The NeoPolitan Pizza and Foods IPO is set to open for public subscription soon, providing a promising opportunity for investors. The IPO offers a glimpse into a growing company within the quick service restaurant (QSR) sector, along with its agricultural commodity trading operations. Here’s everything you need to know about the NeoPolitan Pizza and Foods IPO, including subscription details, GMP today, business overview, financials, and more.

NeoPolitan Pizza and Foods IPO Details

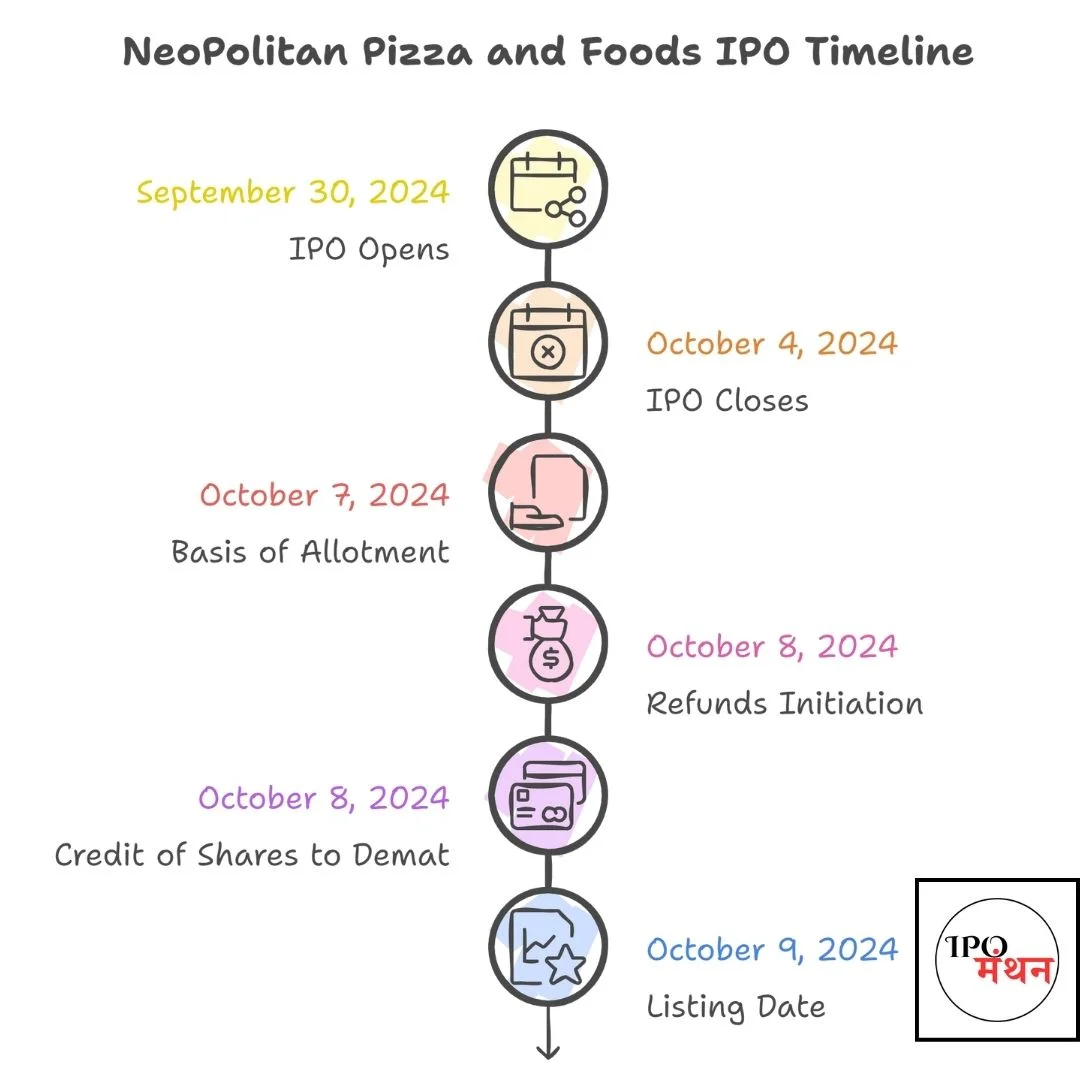

The NeoPolitan Pizza and Foods IPO opens on September 30, 2024, and closes on October 4, 2024. With an issue price of ₹20 per share, the total issue size is ₹12 crore. Investors can apply in lots of 6,000 shares, making the minimum investment amount ₹120,000.

Key Dates and Details

| Details | Information |

|---|---|

| Open Date | September 30, 2024 |

| Close Date | October 4, 2024 |

| Issue Price | ₹20 per share |

| Lot Size | 6,000 shares |

| Minimum Investment | ₹120,000 |

| Total Issue Size | ₹12 crore (60 lakh shares) |

| Basis of Allotment Date | October 7, 2024 |

| Refunds Initiation | October 8, 2024 |

| Credit of Shares to Demat | October 8, 2024 |

| Listing Date | October 9, 2024 (BSE SME) |

NeoPolitan Pizza and Foods IPO Subscription

The NeoPolitan Pizza and Foods IPO reserves 50% of the total issue for retail investors, with the remaining shares allocated for Qualified Institutional Buyers (QIBs) and Non-Institutional Investors (NIIs). The subscription status is expected to become more visible as the closing date approaches.

