Ganesh Infraworld Limited is a growing name in India’s infrastructure sector. The company’s recent IPO attracted significant attention, reflecting investor confidence in its business model and growth prospects. In this blog, we explore Ganesh Infraworld’s IPO details, business operations, financials, and yearly month-wise Ganesh Infraworld share price targets from 2024 to 2040, along with peer comparisons.

Ganesh Infraworld IPO Details

| Parameter | Details |

|---|---|

| IPO Size | ₹98.58 crore |

| Price Band | ₹78-₹83 per share |

| Shares Offered | 118.77 lakh shares |

| Minimum Lot Size | 1,600 shares (₹1,32,800 investment) |

| IPO Subscription | 369.56 times overall; retail at 289.6 times |

| IPO Opening Date | November 29, 2024 |

| IPO Closing Date | December 3, 2024 |

| Allotment Date | December 4, 2024 |

| Listing Date | December 6, 2024 (NSE SME Platform) |

The IPO proceeds will primarily be used for long-term working capital requirements (₹70 crore) and general corporate purposes.

Ganesh Infraworld Company Details

| Founded | 2017 |

|---|---|

| Headquarters | West Bengal, India |

| Operations | Active across 13 states |

| Core Services | Civil, electrical, road, rail, and water infrastructure projects |

Ganesh Infraworld provides Engineering, Procurement, and Construction (EPC) services across sectors, including industrial, residential, and commercial infrastructure. Its operations span various Indian states such as Rajasthan, Maharashtra, and Uttar Pradesh.

Ganesh Infraworld Business Overview

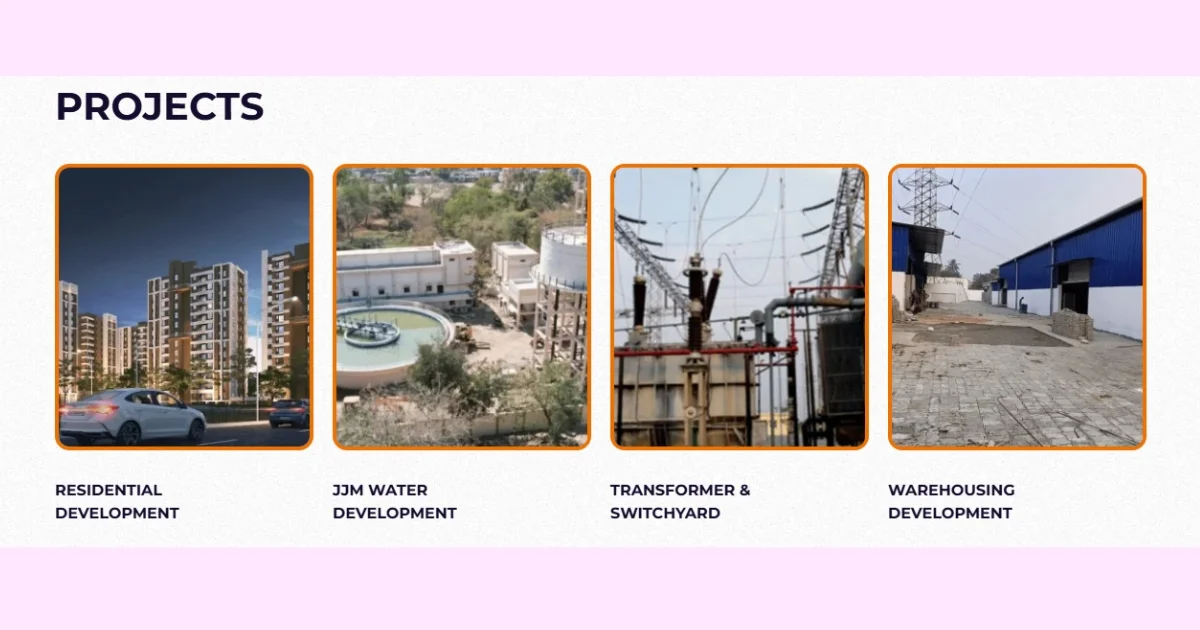

Ganesh Infraworld specializes in a wide range of infrastructure services.

| Segment | Details |

|---|---|

| Civil Infrastructure | Construction of residential and commercial buildings |

| Electrical Infrastructure | Electrification projects for substations and power distribution |

| Road and Rail Projects | Development of roads and railway infrastructure, including overhead equipment for railways |

| Water Infrastructure | Pipelines, pumping systems, and water treatment plants |

The company operates through three verticals: Engineering, Procurement, and Construction. It has a robust order book valued at ₹57.49 crore as of August 2024.

