Tesla, Inc., a leader in electric vehicles and sustainable energy, continues to captivate investors with its innovation and market dominance. Tesla’s stock has seen remarkable growth and fluctuations, making it one of the most closely watched stocks in the market. This blog explores Tesla’s stock price history, company details, financial performance, shareholding patterns, and Tesla Stock Price Prediction 2025 2025 to 2040, month by month, along with comparisons to key competitors.

Tesla Stock Price History

| Key Metrics | Details |

|---|---|

| IPO Date | June 29, 2010 |

| IPO Price | $17 per share |

| All-Time High | $409.97 (November 2021) |

| 52-Week High/Low | $389.49 / $138.80 (2024) |

| Current Price (2024) | $389.22 |

Since its IPO, Tesla’s stock has grown exponentially, driven by its dominance in the EV market and its expansion into energy storage and renewable energy solutions.

Tesla Company Details

| Founded | July 1, 2003 |

|---|---|

| Founders | Martin Eberhard, Marc Tarpenning, Elon Musk (early investor) |

| Headquarters | Austin, Texas, USA |

| Stock Symbol | TSLA (NASDAQ) |

Tesla has transformed the global EV market with its innovative lineup of vehicles and renewable energy solutions, maintaining a strong presence in over 70 countries.

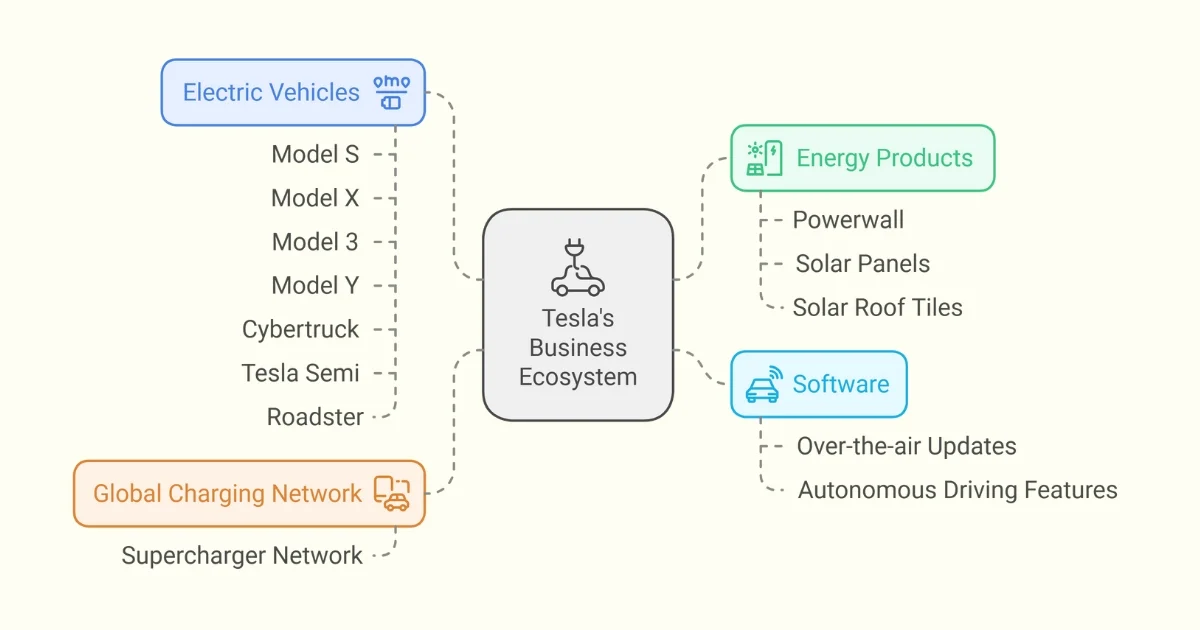

Tesla Business Overview

Tesla operates across multiple verticals, creating an ecosystem of clean energy and cutting-edge technology.

| Segment | Details |

|---|---|

| Electric Vehicles | Model S, Model X, Model 3, Model Y, Cybertruck, Tesla Semi, Roadster |

| Energy Products | Powerwall, solar panels, solar roof tiles |

| Software | Over-the-air updates, autonomous driving features |

| Global Charging Network | Supercharger network worldwide |

Tesla’s business model integrates manufacturing, software, and energy solutions, creating a seamless experience for consumers and a competitive edge in the market.

Tesla Financials

| Metric | 2021 ($ Billion) | 2022 ($ Billion) | 2023 ($ Billion) |

|---|---|---|---|

| Revenue | 53.82 | 81.46 | 96.77 |

| Net Income | 5.52 | 12.58 | 15.00 |

| Market Cap (2024) | $1.25 Trillion | ||

| P/E Ratio (2024) | 106.34 |

Tesla has demonstrated steady revenue growth, supported by increased vehicle deliveries and expansion in the renewable energy segment.

Tesla Shareholding Pattern

| Category | Ownership (%) |

|---|---|

| Institutional Investors | 66.2 |

| Elon Musk | 20.5 |

| Retail Investors | 13.3 |

Tesla’s institutional backing reflects investor confidence in its growth potential, while Elon Musk’s significant stake aligns with the company’s long-term vision.

