As the Union Budget 2025 approaches, the focus on infrastructure development is expected to bring significant growth opportunities for railway sector stocks. Investors are eyeing key players in this sector to benefit from increased government spending and modernization initiatives. The Indian Railways, being one of the largest rail networks in the world, plays a pivotal role in driving economic growth and regional connectivity. With the government’s commitment to modernize the sector, investors are optimistic about the growth potential of railway sector stocks.

Best Railway Sector Stocks for Budget 2025

The railway sector stocks are poised for potential growth as the government emphasizes infrastructure enhancement, digitization, and sustainable transportation.

| Stock Name | Overview | Potential Benefits |

|---|---|---|

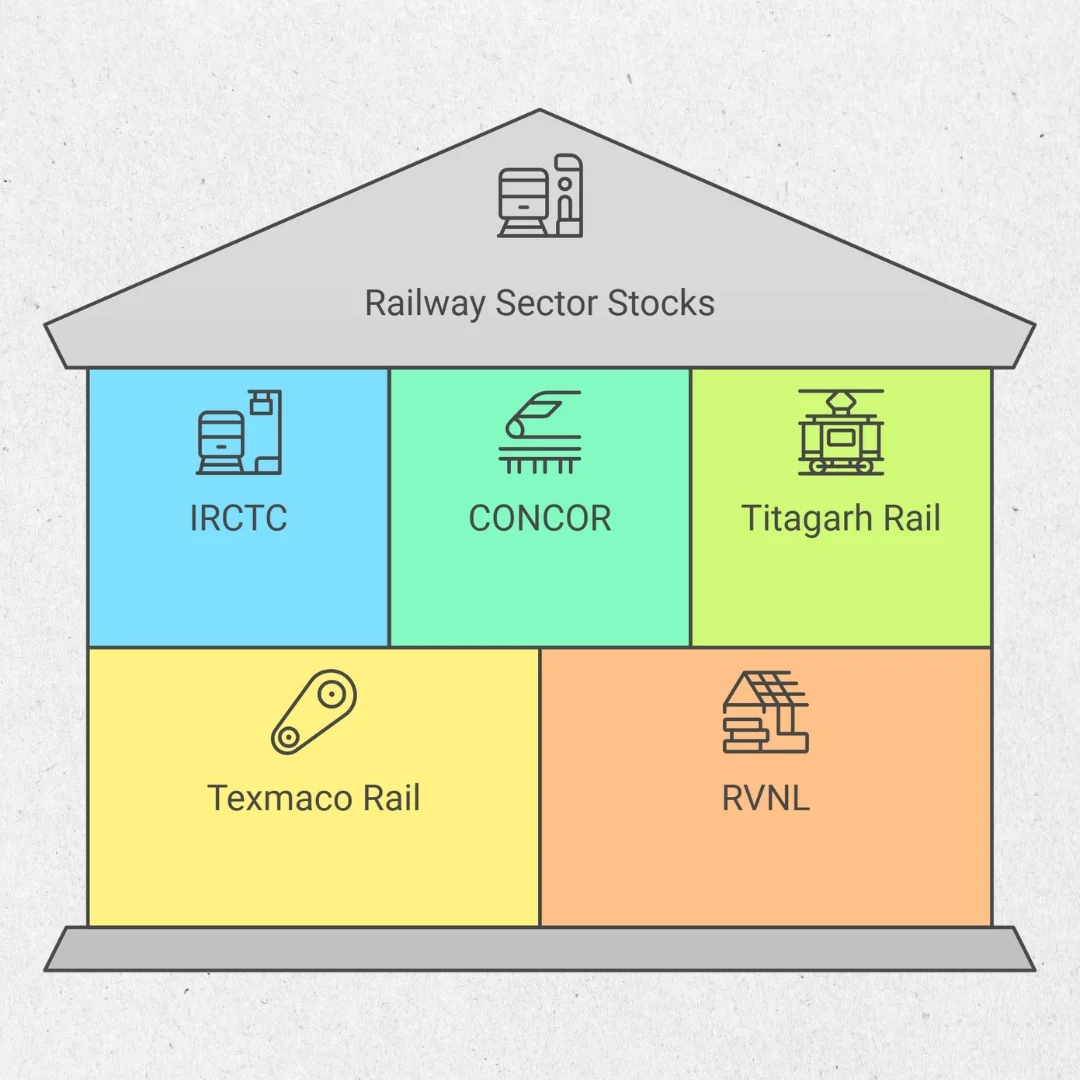

| IRCTC | Manages online ticketing, catering, and tourism services | Increased revenue from digital services and tourism |

| Container Corporation of India (CONCOR) | Provides multimodal logistics and freight services | Boost from trade facilitation and improved supply chains |

| Titagarh Rail Systems | Specializes in freight and passenger railcars | Expected growth from defense orders and infrastructure projects |

| Texmaco Rail & Engineering | Manufactures freight cars and railway equipment | Benefits from increased infrastructure expenditure |

| Rail Vikas Nigam Limited (RVNL) | Focuses on railway infrastructure development | Strong order book and ongoing mega projects |

These railway sector stocks stand to gain from the government’s continued emphasis on infrastructure investment and digital transformation. The increased focus on public-private partnerships (PPP) is also expected to attract more private capital into railway projects, further boosting stock performance.

Top Railway Sector Stocks for Budget 2025

Below we have covered the railway sector stocks list which everyone has to note before investing in the stock market following the railway budget 2025.

1. IRCTC (Indian Railway Catering and Tourism Corporation)

Overview: Manages online ticketing, catering, and tourism services.

Potential Benefits: Increased revenue from digital services and tourism, along with growth in catering and travel packages.

