This blog delves into Dhanlaxmi Crop Science’s IPO details, company overview, financial performance, shareholding pattern, and yearly month-wise Dhanlaxmi Crop Science share price target from 2025 to 2040, along with comparisons to its peers.

Dhanlaxmi Crop Science Ltd, a leading player in the agricultural seed industry, has garnered significant attention with its IPO and robust growth trajectory. The company specializes in developing high-quality seeds for various field crops and vegetables, integrating biotechnology with traditional breeding methods.

Dhanlaxmi Crop Science Share Price

Dhanlaxmi Crop Science Ltd had an impressive debut on the NSE Emerge platform on December 16, 2024, with its shares opening at ₹104.25, a 90% premium over the IPO price of ₹52-₹55 per share.

The IPO was a massive success, being oversubscribed 550 times during the bidding period from December 9 to December 11, 2024. The company issued 4,328,000 fresh shares, aiming to raise ₹23.80 crores to fund working capital needs and general corporate purposes.

Dhanlaxmi Crop Science IPO Details

| Parameter | Details |

|---|---|

| IPO Size | ₹23.80 crore |

| Price Band | ₹52-₹55 per share |

| Shares Offered | 43.28 lakh |

| Subscription Rate | 17.24 times overall |

| Listing Date | December 16, 2024 |

| GMP | ₹28 per share (Dec 10, 2024) |

The IPO witnessed strong participation, particularly from retail investors, who oversubscribed their portion by 31.33 times. Proceeds from the IPO will primarily fund working capital requirements and other corporate initiatives.

Dhanlaxmi Crop Science Company Details

| Founded | 2005 |

|---|---|

| Headquarters | Gujarat, India |

| Core Focus | Hybrid and open-pollinated seeds |

| Product Range | 24 field crops and vegetables |

The company’s R&D facilities emphasize high-yield and pest-resistant seeds tailored for diverse agro-climatic conditions in India. Key products include cotton, maize, cumin, and vegetables like okra and onion.

Dhanlaxmi Crop Science Business Overview

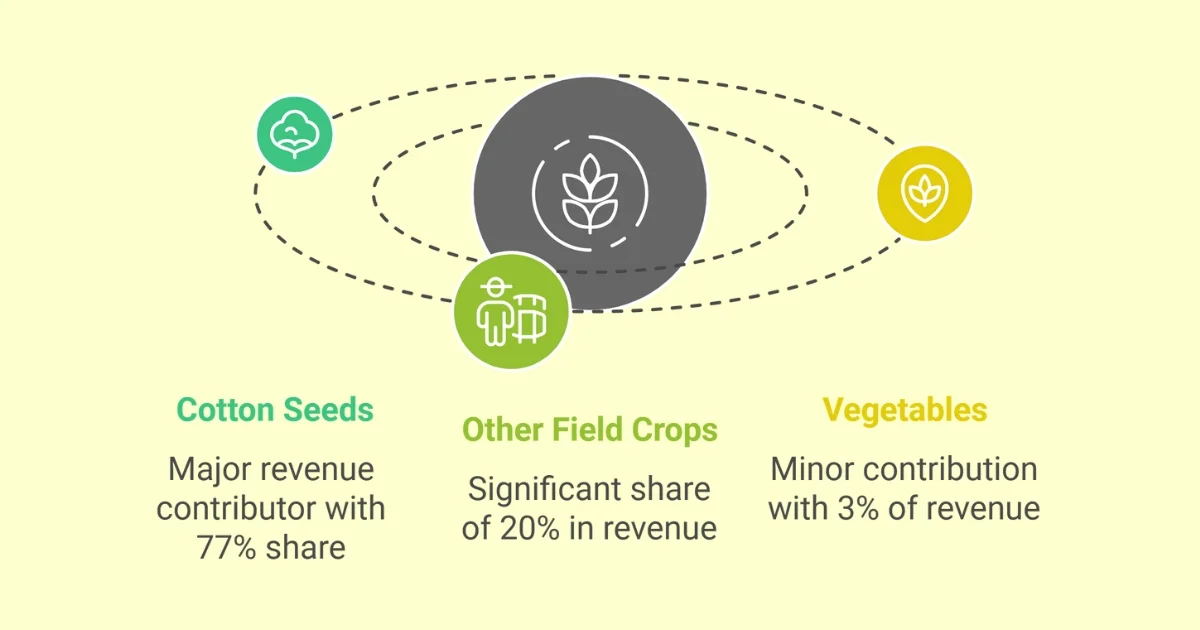

Dhanlaxmi Crop Science has evolved into a technology-driven seed company.

| Key Products | Contribution to Revenue |

|---|---|

| Cotton Seeds | 77% |

| Other Field Crops | 20% |

| Vegetables | 3% |

The company’s production capacity exceeds 60 kMT of seeds annually, supported by state-of-the-art processing facilities.

