In this blog, we’ll explore Zinka Logistics IPO details, business overview, financials, and the much-anticipated BlackBuck share price target. The BlackBuck IPO is making waves in the Indian stock market, with a price band of ₹259 to ₹273 per share. Set to list on November 21, 2024, BlackBuck, also known as Zinka Logistics Solutions, aims to raise ₹1,114.72 crore through a combination of a fresh issue and an offer for sale. As the country’s top digital trucking platform, BlackBuck is drawing significant interest from retail and institutional investors alike.

BlackBuck IPO Details

Here’s a table summarizing the details of the IPO:

| Details | Information |

|---|---|

| IPO Opening Date | November 13, 2024 |

| IPO Closing Date | November 18, 2024 |

| Price Band | ₹259 to ₹273 per share |

| Lot Size | 54 shares (minimum investment ₹14,742) |

| Allotment Date | November 19, 2024 |

| Listing Date | November 21, 2024 |

| Structure | Fresh issue of ₹550 crore and an offer for sale of 20.69 million shares |

The BlackBuck IPO aims to generate ₹1,114.72 crore. Retail investors can purchase a minimum of one lot, totaling ₹14,742. The IPO is structured to attract significant institutional interest, with 75% allocated to Qualified Institutional Buyers (QIBs), 15% to Non-Institutional Investors (NIIs), and 10% to retail investors.

BlackBuck Share Listing Price

With a price band set between ₹259 and ₹273 per share, analysts expect BlackBuck’s share listing price to reflect the company’s strong position in India’s logistics sector. The listing on November 21, 2024, could see the share price trade within or slightly above the set band, potentially reaching ₹300 in the early days of trading due to high demand and growth expectations.

BlackBuck Business Overview

Founded in 2015, BlackBuck, or Zinka Logistics Solutions, has transformed India’s logistics industry by digitally connecting truck operators with shippers. The platform addresses major needs in the trucking sector:

| Feature | Description |

|---|---|

| Load Matching | Efficiently connects truck operators with available loads, minimizing idle time. |

| Fleet Management | Provides truck operators with tools to monitor vehicle performance and improve efficiency. |

| Toll Payments | Digital toll solutions make payments smoother for truckers on the move. |

| Vehicle Financing | Facilitates loans for truck operators, supporting business growth in the logistics space. |

By streamlining logistics and optimizing transportation, BlackBuck has become a leader in the Indian trucking industry. With its tech-driven model, the company is poised for continued expansion, which directly impacts the BlackBuck share price target over the coming years.

BlackBuck Financials

Over recent years, BlackBuck’s financials show impressive revenue growth despite ongoing net losses. Below are the company’s financial highlights:

In the first quarter of FY25, BlackBuck reported a turnaround, achieving a net profit of ₹28.67 crore, compared to a net loss of ₹35.93 crore in Q1 FY24. Revenue reached ₹92.16 crore, marking a 55% year-over-year increase. This financial improvement boosts optimism around the BlackBuck share price target, indicating that the company is on the path to profitability.

