Garuda Construction and Engineering Limited is set to launch its Initial Public Offering (IPO) from October 8 to October 10, 2024. This blog provides an in-depth analysis of the Garuda Construction and Engineering IPO, covering its key details, subscription status, GMP today, business overview, financials, IPO review, allotment status, and FAQs.

Garuda Construction and Engineering IPO Details

The Garuda Construction and Engineering IPO has drawn attention due to the company’s diversified portfolio in the construction sector. Below are the key details:

| IPO Element | Details |

|---|---|

| Price Band | ₹92 to ₹95 per share |

| IPO Size | ₹264.10 crores |

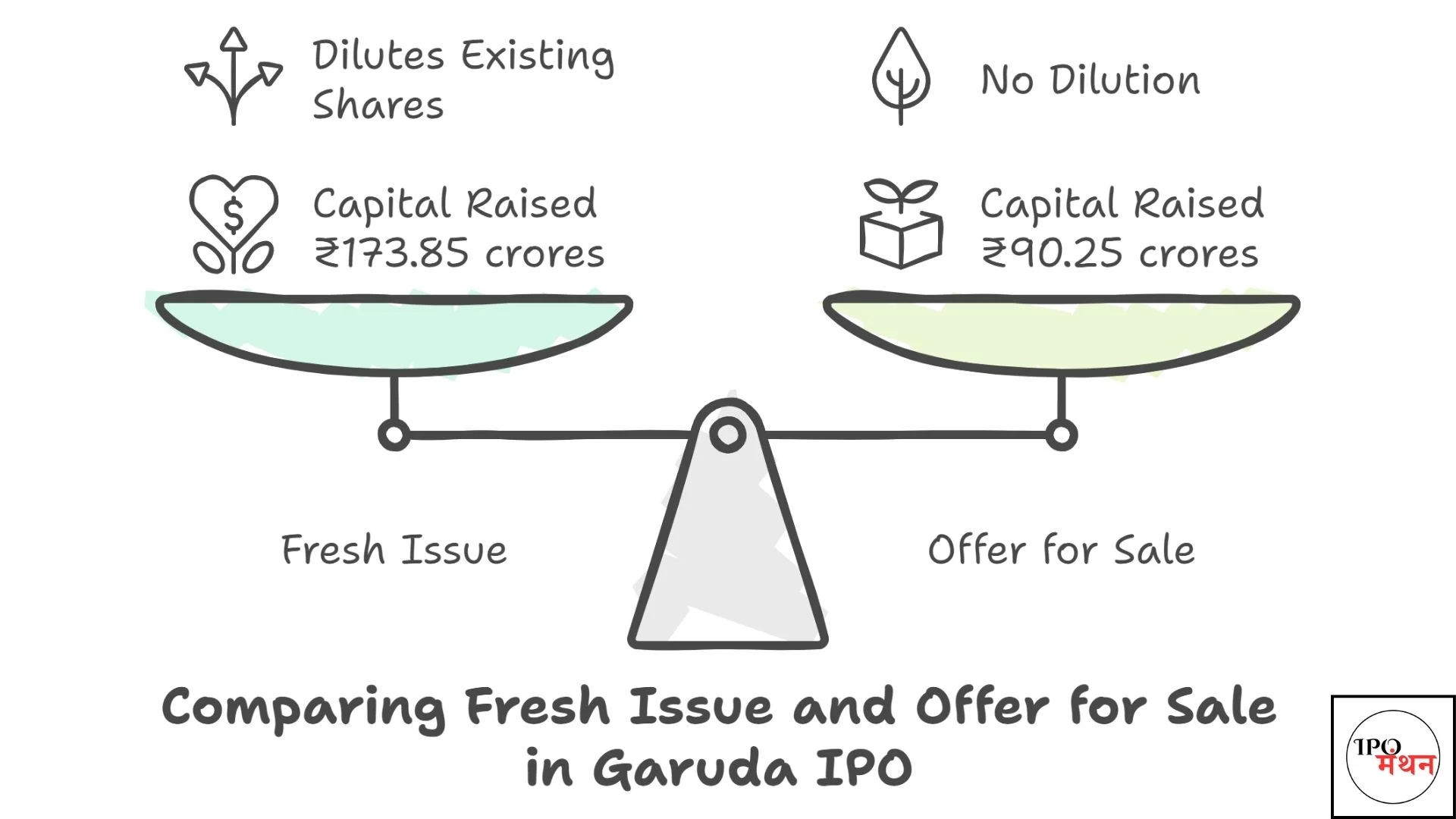

| Fresh Issue | ₹173.85 crores |

| Offer for Sale (OFS) | ₹90.25 crores |

| Lot Size | 157 shares |

| Minimum Investment | ₹14,915 (1 lot) |

| Total Shares | 2.78 crore shares |

| Qualified Institutional Buyers (QIB) | 50% allocation |

| Non-Institutional Investors (NII) | 15% allocation |

| Retail Investors | 35% allocation |

The IPO opens for public subscription from October 8 to October 10, 2024, and is expected to raise approximately ₹264.10 crores. The fresh issue comprises ₹173.85 crores, while ₹90.25 crores will be sold by promoter PKH Ventures Limited through the offer for sale (OFS).

