Inventurus Knowledge Solutions, commonly referred to as IKS Health, is a leading healthcare technology solutions provider specializing in care enablement platforms. The company’s recent IPO has generated significant buzz, and its long-term growth trajectory offers promising opportunities for investors. This blog discusses the Inventurus Knowledge Solutions share price target for 2025 to 2040, along with insights into the company’s IPO, business, financials, and peer comparison.

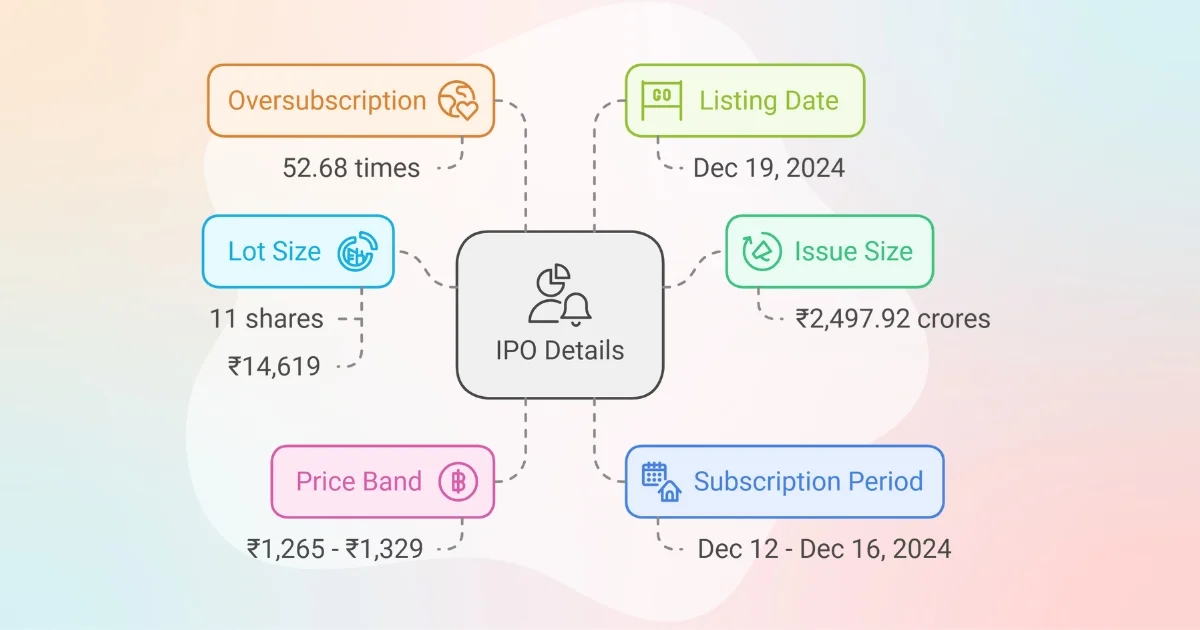

Inventurus Knowledge Solutions IPO Details

| Metric | Details |

|---|---|

| Issue Size | ₹2,497.92 crores |

| Price Band | ₹1,265 – ₹1,329 per share |

| Lot Size | 11 shares (₹14,619 minimum investment) |

| Subscription Period | Dec 12 – Dec 16, 2024 |

| Oversubscription | 52.68 times |

| Listing Date | Dec 19, 2024 |

The IPO proceeds were entirely from an Offer for Sale (OFS), with substantial interest from Qualified Institutional Buyers (QIBs).

Inventurus Knowledge Solutions Company Details

| Founded | 2006 |

|---|---|

| Headquarters | India |

| Industry | Healthcare Technology |

| Workforce | 13,528 employees (2,612 clinically trained professionals) |

Inventurus provides care enablement solutions, including medical billing, coding, and revenue cycle management (RCM). Its clients include notable healthcare organizations across the U.S., Canada, and Australia.

Inventurus Knowledge Solutions Business Overview

| Service | Details |

|---|---|

| Revenue Cycle Management | Billing, coding, claims processing, analytics |

| Clinical Documentation | Enhancing accuracy for better compliance |

| Consultative Services | Value-based care transition support |

The company leverages AI and automation to streamline healthcare operations, improve patient care, and optimize financial performance.

Inventurus Knowledge Solutions Financials

| Metric | FY22 (₹ Cr.) | FY23 (₹ Cr.) | FY24 (₹ Cr.) |

|---|---|---|---|

| Revenue | 1,060.16 | 1,817.92 | 1,294.61* |

| Profit After Tax | 305.23 | 370.49 | 208.58* |

| EBITDA Margin (%) | 39.0 | 28.6 | 29.0* |

*Figures for FY24 are based on partial-year results until September.

The company’s revenue doubled from FY22 to FY23, reflecting market expansion and operational efficiency, though FY24 shows margin pressures.

Inventurus Knowledge Solutions Shareholding Pattern

| Category | Pre-IPO (%) | Post-IPO (%) |

|---|---|---|

| Promoters | 69.73 | 60.61 |

| Others | 27.53 | 39.90 |

| Public Investors | 2.74 | 0.49 |

Promoters retain a significant stake, while new institutional and retail investors have increased their share post-IPO.