Dhanlaxmi Crop Science Financials

| Metric | FY 2022 | FY 2023 | FY 2024 |

|---|---|---|---|

| Revenue (₹ Cr.) | 35.43 | 46.61 | 63.71 |

| PAT (₹ Cr.) | 0.58 | 2.99 | 4.65 |

| Net Worth (₹ Cr.) | 6.17 | 11.39 | 16.12 |

The company has shown consistent revenue growth, with profitability improving by 55.35% in FY 2024 compared to the previous year.

Dhanlaxmi Crop Science Shareholding Pattern

| Category | Pre-IPO (%) | Post-IPO (%) |

|---|---|---|

| Promoters | 99.48 | 73.11 |

| Public | 0.52 | 26.89 |

The IPO has significantly increased public shareholding, reflecting enhanced liquidity and market participation.

Dhanlaxmi Crop Science Share Price Target: 2025 to 2040

Below are the month-wise Dhanlaxmi Crop Science share price targets for the years 2025 to 2040:

Dhanlaxmi Crop Science Share Price Target 2025

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 60 | 55 |

| February | 61 | 56 |

| March | 61.5 | 56.5 |

| April | 62 | 57 |

| May | 63 | 58 |

| June | 62 | 58 |

| July | 63.5 | 59 |

| August | 64 | 59.5 |

| September | 64.5 | 60 |

| October | 65 | 60.5 |

| November | 65.5 | 60.8 |

| December | 65 | 60 |

Dhanlaxmi Crop Science Share Price Target 2026

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 80 | 70 |

| February | 81 | 71 |

| March | 82 | 72 |

| April | 83 | 73 |

| May | 84 | 74 |

| June | 82 | 75 |

| July | 84.5 | 76 |

| August | 85 | 77 |

| September | 86 | 78 |

| October | 87 | 79 |

| November | 88 | 79.5 |

| December | 85 | 80 |

Dhanlaxmi Crop Science Share Price Target 2027

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 100 | 85 |

| February | 102 | 86 |

| March | 103 | 87 |

| April | 104 | 88 |

| May | 105 | 89 |

| June | 105 | 90 |

| July | 107 | 91 |

| August | 108 | 92 |

| September | 109 | 93 |

| October | 110 | 94 |

| November | 111 | 95 |

| December | 110 | 95 |

Dhanlaxmi Crop Science Share Price Target 2028

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 120 | 105 |

| February | 122 | 107 |

| March | 123 | 108 |

| April | 124 | 109 |

| May | 125 | 110 |

| June | 125 | 110 |

| July | 127 | 111 |

| August | 128 | 112 |

| September | 129 | 113 |

| October | 130 | 114 |

| November | 131 | 115 |

| December | 130 | 115 |

Dhanlaxmi Crop Science Share Price Target 2029

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 150 | 125 |

| February | 152 | 127 |

| March | 154 | 128 |

| April | 156 | 129 |

| May | 158 | 130 |

| June | 155 | 130 |

| July | 159 | 131 |

| August | 160 | 132 |

| September | 161 | 133 |

| October | 162 | 134 |

| November | 163 | 135 |

| December | 160 | 135 |

Dhanlaxmi Crop Science Share Price Target 2030

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 170 | 140 |

| February | 172 | 142 |

| March | 174 | 144 |

| April | 176 | 146 |

| May | 178 | 148 |

| June | 175 | 150 |

| July | 180 | 151 |

| August | 182 | 153 |

| September | 184 | 155 |

| October | 186 | 157 |

| November | 188 | 158 |

| December | 180 | 150 |

Dhanlaxmi Crop Science Share Price Target 2040

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 300 | 250 |

| February | 305 | 255 |

| March | 310 | 260 |

| April | 315 | 265 |

| May | 320 | 270 |

| June | 325 | 275 |

| July | 330 | 280 |

| August | 335 | 285 |

| September | 340 | 290 |

| October | 345 | 295 |

| November | 348 | 298 |

| December | 350 | 300 |

Dhanlaxmi Crop Science Peer Comparison

| Company Name | Market Cap (₹ Cr.) | P/E Ratio | ROE (%) | Debt/Equity Ratio |

|---|---|---|---|---|

| Dhanlaxmi Crop Science | 89.80 | 14.18 | 33.82 | 0.06 |

| Mangalam Seeds | 128.00 | 18.50 | 25.00 | 0.15 |

| Upsurge Seeds | 75.00 | 12.00 | 20.00 | 0.10 |

Dhanlaxmi Crop Science demonstrates stronger profitability and lower debt compared to its peers, highlighting its competitive edge in the seed industry.

FAQs

1. What is the Dhanlaxmi Crop Science share price target for 2025?

The share price is expected to range between ₹55 and ₹65 by December 2025.

2. How does Dhanlaxmi Crop Science compare to competitors?

The company leads in ROE and ROCE, with a lower debt-to-equity ratio, reflecting its strong financial health.

3. What are the growth drivers for Dhanlaxmi Crop Science?

Key drivers include its R&D initiatives, diversified product portfolio, and focus on sustainable agriculture practices.

Final Words

Dhanlaxmi Crop Science Ltd presents a compelling investment opportunity with its robust financials, strategic growth plans, and leadership in the agricultural seed industry. The share price predictions indicate steady growth, making it an attractive option for long-term investors.