Ganesh Infraworld Financials

| Metric | FY 2021-22 | FY 2022-23 | FY 2023-24 | 5M FY 2024-25 |

|---|---|---|---|---|

| Revenue (₹ Lakh) | 8,115.46 | 13,504.85 | 29,181.12 | 21,232.86 |

| EBITDA (₹ Lakh) | 373.04 | 916.58 | 2,419.15 | 2,163.62 |

| PAT (₹ Lakh) | 188.75 | 520.92 | 1,554.47 | 1,537.20 |

| EBITDA Margin (%) | 4.59 | 6.79 | 8.28 | 10.19 |

| PAT Margin (%) | 2.33 | 3.86 | 5.33 | 7.24 |

The company has shown significant growth, with a 198% increase in PAT between FY 2023 and FY 2024.

Ganesh Infraworld Shareholding Pattern

| Category | Holding (%) |

|---|---|

| Promoters | 100 |

| Public and Others | 0 |

The entire shareholding is currently with Indian promoters, reflecting strong management control.

Ganesh Infraworld Share Price Target 2024 To 2040

Below are the month-wise Ganesh Infraworld share price targets for Ganesh Infraworld from 2024 to 2040:

Ganesh Infraworld Share Price Target 2024

| Month | Price (₹) |

|---|---|

| January | IPO not listed |

| February | IPO not listed |

| March | IPO not listed |

| April | IPO not listed |

| May | IPO not listed |

| June | IPO not listed |

| July | IPO not listed |

| August | IPO not listed |

| September | IPO not listed |

| October | IPO not listed |

| November | IPO not listed |

| December | 90 |

Ganesh Infraworld Share Price Target 2025

| Month | Price (₹) |

|---|---|

| January | 91 |

| February | 93 |

| March | 95 |

| April | 97 |

| May | 98 |

| June | 100 |

| July | 102 |

| August | 104 |

| September | 106 |

| October | 108 |

| November | 109 |

| December | 110 |

Ganesh Infraworld Share Price Target 2026

| Month | Price (₹) |

|---|---|

| January | 112 |

| February | 114 |

| March | 116 |

| April | 118 |

| May | 120 |

| June | 122 |

| July | 124 |

| August | 126 |

| September | 128 |

| October | 129 |

| November | 130 |

| December | 132 |

Ganesh Infraworld Share Price Target 2027

| Month | Price (₹) |

|---|---|

| January | 135 |

| February | 138 |

| March | 141 |

| April | 143 |

| May | 145 |

| June | 147 |

| July | 149 |

| August | 150 |

| September | 152 |

| October | 154 |

| November | 156 |

| December | 158 |

Ganesh Infraworld Share Price Target 2028

| Month | Price (₹) |

|---|---|

| January | 160 |

| February | 163 |

| March | 166 |

| April | 169 |

| May | 171 |

| June | 174 |

| July | 177 |

| August | 179 |

| September | 182 |

| October | 184 |

| November | 186 |

| December | 188 |

Ganesh Infraworld Share Price Target 2029

| Month | Price (₹) |

|---|---|

| January | 190 |

| February | 193 |

| March | 196 |

| April | 199 |

| May | 202 |

| June | 205 |

| July | 208 |

| August | 210 |

| September | 212 |

| October | 215 |

| November | 218 |

| December | 220 |

Ganesh Infraworld Share Price Target 2030

| Month | Price (₹) |

|---|---|

| January | 223 |

| February | 226 |

| March | 229 |

| April | 232 |

| May | 235 |

| June | 238 |

| July | 240 |

| August | 243 |

| September | 246 |

| October | 249 |

| November | 252 |

| December | 255 |

Ganesh Infraworld Share Price Target 2040

| Month | Price (₹) |

|---|---|

| January | 500 |

| February | 520 |

| March | 540 |

| April | 560 |

| May | 580 |

| June | 600 |

| July | 620 |

| August | 640 |

| September | 660 |

| October | 680 |

| November | 700 |

| December | 720 |

Ganesh Infraworld Peer Comparison

| Company | P/E Ratio | Market Cap (₹ Cr.) | Sales (Qtr) (₹ Cr.) |

|---|---|---|---|

| Ganesh Infraworld | 89.1 | 355 | – |

| NCC Ltd | 24.49 | 19,453.83 | 4,444.98 |

| Man Infraconstruction | 56.26 | 8,731.53 | 70.60 |

Ganesh Infraworld operates in a competitive landscape but stands out for its focused infrastructure services and growth potential.

FAQs

1. What is the Ganesh Infraworld share price target for 2024?

The target is ₹90 by December 2024.

2. How does Ganesh Infraworld compare to its peers?

Ganesh Infraworld shows a higher P/E ratio, reflecting optimism about its growth potential.

3. What drives Ganesh Infraworld’s growth?

Robust order book, efficient operations, and strategic use of IPO proceeds drive growth.

Final Words

Ganesh Infraworld Limited is positioned to capitalize on India’s growing infrastructure demand. With detailed share price targets indicating steady growth, the company presents an attractive investment opportunity for long-term investors.