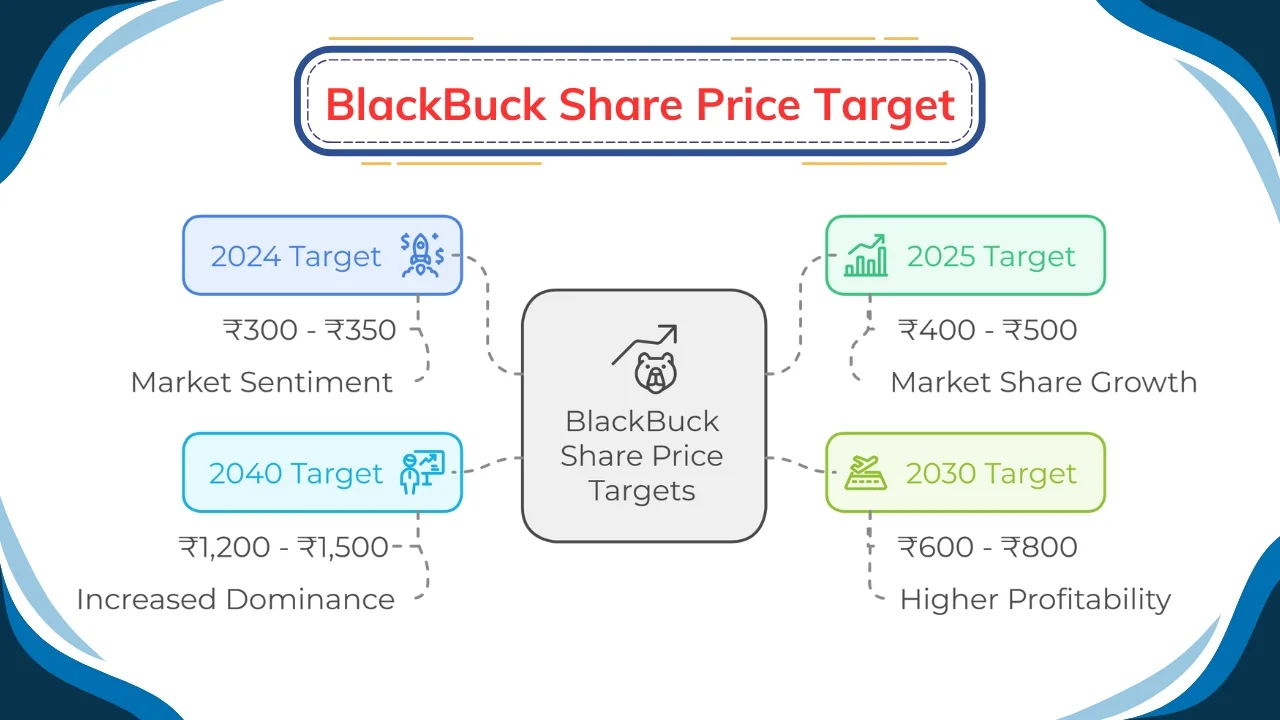

BlackBuck Share Price Target

The BlackBuck share price target 2025 is anticipated to range between ₹400-500, reflecting positive market sentiment and the company’s strong fundamentals. Here’s an outline of potential long-term targets:

Year | Target Range (₹) |

|---|---|

| 2024 Target | ₹300 – ₹350 |

| 2025 Target | ₹400 – ₹500, as BlackBuck continues to grow its market share |

| 2030 Target | ₹600 – ₹800, driven by operational scalability and higher profitability |

| 2040 Target | ₹1,200 – ₹1,500, assuming sustained growth in India’s logistics sector and BlackBuck’s increasing market dominance |

These targets reflect BlackBuck’s growth trajectory, with the BlackBuck share price target rising as the company gains operational efficiencies and expands its revenue base.

BlackBuck Share Holding Pattern

The shareholding structure post-IPO is as follows:

| Category | Details |

|---|---|

| Promoters | Currently hold 32.91%, will reduce to 27.84% after the IPO |

| Qualified Institutional Buyers (QIBs) | Allocated 75% of the IPO, indicating strong institutional interest |

| Non-Institutional Investors (NIIs) | Allocated 15% |

| Retail Investors | Allocated 10%, ensuring retail participation |

| Employee Quota | Reserved 26,000 shares with a discount of ₹25 per share |

This distribution reflects BlackBuck’s focus on attracting long-term institutional investors, which could provide stability to the BlackBuck share price target over time.⁷

FAQs

Q1: What is BlackBuck’s share price target for 2024?

For 2024, the BlackBuck share price target is projected to be around ₹300-350, given its anticipated strong listing performance.

Q2: What factors influence BlackBuck’s share price target?

Key factors include BlackBuck’s revenue growth, shift towards profitability, and its dominant position in India’s logistics market.

Q3: Is BlackBuck a good investment for the long term?

With a strong growth model and potential for long-term profitability, BlackBuck presents an attractive investment opportunity, especially for investors looking at the 2030 and 2040 BlackBuck share price target.

Q4: What is the minimum investment for retail investors in BlackBuck’s IPO?

Retail investors can participate with a minimum investment of ₹14,742 for one lot of 54 shares.

Final Words

The BlackBuck share price target has generated significant interest, with investors hopeful about the company’s growth potential in India’s expanding logistics market. With its IPO on November 21, 2024, BlackBuck is poised to attract both institutional and retail investors, establishing itself as a formidable player in the digital trucking industry. Looking ahead, the BlackBuck share price target of ₹300-350 for 2024 appears achievable, and long-term targets up to ₹1,500 by 2040 highlight the company’s potential for scaling operations and profitability.

For investors seeking exposure to India’s logistics growth story, BlackBuck’s IPO provides a valuable opportunity, with BlackBuck share price targets showing promise across the coming decades.