Inventurus Knowledge Solutions Share Price Target 2025 To 2040

Inventurus Knowledge Solutions Share Price Target for each year from 2025 to 2040 is provided below with month-wise projections.

Inventurus Knowledge Solutions Share Price Target 2025

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 1,400 | 1,300 |

| February | 1,420 | 1,320 |

| March | 1,450 | 1,350 |

| April | 1,470 | 1,370 |

| May | 1,500 | 1,400 |

| June | 1,550 | 1,450 |

| July | 1,580 | 1,480 |

| August | 1,600 | 1,500 |

| September | 1,650 | 1,550 |

| October | 1,700 | 1,600 |

| November | 1,750 | 1,650 |

| December | 1,800 | 1,700 |

Inventurus Knowledge Solutions Share Price Target for 2025 ranges from ₹1,300 to ₹1,800.

Inventurus Knowledge Solutions Share Price Target 2026

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 1,900 | 1,800 |

| February | 1,920 | 1,820 |

| March | 1,950 | 1,850 |

| April | 1,970 | 1,870 |

| May | 2,000 | 1,900 |

| June | 2,100 | 1,950 |

| July | 2,150 | 2,000 |

| August | 2,200 | 2,050 |

| September | 2,250 | 2,100 |

| October | 2,300 | 2,150 |

| November | 2,350 | 2,200 |

| December | 2,400 | 2,300 |

Inventurus Knowledge Solutions Share Price Target 2027

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 2,500 | 2,400 |

| February | 2,550 | 2,450 |

| March | 2,600 | 2,500 |

| April | 2,650 | 2,550 |

| May | 2,700 | 2,600 |

| June | 2,750 | 2,650 |

| July | 2,800 | 2,700 |

| August | 2,850 | 2,750 |

| September | 2,900 | 2,800 |

| October | 2,950 | 2,850 |

| November | 3,000 | 2,900 |

| December | 3,050 | 2,950 |

Inventurus Knowledge Solutions Share Price Target 2028

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 3,100 | 3,000 |

| February | 3,150 | 3,050 |

| March | 3,200 | 3,100 |

| April | 3,300 | 3,200 |

| May | 3,400 | 3,300 |

| June | 3,500 | 3,400 |

| July | 3,600 | 3,500 |

| August | 3,700 | 3,600 |

| September | 3,800 | 3,700 |

| October | 3,900 | 3,800 |

| November | 4,000 | 3,900 |

| December | 4,100 | 4,000 |

Inventurus Knowledge Solutions Share Price Target 2029

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 4,200 | 4,100 |

| February | 4,300 | 4,200 |

| March | 4,400 | 4,300 |

| April | 4,500 | 4,400 |

| May | 4,600 | 4,500 |

| June | 4,700 | 4,600 |

| July | 4,800 | 4,700 |

| August | 4,900 | 4,800 |

| September | 5,000 | 4,900 |

| October | 5,100 | 5,000 |

| November | 5,200 | 5,100 |

| December | 5,300 | 5,200 |

Inventurus Knowledge Solutions Share Price Target 2030

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 5,400 | 5,300 |

| February | 5,500 | 5,400 |

| March | 5,600 | 5,500 |

| April | 5,700 | 5,600 |

| May | 5,800 | 5,700 |

| June | 6,000 | 5,800 |

| July | 6,200 | 6,000 |

| August | 6,400 | 6,200 |

| September | 6,600 | 6,400 |

| October | 6,800 | 6,600 |

| November | 7,000 | 6,800 |

| December | 7,200 | 7,000 |

Inventurus Knowledge Solutions Share Price Target 2040

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 10,000 | 9,500 |

| February | 10,200 | 9,700 |

| March | 10,400 | 9,900 |

| April | 10,600 | 10,100 |

| May | 10,800 | 10,300 |

| June | 11,000 | 10,500 |

| July | 11,200 | 10,700 |

| August | 11,400 | 10,900 |

| September | 11,600 | 11,100 |

| October | 11,800 | 11,300 |

| November | 12,000 | 11,500 |

| December | 12,200 | 11,700 |

The Inventurus Knowledge Solutions Share Price Target highlights consistent growth potential, reflecting the company’s strong market position in the healthcare technology industry.

Inventurus Knowledge Solutions Peer Comparison

| Company | Revenue (FY24) | Net Profit (₹ Cr) | EBITDA Margin (%) |

|---|---|---|---|

| Inventurus Knowledge Solutions | 1,818 | 370 | 28.6 |

| Indegene Ltd. | 1,200 | 156 | 13.0 |

| Entero Healthcare Solutions | 900 | 26 | 2.9 |

IKS Health’s superior margins and diversified offerings make it a leader among its peers.

FAQs

1. What is the Inventurus Knowledge Solutions share price target for 2025?

The target ranges between ₹1,600 and ₹1,800 by December 2025.

2. What drives Inventurus Knowledge Solutions’ growth?

Key growth drivers include technological innovation, strategic acquisitions, and expanding client bases in global markets.

3. How does Inventurus compare to peers?

IKS stands out with higher EBITDA margins and a broader service portfolio, giving it a competitive edge.

Final Words

The Inventurus Knowledge Solutions share price target projections show a promising upward trajectory. As a leader in healthcare technology, its commitment to innovation, efficiency, and market expansion offers significant potential for long-term investors.