Shiv Texchem Limited is gearing up to launch its Initial Public Offering (IPO) in October 2024. This IPO has caught the attention of investors, thanks to the company’s strong presence in the chemical distribution sector. In this blog, we’ll break down everything you need to know about the Shiv Texchem IPO – from the issue size to its subscription status, financials, and more.

Shiv Texchem IPO Details

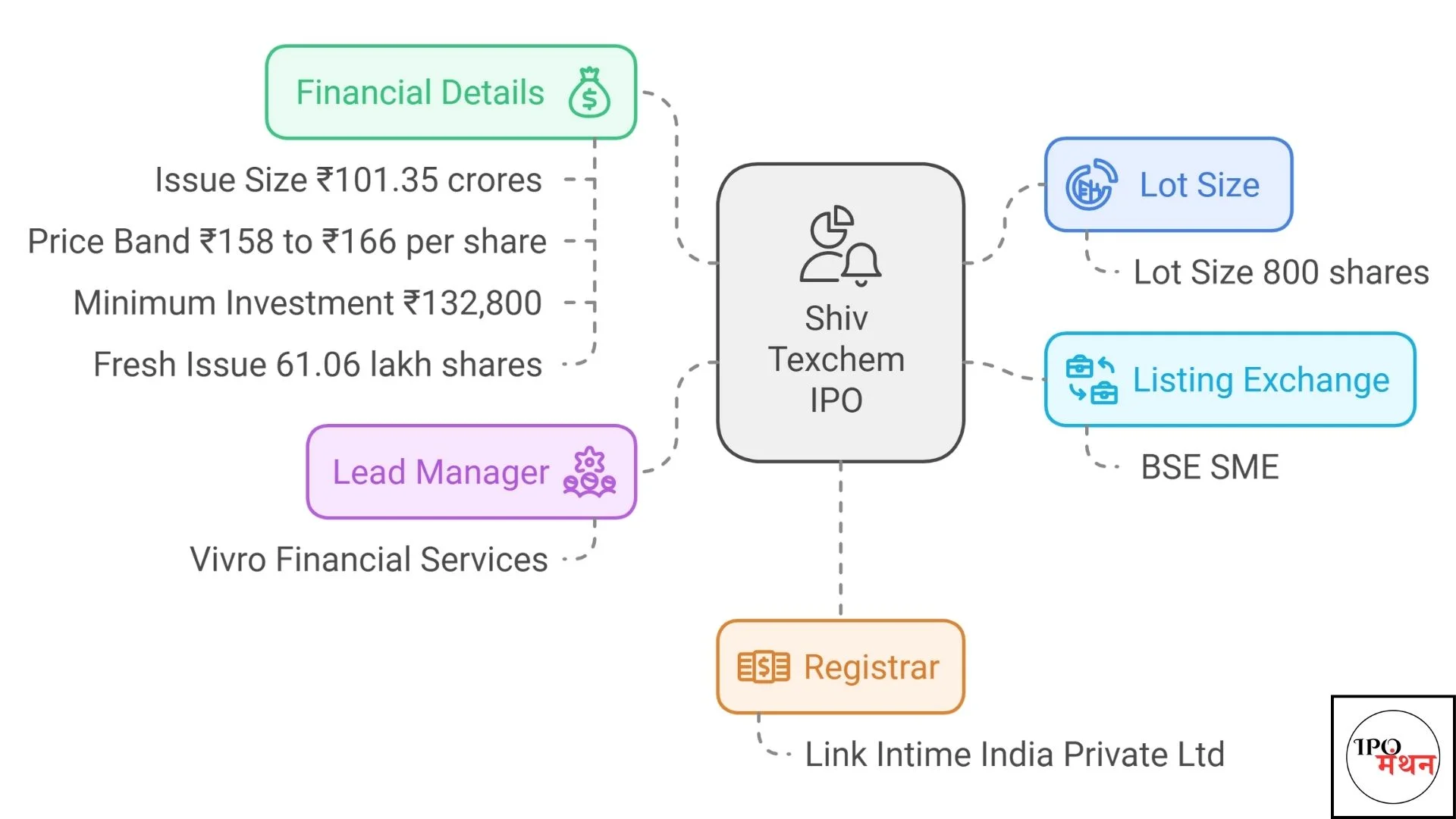

Let’s start with the essential details of the Shiv Texchem IPO:

| Category | Details |

|---|---|

| Issue Size | ₹101.35 crores |

| Price Band | ₹158 to ₹166 per share |

| Lot Size | 800 shares |

| Minimum Investment | ₹132,800 (for one lot) |

| Fresh Issue | 61.06 lakh shares |

| Listing Exchange | BSE SME |

| Lead Manager | Vivro Financial Services |

| Registrar | Link Intime India Private Ltd |

The Shiv Texchem IPO will be open for subscription from October 8, 2024, and will close on October 10, 2024. The minimum investment required for retail investors is ₹132,800 for one lot, which consists of 800 shares. The price band is set between ₹158 and ₹166 per share.

