IPO not listed |

| August | IPO not listed |

| September | IPO not listed |

| October | IPO not listed |

| November | IPO not listed |

| December | 500 |

Suraksha Diagnostic Share Price Target 2025

| Month | Price (₹) |

|---|---|

| January | 510 |

| February | 520 |

| March | 530 |

| April | 540 |

| May | 550 |

| June | 560 |

| July | 570 |

| August | 580 |

| September | 590 |

| October | 600 |

| November | 610 |

| December | 620 |

Suraksha Diagnostic Share Price Target 2026

| Month | Price (₹) |

|---|---|

| January | 630 |

| February | 640 |

| March | 650 |

| April | 660 |

| May | 670 |

| June | 680 |

| July | 690 |

| August | 700 |

| September | 710 |

| October | 720 |

| November | 730 |

| December | 740 |

Suraksha Diagnostic Share Price Target 2027

| Month | Price (₹) |

|---|---|

| January | 750 |

| February | 760 |

| March | 770 |

| April | 780 |

| May | 790 |

| June | 800 |

| July | 810 |

| August | 820 |

| September | 830 |

| October | 840 |

| November | 850 |

| December | 860 |

Suraksha Diagnostic Share Price Target 2028

| Month | Price (₹) |

|---|---|

| January | 870 |

| February | 880 |

| March | 890 |

| April | 900 |

| May | 910 |

| June | 920 |

| July | 930 |

| August | 940 |

| September | 950 |

| October | 960 |

| November | 970 |

| December | 980 |

Suraksha Diagnostic Share Price Target 2029

| Month | Price (₹) |

|---|---|

| January | 990 |

| February | 1,000 |

| March | 1,010 |

| April | 1,020 |

| May | 1,030 |

| June | 1,040 |

| July | 1,050 |

| August | 1,060 |

| September | 1,070 |

| October | 1,080 |

| November | 1,090 |

| December | 1,100 |

Suraksha Diagnostic Share Price Target 2030

| Month | Price (₹) |

|---|---|

| January | 1,110 |

| February | 1,120 |

| March | 1,130 |

| April | 1,140 |

| May | 1,150 |

| June | 1,160 |

| July | 1,170 |

| August | 1,180 |

| September | 1,190 |

| October | 1,200 |

| November | 1,210 |

| December | 1,220 |

Suraksha Diagnostic Share Price Target 2040

| Month | Price (₹) |

|---|---|

| January | 3,000 |

| June | 3,500 |

| December | 4,000 |

Suraksha Diagnostic Peer Comparison

| Company | Revenue (₹ Cr) | P/E Ratio | ROE (%) | Market Share | Geographical Reach |

|---|---|---|---|---|---|

| Suraksha Diagnostic | 218.7 | 99.3 | 14.09 | 1.2% | Eastern India |

| Dr. Lal PathLabs | 2,226.60 | 77.08 | 20.35 | 5.3% | Pan-India |

| Metropolis Healthcare | 1,207.70 | 89.61 | 12.26 | – | Pan-India |

| Thyrocare Technologies | 572.39 | 65.52 | 13.34 | – | Pan-India |

FAQs

1. What is the Suraksha Diagnostic share price target for 2024?

The target is ₹500 by December 2024.

2. How does Suraksha Diagnostic compare to Dr. Lal PathLabs?

Suraksha has lower revenue and market share but focuses on a niche market in Eastern India.

3. What drives Suraksha’s growth?

Expansion plans, a hub-and-spoke model, and a focus on underserved markets drive its growth.

Final Words

Suraksha Diagnostic Limited is well-positioned to capture growth in the diagnostics sector with its strong operational network and focus on underserved regions. The detailed month-wise share price targets indicate steady growth, making it an attractive option for long-term investors.