2. Container Corporation of India (CONCOR)

Overview: Provides multimodal logistics and freight services.

Potential Benefits: Boost from trade facilitation, improved supply chains, and increased freight movement.

3. Titagarh Rail Systems

Overview: Specializes in manufacturing freight and passenger railcars.

Potential Benefits: Increased defense orders and government focus on railway infrastructure.

4. Texmaco Rail & Engineering

Overview: Manufactures freight cars, wagons, and railway infrastructure equipment.

Potential Benefits: Growth driven by increased infrastructure expenditure and railway modernization projects.

5. Rail Vikas Nigam Limited (RVNL)

Overview: Engaged in railway infrastructure projects including construction and development.

Potential Benefits: Strong order book, execution of major infrastructure projects, and steady revenue streams.

6. Indian Railway Finance Corporation (IRFC)

Overview: Financial arm of Indian Railways, responsible for funding railway projects.

Potential Benefits: Increased financing opportunities for upcoming mega projects.

7. Jupiter Wagons

Overview: Specializes in manufacturing railway wagons, coaches, and freight solutions.

Potential Benefits: Increased demand for freight movement and government spending on freight infrastructure.

8. RITES Limited

Overview: Provides consultancy and engineering services in transport infrastructure.

Potential Benefits: Increased consulting contracts for rail projects and focus on export markets.

9. BEML Limited

Overview: Manufactures rail coaches, metro cars, and defense equipment.

Potential Benefits: Growth from metro and railway expansion projects.

10. Larsen & Toubro (L&T)

Overview: Involved in railway infrastructure, electrification, and signaling systems.

Potential Benefits: Large-scale infrastructure contracts and technological advancements.

Key Drivers for Growth in Railway Sector Stocks

- Increased Capital Expenditure: The government is expected to allocate approximately ₹3 lakh crore for railway infrastructure.

- Technological Advancements: Introduction of advanced technologies like AI, IoT, and automation in rail operations.

- Expansion of Rail Network: Extension of railway lines and electrification projects.

- Modernization of Stations: Focus on developing world-class railway stations.

- Boost to Tourism: Increased emphasis on tourism-related rail projects.

Railway Budget 2025 Expectations

The Railway Budget 2025 is anticipated to bring significant capital allocation to modernize rail infrastructure, improve safety measures, and enhance passenger services.

- Capital Expenditure: Estimated allocation around ₹3 lakh crore.

- Revenue Projections: Traffic revenue expected to reach ₹2.78 lakh crore.

- Strategic Areas: Focus on safety, digitization, and capacity enhancement.

- Passenger Revenue Growth: Expected to increase from ₹73,000 crore to ₹80,000 crore.

- Freight Revenue Contribution: Projected to reach ₹1.80 lakh crore.

The emphasis will remain on infrastructure expansion and technological advancements, including Vande Bharat and Amrit Bharat trains.

Railway Spending 2025

| Spending Category | Allocation (Approx.) |

|---|---|

| Infrastructure Development | ₹2.65 lakh crore |

| Passenger Services | ₹80,000 crore |

| Freight Services | ₹1.80 lakh crore |

| Station Modernization | ₹60,000 crore |

| Safety Enhancements | ₹50,000 crore |

The government aims to improve passenger amenities, modernize tracks, and expand railway connectivity across regions. Special emphasis will also be given to improving safety measures, reducing accidents, and adopting green initiatives for environmental sustainability.

Why Invest in Railway Sector Stocks?

Investing in railway sector stocks offers several advantages:

- Government Backing: Strong financial and policy support.

- Steady Revenue Streams: Revenue from both passenger and freight services.

- Infrastructure Focus: Ongoing projects ensure long-term growth.

- Technological Integration: Improved efficiency and productivity.

- Tourism Growth: Increased focus on promoting tourism via rail.

Investors should keep an eye on these stocks as they are directly linked to government spending and policy changes. A robust railway infrastructure is critical for India’s economic growth, and companies involved in its development are expected to reap significant benefits.

Risks to Consider When Investing in Railway Sector Stocks

- Dependence on Government Spending: Budget allocations directly impact stock performance.

- Economic Cycles: Railway revenues are sensitive to economic downturns.

- High Valuations: Many stocks are trading at high valuations, increasing correction risks.

- Operational Challenges: Labor disputes, infrastructure delays, and regulatory changes.

- Competition: Growing competition from road and air transport.

Investors must carefully assess these risks while making investment decisions.

Investment Strategy for Railway Sector Stocks

- Diversification: Invest across multiple railway sector stocks.

- Long-term Approach: Infrastructure growth takes time; patience is key.

- Focus on Fundamentals: Choose fundamentally strong stocks with good management.

- Monitor Government Policies: Stay updated on policy changes and budget announcements.

FAQ’s

Q1: Why invest in railway sector stocks?

A: These stocks benefit directly from increased government expenditure and infrastructure projects.

Q2: Which are the best railway sector stocks for 2025?

A: IRCTC, RVNL, CONCOR, Texmaco Rail, and Titagarh Rail Systems.

Q3: What is the expected capital allocation for railways in Budget 2025?

A: Around ₹3 lakh crore.

Q4: Are railway stocks good for long-term investment?

A: Yes, given their alignment with government priorities and growth potential.

Final Words

The railway sector stocks are set to play a crucial role in India’s economic growth in 2025. With increased government spending, modernization projects, and digitization initiatives, these stocks present significant investment opportunities for long-term growth. Investors should closely monitor budget announcements and policy updates to make informed investment decisions. The sector remains one of the most promising areas for infrastructure-led growth, making it an attractive option for investors.