Sai Life Sciences Limited is launching its much-anticipated Initial Public Offering (IPO) to raise funds and expand its business operations. Below is an in-depth look at the Sai Life Sciences IPO GMP, including key details, subscription information, business overview, financials, and more.

Sai Life Sciences IPO Details

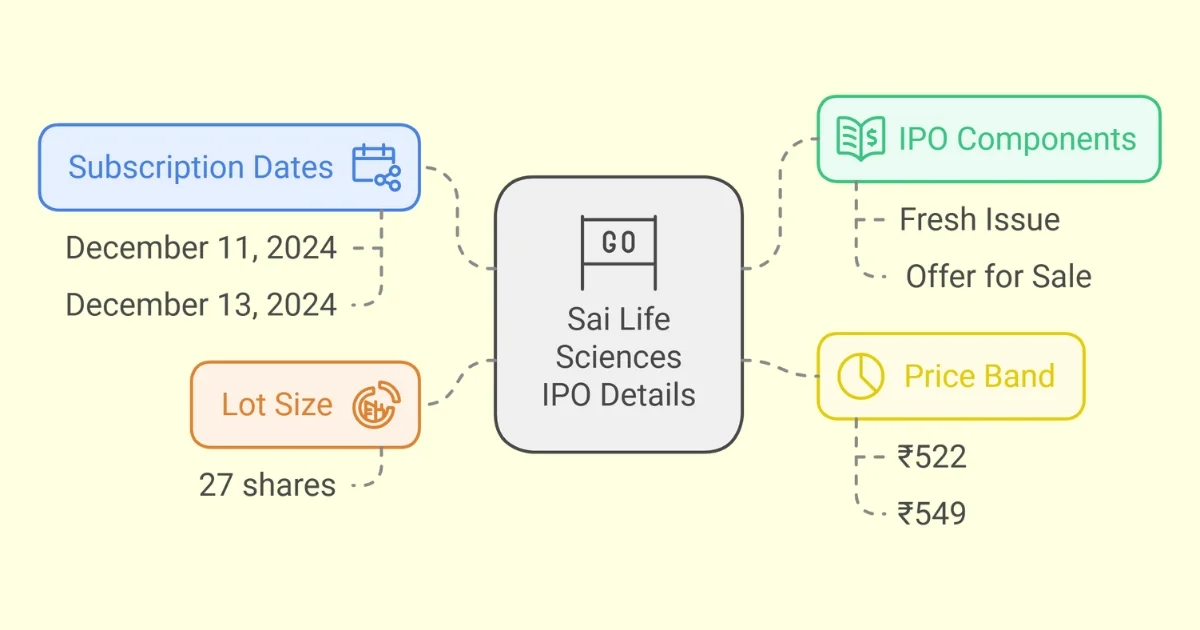

The Sai Life Sciences IPO will be open for subscription from December 11, 2024, to December 13, 2024. The IPO comprises a fresh issue of ₹950 crores and an offer for sale (OFS) of 38,116,934 equity shares. The price band is set at ₹522 to ₹549 per equity share, with a lot size of 27 shares.

| Category | Details |

|---|---|

| IPO Open Date | December 11, 2024 |

| IPO Close Date | December 13, 2024 |

| Price Band | ₹522 to ₹549 |

| Face Value | ₹1 per equity share |

| Lot Size | 27 shares |

| Total Issue Size | ₹3,042.62 crores |

| Fresh Issue | ₹950 crores |

| Offer for Sale | 38,116,934 shares |

| Listing | NSE, BSE |

Retail investors are allocated 35%, while 50% is reserved for Qualified Institutional Buyers (QIBs) and 15% for Non-Institutional Investors (NIIs).

Sai Life Sciences IPO Subscription

The IPO offers three investor categories: Retail, QIBs, and NIIs. Investors can apply for a minimum of one lot (27 shares), requiring an investment of approximately ₹14,823.

| Investor Category | Percentage of Issue Reserved |

|---|---|

| Retail | 35% |

| QIBs | 50% |

| NIIs | 15% |

Key dates include the basis of allotment on December 16, 2024, and the listing date on December 18, 2024.

