Afcons Infrastructure Ltd, a prominent player in the Indian infrastructure sector and part of the Shapoorji Pallonji Group, has established itself as a reliable name in engineering and construction. Following its IPO, the company has gained attention for its large-scale projects and promising growth trajectory. This blog covers the IPO details, business overview, financials, shareholding structure, and month-wise Afcons Infrastructure share price targets for 2024 to 2040.

Afcons Infrastructure IPO Details

The IPO of Afcons Infrastructure Ltd was open from October 25, 2024, to October 29, 2024, with shares listed on November 4, 2024.

| Parameter | Details |

|---|---|

| IPO Size | ₹5,430 crore |

| Fresh Issue | ₹1,250 crore (approx. 2.7 crore shares) |

| Offer for Sale (OFS) | ₹4,180 crore (approx. 9.03 crore shares) |

| Price Band | ₹440-₹463 per share |

| Lot Size | 32 shares (₹14,816 minimum investment) |

The proceeds from the IPO are allocated to debt repayment, capital expenditure, and working capital, supporting the company’s growth and operational expansion.

Afcons Infrastructure Business Overview

Founded in 1959, Afcons Infrastructure is a key player in sectors like transportation, marine infrastructure, hydro and tunneling, and industrial construction. The company has completed over 350 projects across 25+ countries, including the Chenab Railway Bridge and the Atal Tunnel, showcasing its technical expertise and innovation.

| Key Metrics | Details |

|---|---|

| Headquarters | Mumbai, India |

| Global Ranking | 6th in marine facilities, 21st in bridges (ENR Rankings) |

| Order Book Value | ₹348.88 billion |

Afcons’ alignment with the National Infrastructure Pipeline (NIP) and ongoing investment in large-scale projects ensures a strong pipeline for future growth.

Afcons Infrastructure Financial Performance

Afcons Infrastructure’s financials highlight its operational efficiency and steady growth.

| Metric | FY 2021 | FY 2022 | FY 2023 | FY 2024 (Projected) |

|---|---|---|---|---|

| Revenue (₹ Cr.) | 8,840.56 | 10,404.22 | 12,362.97 | 13,285.34 |

| Profit After Tax (₹ Cr.) | 125.93 | 259.30 | 409.67 | 442.12 |

| Total Assets (₹ Cr.) | 12,489.94 | 12,973.77 | 14,301.25 | 16,233.64 |

Afcons Infrastructure Shareholding Pattern

Post-IPO, the shareholding structure demonstrates a balance between promoter control and public participation.