Tesla Stock Price Prediction 2025 To 2040

Below are the month-wise Tesla Stock price predictions from 2025 to 2040, including bullish and bearish scenarios.

Tesla Stock Price Prediction 2025

| Month | Bullish Price ($) | Bearish Price ($) |

|---|---|---|

| January | 520 | 215 |

| February | 530 | 217 |

| March | 540 | 218 |

| April | 550 | 219 |

| May | 560 | 220 |

| June | 555 | 216 |

| July | 575 | 221 |

| August | 600 | 222 |

| September | 650 | 223 |

| October | 720 | 224 |

| November | 765 | 225 |

| December | 786 | 218 |

Tesla Stock Price Prediction 2026

| Month | Bullish Price ($) | Bearish Price ($) |

|---|---|---|

| January | 820 | 185 |

| February | 835 | 187 |

| March | 850 | 188 |

| April | 870 | 189 |

| May | 900 | 190 |

| June | 1,026 | 186 |

| July | 1,050 | 192 |

| August | 1,100 | 195 |

| September | 1,150 | 198 |

| October | 1,180 | 200 |

| November | 1,200 | 205 |

| December | 1,213 | 189 |

Tesla Stock Price Prediction 2027

| Month | Bullish Price ($) | Bearish Price ($) |

|---|---|---|

| January | 1,500 | 155 |

| February | 1,525 | 157 |

| March | 1,550 | 159 |

| April | 1,575 | 161 |

| May | 1,600 | 163 |

| June | 1,700 | 156 |

| July | 1,750 | 165 |

| August | 1,800 | 170 |

| September | 1,850 | 175 |

| October | 1,900 | 180 |

| November | 1,950 | 185 |

| December | 2,000 | 160 |

Tesla Stock Price Prediction 2028

| Month | Bullish Price ($) | Bearish Price ($) |

|---|---|---|

| January | 2,100 | 175 |

| February | 2,150 | 180 |

| March | 2,200 | 182 |

| April | 2,250 | 185 |

| May | 2,300 | 187 |

| June | 2,300 | 180 |

| July | 2,350 | 190 |

| August | 2,400 | 195 |

| September | 2,450 | 200 |

| October | 2,475 | 205 |

| November | 2,490 | 210 |

| December | 2,500 | 185 |

Tesla Stock Price Prediction 2029

| Month | Bullish Price ($) | Bearish Price ($) |

|---|---|---|

| January | 2,700 | 200 |

| February | 2,750 | 205 |

| March | 2,800 | 210 |

| April | 2,850 | 215 |

| May | 2,900 | 220 |

| June | 2,900 | 210 |

| July | 2,950 | 225 |

| August | 3,000 | 230 |

| September | 3,050 | 235 |

| October | 3,075 | 240 |

| November | 3,090 | 245 |

| December | 3,100 | 220 |

Tesla Stock Price Prediction 2030

| Month | Bullish Price ($) | Bearish Price ($) |

|---|---|---|

| January | 3,300 | 240 |

| February | 3,350 | 250 |

| March | 3,400 | 260 |

| April | 3,450 | 270 |

| May | 3,500 | 280 |

| June | 3,600 | 260 |

| July | 3,700 | 290 |

| August | 3,800 | 300 |

| September | 3,900 | 310 |

| October | 3,950 | 320 |

| November | 3,975 | 330 |

| December | 4,000 | 280 |

Tesla Stock Price Prediction 2040

| Month | Bullish Price ($) | Bearish Price ($) |

|---|---|---|

| January | 4,500 | 400 |

| February | 4,600 | 410 |

| March | 4,700 | 420 |

| April | 4,800 | 430 |

| May | 5,000 | 450 |

| June | 5,500 | 460 |

| July | 6,000 | 470 |

| August | 6,200 | 480 |

| September | 6,400 | 490 |

| October | 6,500 | 495 |

| November | 6,550 | 498 |

| December | 6,500 | 500 |

Tesla Stock Peer Comparison

| Company | Market Cap ($ Billion) | P/E Ratio | Notable EV Models |

|---|---|---|---|

| Tesla | 1,240 | 106.34 | Model S, Model 3, Cybertruck |

| Ford | 44.23 | 12.69 | Mustang Mach-E |

| General Motors | 61.13 | 5.93 | Chevrolet Bolt |

| NIO | 9.11 | N/A | ES6, EC6 |

| BYD | ~100 | N/A | Plug-in hybrids |

Tesla leads the premium EV market, with strong growth potential and expanding energy solutions, but faces competition from traditional automakers and new entrants.

FAQs

1. What is Tesla’s stock price prediction for 2025?

The stock is predicted to range between $218 (bearish) and $786 (bullish) by December 2025.

2. What drives Tesla’s stock growth?

Tesla’s market leadership in EVs, renewable energy expansion, and consistent revenue growth are major factors.

3. How does Tesla compare to competitors?

Tesla’s innovation and scale make it a leader, but competitors like Ford and BYD are catching up in the EV segment.

Final Words

Tesla’s stock continues to be a top choice for investors due to its innovation, growth potential, and market dominance. The year-by-year predictions highlight consistent growth, with bullish scenarios projecting significant returns. Tesla remains a pivotal player in the transition to sustainable transportation and energy, making it a compelling long-term investment.