Shiv Texchem Limited IPO Subscription Details

Investors will be categorized into three main groups: Qualified Institutional Buyers (QIB), Retail Individual Investors (RII), and Non-Institutional Investors (NII). Here’s how the shares will be distributed:

| Investor Category | Allocation Percentage |

|---|---|

| QIB | 50% |

| RII | 35% |

| NII | 15% |

The Shiv Texchem IPO subscription status will be updated once the IPO opens on October 8, 2024. You can keep an eye on the registrar’s website for real-time updates.

Shiv Texchem IPO GMP Today

Grey Market Premium (GMP) is a key indicator of investor sentiment before an IPO is officially listed. As of now, Shiv Texchem IPO GMP stands at approximately ₹40. This means that shares could potentially list at a price higher than the issue price, reflecting a positive outlook from investors.

| Date | GMP (Approx.) |

|---|---|

| October 6, 2024 | ₹35 |

| October 7, 2024 | To be updated |

Please note that GMP is not an official measure and can fluctuate based on market sentiment.

Business Overview

Shiv Texchem Limited has carved out a strong position in the chemicals sector. Established in 2005, the company specializes in importing and distributing secondary and tertiary chemicals that are crucial for various industries like:

- Paints and Coatings

- Agrochemicals

- Pharmaceuticals

- Printing Inks

- Specialty Polymers

- Industrial Chemicals

Shiv Texchem sources its products from global suppliers in countries like China, Taiwan, South Korea, and the USA. Over the past few years, the company has significantly expanded its product portfolio and customer base.

Key Business Highlights

| Year | Number of Products | Customers |

|---|---|---|

| 2022 | 21 | 400 |

| 2024 | 39 | 650 |

This growth positions the company as a key player in the chemical distribution sector, and the Shiv Texchem IPO is expected to help the company further expand its operations.

Financials

Shiv Texchem has shown robust financial performance in recent years, with significant growth in revenue and profits. Here’s a snapshot of the company’s financials:

| Financial Year | Revenue (₹ Crores) | PAT (₹ Crores) | Total Assets (₹ Crores) |

|---|---|---|---|

| 2022 | ₹865.47 | ₹13.86 | ₹425.44 |

| 2023 | ₹1,118.67 | ₹16.03 | ₹602.35 |

| 2024 | ₹1,536.69 | ₹30.11 | ₹798.68 |

Financial Ratios

Here’s a look at some key financial ratios for Shiv Texchem:

| Metric | Value |

|---|---|

| Return on Equity (ROE) | 19.08% |

| EBITDA Margin | 3.90% |

| PAT Margin | 1.96% |

| Debt to Equity Ratio | 1.54 |

The company has seen a steady increase in revenue and profits, which signals strong financial health. The funds raised from the Shiv Texchem IPO will be utilized for working capital requirements and general corporate purposes.

Shiv Texchem IPO Review

The Shiv Texchem IPO offers investors a chance to invest in a growing company in the chemicals sector. Here are some of the strengths and risks associated with this IPO:

Strengths

- Diverse Product Portfolio: The company has expanded its offerings, now providing 39 products across various industries.

- Strong Customer Base: Shiv Texchem has grown its customer base significantly, which indicates strong market demand.

- Financial Growth: The company has reported impressive revenue and profit growth over the past few years.

Risks

- Market Competition: The chemical distribution industry is highly competitive, and maintaining market share will be crucial.

- Import Dependency: The company relies on international suppliers, which could expose it to supply chain disruptions.

Overall, the Shiv Texchem IPO presents a promising investment opportunity, but potential investors should weigh the risks before making a decision.

Allotment Status

The allotment status for the Shiv Texchem IPO will be available after the IPO closes on October 10, 2024. Investors can check the status on the registrar’s website (Link Intime India Private Ltd) by entering their PAN or application number.

Key Dates for Allotment

| Event | Date |

|---|---|

| Allotment Date | October 11, 2024 |

| Refund Initiation | October 14, 2024 |

| Shares Credit to Demat | October 14, 2024 |

| Listing Date | October 15, 2024 |

FAQs

Here are some frequently asked questions about the Shiv Texchem IPO:

1. What is the Shiv Texchem IPO issue size?

The issue size is ₹101.35 crores.

2. What is the price band for the Shiv Texchem IPO?

The price band is set between ₹158 and ₹166 per share.

3. What is the minimum investment required?

The minimum investment for retail investors is ₹132,800, which covers one lot of 800 shares.

4. When will the shares be credited to my demat account?

Shares will be credited to your demat account on October 14, 2024.

5. What is the GMP for the Shiv Texchem IPO?

The GMP is approximately ₹40, reflecting positive investor sentiment.

In conclusion, the Shiv Texchem IPO offers a solid investment opportunity in the chemical distribution sector. With its strong financials, expanding product portfolio, and positive market outlook, this IPO could be a good fit for both retail and institutional investors.

Thank you for reading and staying informed about the Shiv Texchem IPO!