Subscription Status of Garuda Construction and Engineering IPO

The subscription status of the Garuda Construction and Engineering IPO will be available once the IPO opens for bids on October 8, 2024. The allotment will be divided among QIBs (50%), NIIs (15%), and Retail Investors (35%).

| Investor Category | Percentage of Allotment |

|---|---|

| QIBs | 50% |

| NIIs | 15% |

| Retail Investors | 35% |

Investors can check the subscription status through stock exchanges or brokerage platforms during the IPO period.

Garuda Construction and Engineering IPO GMP Today

The Grey Market Premium (GMP) for the Garuda Construction and Engineering IPO is ₹0. The GMP tends to fluctuate as the IPO date approaches, so investors should monitor market trends closer to the opening date.

| Garuda Construction and Engineering IPO GMP Today | ₹ 0 |

|---|

A lack of reported GMP indicates no grey market activity currently, but this may change as demand for the IPO grows.

Business Overview of Garuda Construction and Engineering

Founded in 2010, Garuda Construction and Engineering is a prominent player in India’s civil construction industry. The company specializes in a range of services:

Core Services:

- Residential and Commercial Projects: Developing housing complexes, office buildings, and retail spaces.

- Infrastructure Projects: Construction of roads, bridges, and public utilities.

- Industrial Projects: Developing manufacturing and production facilities.

- Hospitality Services: Known for projects like Golden Chariot Vasai Hotel & Spa.

Additional Services:

- Operations and Maintenance (O&M): Post-construction facility management.

- Mechanical, Electrical, and Plumbing (MEP) Services: Critical infrastructure installations.

- Finishing Works: Enhancing aesthetic and functional quality.

Ongoing Projects:

Garuda Construction currently manages 12 projects across multiple Indian states, including Maharashtra, Tamil Nadu, New Delhi, and Karnataka. The company boasts an order book valued at ₹1,408.27 crores, including projects like the Delhi Police Headquarters and Trinity Oasis in Thane.

Financials of Garuda Construction and Engineering

The financial performance of Garuda Construction and Engineering reflects its solid growth over the past few years, although there has been some volatility. Below is a summary of key financial data:

| Financial Metric | FY 2022 | FY 2023 | FY 2024 |

|---|---|---|---|

| Revenue | ₹77.03 crore | ₹161.02 crore | ₹154.47 crore |

| Profit After Tax | ₹18.78 crore | ₹40.80 crore | ₹36.44 crore |

| Net Worth | ₹41.79 crore | ₹122.51 crore | ₹122.51 crore |

| EBITDA Margin | 32.49% | 32.49% | 32.49% |

While revenue declined slightly from FY 2023 to FY 2024, the company maintained a healthy EBITDA margin of 32.49%. Total borrowings decreased significantly, showing improved financial health.

Garuda Construction and Engineering IPO Review

The Garuda Construction and Engineering IPO presents a promising opportunity for investors interested in India’s growing construction sector. The company’s large order book and reduced debt levels indicate strong growth potential. Here’s a quick review:

Positives:

- Strong Order Book: Valued at ₹1,408.27 crores.

- Diversified Business Model: Focused on residential, commercial, infrastructure, and industrial projects.

- Reduced Debt: Borrowings decreased by 98.8% from FY 2022 to FY 2024.

Risks:

- Sectoral Cyclicality: The construction industry is subject to economic cycles.

- Geographical Concentration: Limited presence outside key Indian states compared to larger competitors.

Garuda Construction and Engineering IPO Allotment Status

The allotment status for the Garuda Construction and Engineering IPO will be finalized on October 11, 2024. Shares will be credited to the demat accounts of successful applicants by October 14, 2024, with the listing on BSE and NSE expected on October 15, 2024.

How to Check Allotment Status:

- Registrar’s Website: Check on Link Intime India’s website.

- Brokerage Platform: Most brokers provide IPO allotment status.

- SMS Alerts: Many brokers send allotment notifications via SMS.

| Event | Date |

|---|---|

| IPO Opening Date | October 8, 2024 |

| IPO Closing Date | October 10, 2024 |

| Allotment Date | October 11, 2024 |

| Credit to Demat Accounts | October 14, 2024 |

| Listing Date | October 15, 2024 |

FAQs about Garuda Construction and Engineering IPO

Here are some frequently asked questions about the Garuda Construction and Engineering IPO:

1. What is the IPO price band?

The price band for the IPO is ₹92 to ₹95 per equity share.

2. When will the IPO open and close?

The IPO will open on October 8, 2024, and close on October 10, 2024.

3. What is the minimum investment amount?

The minimum investment for one lot (157 shares) is ₹14,915.

4. How is the IPO allotment divided?

The allotment is divided as follows: QIBs (50%), NIIs (15%), and Retail Investors (35%).

5. What are the proceeds from the IPO used for?

The proceeds will primarily be used for working capital and general corporate purposes.

6. When will the shares be listed?

The shares are expected to be listed on October 15, 2024 on BSE and NSE.

Conclusion

The Garuda Construction and Engineering IPO is an attractive option for investors looking to tap into the growing Indian construction market. With a strong order book, diversified service offerings, and improving financials, the company is well-positioned for growth. Investors should carefully evaluate the risks and market conditions before investing in this IPO.

Thank you for reading and staying informed about the Garuda Construction and Engineering IPO!