Apex Ecotech Limited has become a key name in the water and wastewater treatment sector, attracting significant investor attention with its innovative technologies and sustainable solutions. The company’s recent IPO and impressive growth trajectory make it a promising investment opportunity. This blog discusses its IPO details, business operations, financials, and yearly month-wise Apex Ecotech share price targets from 2024 to 2040.

Apex Ecotech IPO Details

| Parameter | Details |

|---|---|

| IPO Size | ₹25.54 crore |

| Price Band | ₹71-₹73 per share |

| Lot Size | 1,600 shares (₹116,800 minimum investment) |

| IPO Opening Date | November 27, 2024 |

| IPO Closing Date | November 29, 2024 |

| Allotment Date | December 2, 2024 |

| Listing Date | December 4, 2024 |

| Subscription | 54.83 times overall; retail at 81.43 times |

The IPO raised funds to support working capital needs, improve corporate capabilities, and strengthen its foothold in the water treatment industry.

Apex Ecotech Company Details

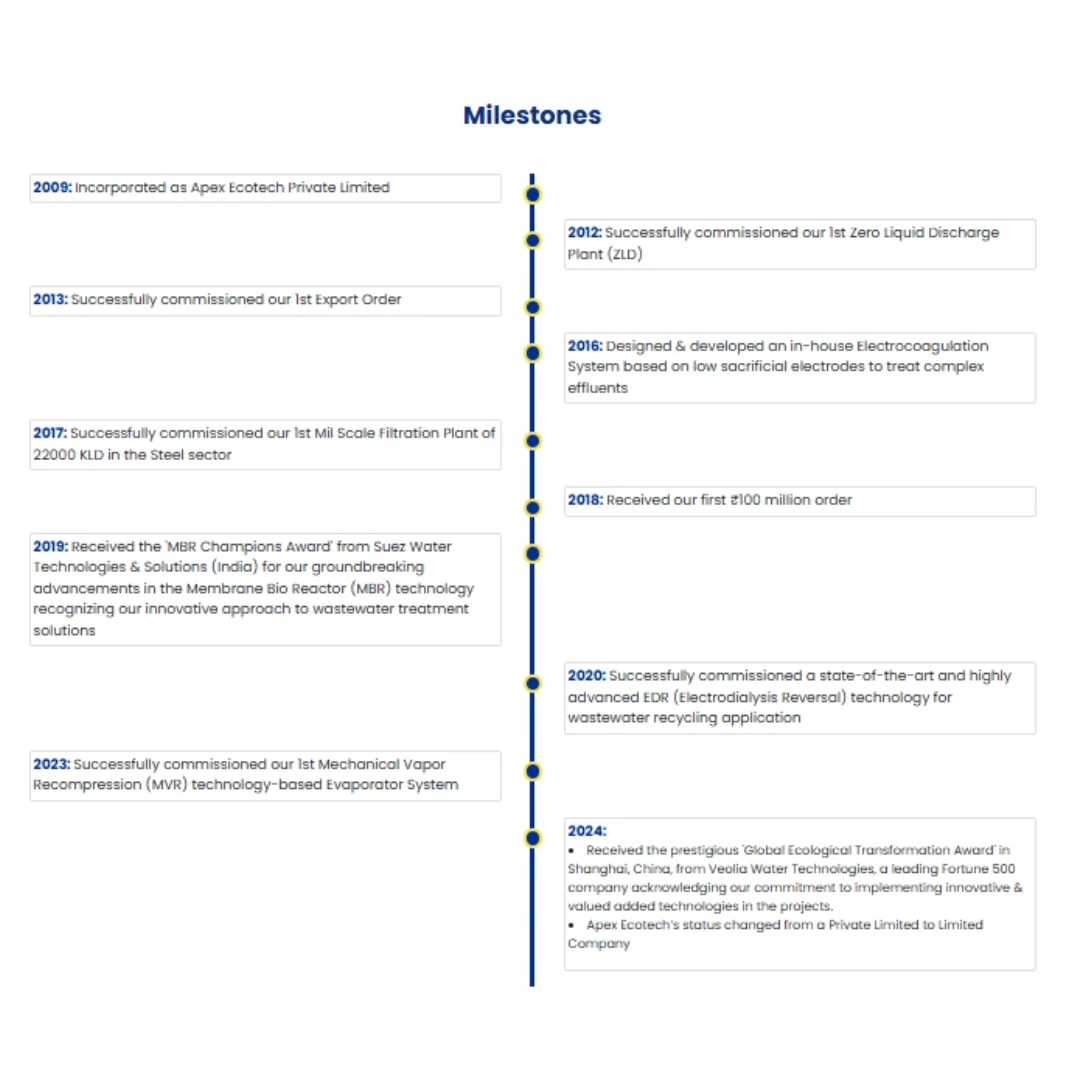

| Incorporated | 2009 |

|---|---|

| Headquarters | Pune, Maharashtra, India |

| Certification | ISO 9001:2015 certified |

| Services | Water treatment, wastewater recycling, ZLD systems |

Apex Ecotech is a leader in water management solutions, providing efficient and sustainable systems for industrial and municipal needs. Its client portfolio includes renowned names such as Aditya Birla Group, PepsiCo, and Hero Motocorp.