Sai Life Sciences IPO GMP Today

Sai Life Sciences IPO GMP Today is around ₹42, indicating a likely listing price of ₹591 at the upper end of the price band. A positive Sai Life Sciences IPO GMP Today suggests strong demand and potential listing gains. Investors should monitor GMP trends leading up to the listing date for better insights.

Sai Life Sciences Business Overview

Sai Life Sciences is a leading Contract Research, Development, and Manufacturing Organization (CRDMO) with a global footprint. The company collaborates with over 280 pharmaceutical and biotech companies and provides services across drug discovery, development, and manufacturing.

Core Services

- Drug Discovery: Includes medicinal chemistry, toxicology studies, and target identification.

- Contract Manufacturing: Focuses on the cGMP production of APIs and intermediates.

- Formulation Development: Delivers high-quality, customized drug formulations.

Key Facilities

Sai Life Sciences operates state-of-the-art facilities, including:

- R&D Campus in Hyderabad, India.

- API Manufacturing Plant in Bidar, India.

- Process Development Lab in Manchester, UK.

| Facility | Location | Focus Area |

|---|---|---|

| R&D Campus | Hyderabad, India | Drug discovery and innovation |

| API Manufacturing | Bidar, India | Large-scale production |

| Process Lab | Manchester, UK | Process development for APIs |

Sai Life Sciences employs over 3,000 professionals, including 290 PhDs, ensuring expertise across its operations.

Sai Life Sciences Financials

Sai Life Sciences has demonstrated strong financial performance in recent years, reflecting steady growth in revenue and profitability.

| Year | Revenue (₹ Cr) | Net Profit (₹ Cr) | EPS (₹) | ROCE (%) | ROE (%) |

|---|---|---|---|---|---|

| FY 2021-22 | 869.59 | 62.26 | 3.42 | 7.24 | 5.63 |

| FY 2022-23 | 1,217.13 | 99.89 | 5.41 | 8.96 | 6.84 |

| FY 2023-24 | 1,494.27 | 82.81 | 4.57 | 10.26 | 8.49 |

| H1 FY 2024-25 | 693.35 | 28.01 | – | – | – |

Key metrics include:

- EBITDA Margin: 20.48%

- Return on Capital Employed (ROCE): 10.26%

- Debt-to-Equity Ratio: 0.75

The IPO proceeds will be used to repay debt and fund general corporate purposes, enhancing financial stability.

Sai Life Sciences IPO Review

Strengths

- Partnerships with over 280 pharmaceutical companies.

- Advanced manufacturing capabilities with a global presence.

- Robust financial performance and steady revenue growth.

Risks

- Reliance on global pharmaceutical clients exposes the company to market fluctuations.

- Regulatory challenges in the pharmaceutical sector could affect operations.

Sai Life Sciences IPO is an attractive option for investors seeking exposure to the pharmaceutical services sector.

Sai Life Sciences IPO Allotment

The allotment status for Sai Life Sciences IPO will be finalized on December 16, 2024. Refunds for unsuccessful bids will be initiated on December 17, 2024, and shares will be credited to Demat accounts on the same day. Investors can check their allotment status on the registrar’s website, KFin Technologies.

Sai Life Sciences IPO FAQs

What is the Sai Life Sciences IPO GMP?

Sai Life Sciences IPO GMP Today is approximately ₹42, suggesting strong demand and potential listing gains.

When will the IPO open and close?

The IPO opens on December 11, 2024, and closes on December 13, 2024.

What is the price band for the Sai Life Sciences IPO?

The price band is ₹522 to ₹549 per share.

What is the minimum investment required?

The minimum investment is ₹14,823 for one lot (27 shares).

How will the IPO proceeds be used?

The proceeds will primarily be used for debt repayment and corporate purposes.

What are the company’s financial highlights?

Sai Life Sciences reported revenue of ₹1,494.27 crore and a net profit of ₹82.81 crore in FY 2023-24.

Who are the lead managers for the IPO?

The lead managers are Axis Capital and ICICI Securities.

What is the allotment date?

The allotment date is December 16, 2024.

Conclusion

Sai Life Sciences IPO offers a compelling investment opportunity with strong fundamentals and growth potential. By leveraging its established global network and robust financials, the company is poised for success. Investors are encouraged to assess Sai Life Sciences IPO GMP Today trends and financial metrics to make informed decisions.