Subscription Categories

| Investor Category | Allocation |

|---|---|

| Retail Investors | 50% of the total issue |

| QIBs and NIIs | 50% of the total issue |

| Market Makers | Reserved 3 lakh shares |

NeoPolitan Pizza and Foods IPO GMP Today

As of the opening day, the Grey Market Premium (GMP) for the NeoPolitan Pizza and Foods IPO is currently ₹0, meaning no premium is being traded in the grey market above the issue price of ₹20 per share. This figure may fluctuate as the IPO progresses, but it’s crucial to remember that GMP is speculative and does not reflect the official market price.

NeoPolitan Pizza and Foods Business Overview

The company operates in two primary business segments: the restaurant business, specializing in Neapolitan-style pizzas, and agricultural commodity trading. With over 21 locations across India and a growing presence internationally, NeoPolitan Pizza is well-positioned in both sectors.

Restaurant Business

NeoPolitan Pizza focuses on providing high-quality, traditional Neapolitan-style pizzas, along with other menu items like soups, salads, bread, and desserts. Their ISO 22000:2018 certified restaurants ensure food safety and consistency across all locations. The company runs a combination of franchise and company-owned outlets.

Agricultural Commodity Trading

The company also deals in agricultural commodities like wheat, rice, tomatoes, and onions, sourcing high-quality products from trusted suppliers. This diversification adds another dimension to their business model, supporting profitability.

Global Expansion

To expand internationally, NeoPolitan Pizza has invested in a wholly-owned subsidiary in the USA, Neoindian Pizza Inc., signaling future growth opportunities on a global scale.

NeoPolitan Pizza and Foods IPO Financials

NeoPolitan Pizza has shown significant revenue growth over the past three years. In FY2024, the company reported ₹44.01 crore in revenue and a net profit of ₹2.11 crore, reflecting strong operational growth and financial health.

Key Financial Figures

| Year | Revenue (₹ crore) | Expenses (₹ crore) | Net Profit (₹ crore) | Assets (₹ crore) |

|---|---|---|---|---|

| 2022 | ₹16.31 | ₹15.38 | ₹0.18 | ₹13.01 |

| 2023 | ₹20.05 | ₹17.79 | ₹1.17 | ₹18.12 |

| 2024 | ₹44.01 | ₹40.75 | ₹2.11 | ₹20.41 |

The company’s earnings per share (EPS) improved to ₹1.90 in FY2024, and its return on net worth (RoNW) rose to 13.15%, reflecting profitability. Their assets and equity have also grown, showcasing a healthy balance sheet.

NeoPolitan Pizza and Foods IPO Review

The NeoPolitan Pizza and Foods IPO presents a compelling opportunity for investors interested in the restaurant sector, particularly within the QSR industry. The company’s expansion plans, financial growth, and dual business model (restaurant and agricultural trading) make it an attractive option for potential investors.

Use of Proceeds

The funds raised through the IPO will be utilized to:

- Open 16 new Quick Service Restaurants (QSRs).

- Cover security deposits, advance rent, and brokerage costs.

- Fund working capital requirements and corporate expenses.

NeoPolitan Pizza and Foods IPO Allotment Status

The allotment status for the NeoPolitan Pizza and Foods IPO is expected to be finalized on October 7, 2024. Investors can check their allotment status through the Bigshare Services Private Limited website or the BSE SME website using their PAN or application number.

Allotment and Listing Timeline

| Event | Date |

|---|---|

| Basis of Allotment | October 7, 2024 |

| Refunds Initiation | October 8, 2024 |

| Credit to Demat Accounts | October 8, 2024 |

| Listing Date | October 9, 2024 (BSE SME) |

NeoPolitan Pizza and Foods IPO FAQs

Here are some commonly asked questions about the NeoPolitan Pizza and Foods IPO:

General Information

- What is the issue price for NeoPolitan Pizza and Foods IPO?

- The issue price is set at ₹20 per share.

- When does the IPO open and close?

- The IPO opens on September 30, 2024, and closes on October 4, 2024.

- What is the minimum investment?

- The minimum investment required is ₹120,000 for one lot of 6,000 shares.

Financial and Business Information

- What is the total issue size?

- The total issue size is ₹12 crore, representing a fresh issue of 60 lakh shares.

- How will the proceeds from the IPO be utilized?

- The funds will be used to open 16 new QSRs, cover security deposits and brokerage charges, and support working capital requirements.

Allotment and Listing

- When will shares be credited to my Demat account?

- Shares will be credited on October 8, 2024, following the allotment on October 7, 2024.

- What is the listing date for the NeoPolitan Pizza and Foods IPO?

- The shares are expected to list on the BSE SME platform on October 9, 2024.

By considering the NeoPolitan Pizza and Foods IPO, investors have the chance to be part of a growing company with strong financials and ambitious expansion plans in both India and abroad. Keep an eye on the subscription status and allotment timeline for a better understanding of the demand and market potential.

Thank you for reading and staying informed about the NeoPolitan Pizza and Foods Ltd IPO!