Apex Ecotech Business Overview

Apex Ecotech focuses on delivering advanced water management solutions, ensuring compliance with environmental standards and promoting resource efficiency.

| Service | Details |

|---|---|

| Water Treatment Plants (WTP) | Systems for industrial water purification |

| Wastewater Recycling Solutions | Advanced membrane and filtration systems |

| Zero Liquid Discharge (ZLD) | Recycling and reuse technologies |

| Effluent and Sewage Treatment | Comprehensive wastewater treatment services |

The company’s proprietary technologies, including Electrocoagulation systems and Mechanical Vapor Recompression (MVR), provide a competitive advantage in the water treatment sector.

Apex Ecotech Financials

| Metric | FY 2021-22 | FY 2022-23 | FY 2023-24 (Projected) |

|---|---|---|---|

| Revenue (₹ Cr.) | 19.51 | 34.57 | 53.08 |

| EBITDA (₹ Cr.) | -0.43 | 4.18 | 8.88 |

| PAT (₹ Cr.) | -0.65 | 3.52 | 6.63 |

| EBITDA Margin (%) | -2.20% | 12.09% | 16.73% |

| PAT Margin (%) | -3.33% | 10.18% | 12.49% |

The company has exhibited strong financial growth, with a revenue increase of over 170% in three years. Profitability has also improved significantly due to efficient operations and a growing demand for its services.

Apex Ecotech Shareholding Pattern

| Category | Pre-IPO (%) | Post-IPO (%) |

|---|---|---|

| Promoters | 94.32 | 69.29 |

| Public and Others | 5.68 | 30.71 |

The post-IPO structure reflects increased public participation, enhancing market liquidity and investor confidence.

Apex Ecotech Share Price Target 2024 To 2040

Below are the month-wise Apex Ecotech share price targets for 2024, 2025,2026, 2027, 2028, 2029, 2030, and 2040:

Apex Ecotech Share Price Target 2024

| Month | Price (₹) |

|---|---|

| January | IPO not listed |

| February | IPO not listed |

| March | IPO not listed |

| April | IPO not listed |

| May | IPO not listed |

| June | IPO not listed |

| July | IPO not listed |

| August | IPO not listed |

| September | IPO not listed |

| October | IPO not listed |

| November | IPO not listed |

| December | 100 |

Apex Ecotech Share Price Target 2025

| Month | Price (₹) |

|---|---|

| January | 105 |

| February | 110 |

| March | 115 |

| April | 120 |

| May | 125 |

| June | 130 |

| July | 135 |

| August | 140 |

| September | 145 |

| October | 150 |

| November | 155 |

| December | 160 |

Apex Ecotech Share Price Target 2026

| Month | Price (₹) |

|---|---|

| January | 170 |

| February | 175 |

| March | 180 |

| April | 185 |

| May | 190 |

| June | 195 |

| July | 200 |

| August | 205 |

| September | 210 |

| October | 215 |

| November | 220 |

| December | 225 |

Apex Ecotech Share Price Target 2027

| Month | Price (₹) |

|---|---|

| January | 230 |

| February | 235 |

| March | 240 |

| April | 245 |

| May | 250 |

| June | 255 |

| July | 260 |

| August | 265 |

| September | 270 |

| October | 275 |

| November | 280 |

| December | 285 |

Apex Ecotech Share Price Target 2028

| Month | Price (₹) |

|---|---|

| January | 290 |

| February | 295 |

| March | 300 |

| April | 305 |

| May | 310 |

| June | 315 |

| July | 320 |

| August | 325 |

| September | 330 |

| October | 335 |

| November | 340 |

| December | 345 |

Apex Ecotech Share Price Target 2029

| Month | Price (₹) |

|---|---|

| January | 350 |

| February | 355 |

| March | 360 |

| April | 365 |

| May | 370 |

| June | 375 |

| July | 380 |

| August | 385 |

| September | 390 |

| October | 395 |

| November | 400 |

| December | 405 |

Apex Ecotech Share Price Target 2030

| Month | Price (₹) |

|---|---|

| January | 410 |

| February | 420 |

| March | 430 |

| April | 440 |

| May | 450 |

| June | 460 |

| July | 470 |

| August | 480 |

| September | 490 |

| October | 500 |

| November | 510 |

| December | 520 |

Apex Ecotech Share Price Target 2040

| Month | Price (₹) |

|---|---|

| January | 1,000 |

| June | 1,200 |

| December | 1,500 |

Apex Ecotech Peer Comparison

| Company | Revenue (₹ Cr.) | EBITDA Margin (%) | PAT Margin (%) | Market Cap (₹ Cr.) |

|---|---|---|---|---|

| Apex Ecotech | 53.08 | 16.73 | 12.49 | 96.25 |

| ION Exchange | 2,548 | 11.58 | 8.43 | 9,318 |

| VA Tech Wabag | 2,965 | 13.05 | 8.97 | 10,440 |

Although smaller in size compared to its peers, Apex Ecotech demonstrates higher margins and rapid growth, making it a competitive player in the water treatment market.

FAQs

1. What is the Apex Ecotech share price target for 2024?

The target for December 2024 is ₹100.

2. How does Apex Ecotech compare to its peers?

Apex Ecotech shows stronger profit margins and efficient operations despite being smaller in scale.

3. What drives Apex Ecotech’s growth?

Rising demand for sustainable water management solutions, government policies, and advanced proprietary technologies.

Final Words

Apex Ecotech Limited is a rapidly growing company in the water and wastewater treatment industry. Its strong financial performance, innovative technologies, and detailed year-wise share price targets highlight its long-term potential. With increasing demand for sustainable solutions, Apex Ecotech presents an excellent opportunity for long-term investors.