| Stakeholders | Pre-Issue (%) | Post-Issue (%) |

|---|---|---|

| Promoters Group | 99.48% | 70.02% |

| Public Shareholders | 0.52% | 29.98% |

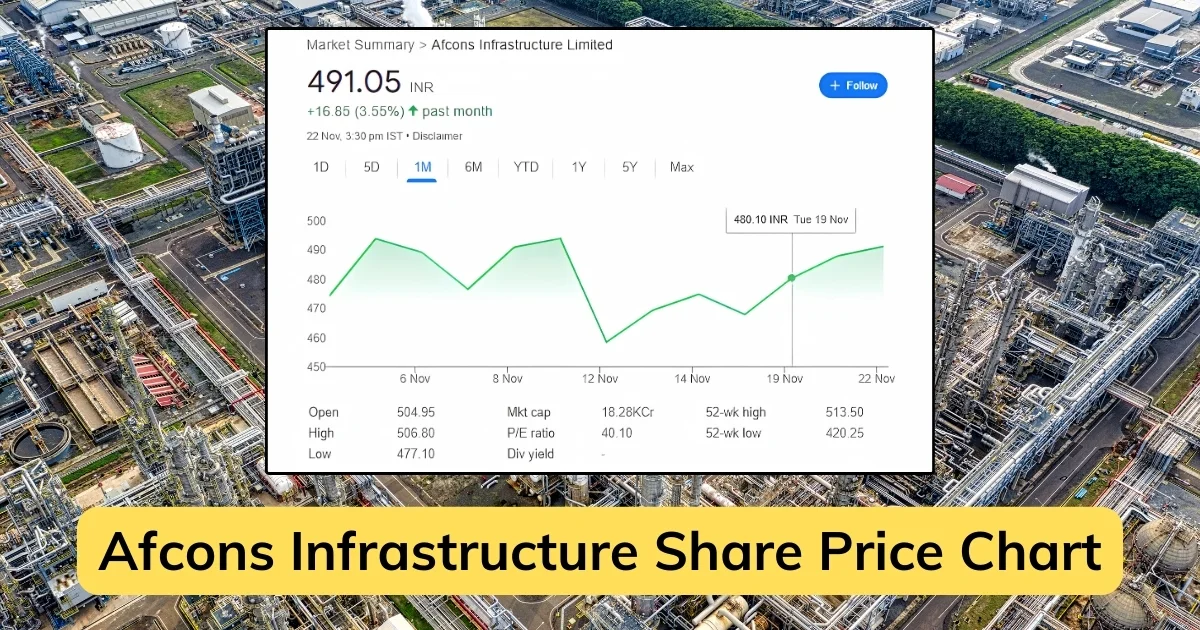

Afcons Infrastructure Share Price Target (Month-Wise)

Here is a detailed month-wise share price target for Afcons Infrastructure Ltd from 2024 to 2040.

Afcons Infrastructure Share Price Target 2024

| Month | Price (₹) |

|---|---|

| January | IPO not listed |

| February | IPO not listed |

| March | IPO not listed |

| April | IPO not listed |

| May | IPO not listed |

| June | IPO not listed |

| July | IPO not listed |

| August | IPO not listed |

| September | IPO not listed |

| October | IPO not listed |

| November | 500 |

| December | 510 |

Afcons Infrastructure Share Price Target 2025

| Month | Price (₹) |

|---|---|

| January | 520 |

| February | 530 |

| March | 540 |

| April | 550 |

| May | 560 |

| June | 570 |

| July | 580 |

| August | 590 |

| September | 600 |

| October | 610 |

| November | 620 |

| December | 630 |

Afcons Infrastructure Share Price Target 2026

| Month | Price (₹) |

|---|---|

| January | 640 |

| February | 650 |

| March | 660 |

| April | 670 |

| May | 680 |

| June | 690 |

| July | 700 |

| August | 710 |

| September | 720 |

| October | 730 |

| November | 740 |

| December | 750 |

Afcons Infrastructure Share Price Target 2027

| Month | Price (₹) |

|---|---|

| January | 760 |

| February | 770 |

| March | 780 |

| April | 790 |

| May | 800 |

| June | 810 |

| July | 820 |

| August | 830 |

| September | 840 |

| October | 850 |

| November | 860 |

| December | 870 |

Afcons Infrastructure Share Price Target 2028

| Month | Price (₹) |

|---|---|

| January | 880 |

| February | 890 |

| March | 900 |

| April | 910 |

| May | 920 |

| June | 930 |

| July | 940 |

| August | 950 |

| September | 960 |

| October | 970 |

| November | 980 |

| December | 990 |

Afcons Infrastructure Share Price Target 2029

| Month | Price (₹) |

|---|---|

| January | 1,000 |

| February | 1,010 |

| March | 1,020 |

| April | 1,030 |

| May | 1,040 |

| June | 1,050 |

| July | 1,060 |

| August | 1,070 |

| September | 1,080 |

| October | 1,090 |

| November | 1,100 |

| December | 1,110 |

Afcons Infrastructure Share Price Target 2030

| Month | Price (₹) |

|---|---|

| January | 1,200 |

| February | 1,220 |

| March | 1,240 |

| April | 1,260 |

| May | 1,280 |

| June | 1,300 |

| July | 1,330 |

| August | 1,350 |

| September | 1,380 |

| October | 1,400 |

| November | 1,450 |

| December | 1,500 |

Afcons Infrastructure Share Price Target 2040

| Month | Price (₹) |

|---|---|

| January | 2,200 |

| June | 2,400 |

| December | 2,570 |

FAQs

1. What is the expected long-term Afcons Infrastructure share price NSE target?

The share price is projected to reach ₹2,570 by 2040.

2. What are the key sectors Afcons operates in?

Afcons operates in transportation, marine infrastructure, hydro and tunneling, and industrial construction.

3. Is Afcons Infrastructure a good long-term investment?

Yes, with its robust order book, steady financials, and strategic projects, Afcons is a promising long-term investment.

Final Words

Afcons Infrastructure Ltd is poised for consistent growth, driven by its expertise in infrastructure and alignment with national development goals. The month-wise share price targets reflect its steady upward trajectory, making it a strong contender for investors seeking both short-term and long-term gains. With a strategic focus on expansion and operational excellence, Afcons is set to deliver substantial returns.