JSW Steel Limited, one of India’s largest steel manufacturers, has become a dominant force in the global steel market. Known for its innovation and strong operational strategies, the company caters to a diverse customer base across construction, automotive, and infrastructure sectors. This blog explores the JSW Steel share price target projections for the years 2025 to 2040, along with insights into the company’s financials, market position, and peer comparisons.

JSW Steel Share Price History

| Metric | Details |

|---|---|

| 52-Week High | ₹1,063.35 (Oct 2024) |

| 52-Week Low | ₹762.00 (Mar 2024) |

JSW Steel’s share price reflects steady growth and resilience in volatile markets. Over the past year, it has been influenced by global steel demand and macroeconomic factors. Its ability to consistently perform during market fluctuations has positioned it as a preferred choice for investors.

JSW Steel Company Details

| Founded | 1982 |

|---|---|

| Headquarters | Mumbai, Maharashtra, India |

| Chairman | Sajjan Jindal |

| Market Cap | ₹1.90 trillion |

| Employees | 12,856 |

JSW Steel is a part of the JSW Group and operates 14 manufacturing facilities with an installed production capacity of 35.7 million tonnes per annum (MTPA), which is expected to expand to 38.5 MTPA by FY25. The company is a pioneer in technological innovation and sustainable production processes, contributing significantly to India’s industrial growth.

JSW Steel Business Overview

| Segment | Products |

|---|---|

| Flat Products | Hot-rolled coils, galvanized sheets |

| Long Products | TMT bars, wire rods |

| Specialty Products | Electrical steel, alloy bars |

JSW Steel caters to diverse industries such as automotive, construction, and renewable energy, and exports its products to over 100 countries. The company has also taken significant steps toward green steel manufacturing, further strengthening its market position.

JSW Steel Financials

| Metric | FY 2021-22 (₹ Cr.) | FY 2022-23 (₹ Cr.) | FY 2023-24 (₹ Cr.) |

|---|---|---|---|

| Revenue | 1,16,928 | 1,30,039 | 1,33,609 |

| Net Profit | 16,702 | 4,937 | 8,041 |

| Earnings Per Share (EPS) | 86 | 17 | 36 |

JSW Steel has demonstrated consistent revenue growth over the years. However, profitability has seen fluctuations due to operational challenges and increased input costs. In FY24, the company managed to stabilize its financials with improved efficiency and higher steel demand.

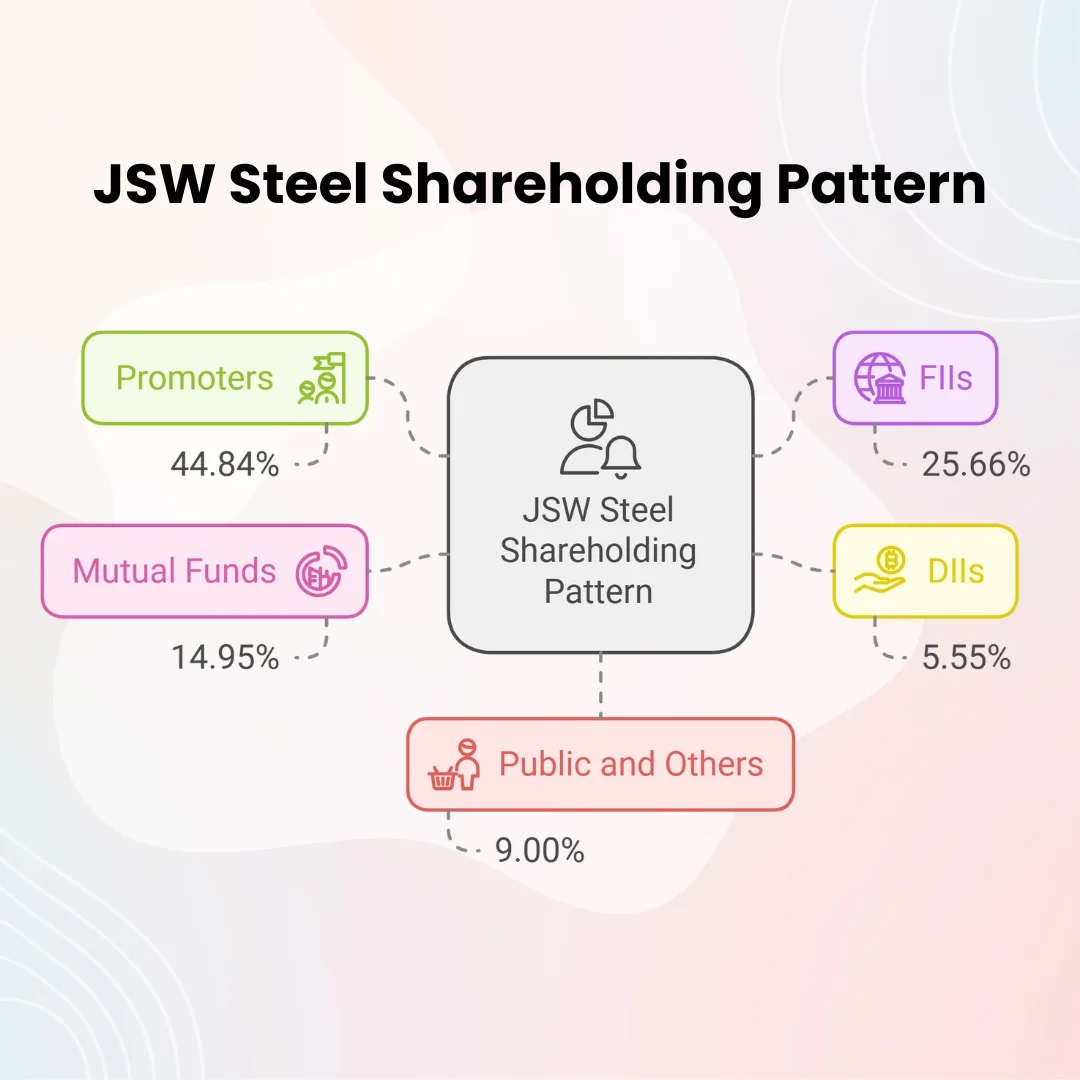

JSW Steel Shareholding Pattern

| Category | Holding (%) |

|---|---|

| Promoters | 44.84 |

| FIIs | 25.66 |

| DIIs | 5.55 |

| Mutual Funds | 14.95 |

| Public and Others | 9.00 |

The high promoter and institutional holdings reflect strong confidence in the company’s long-term growth.

JSW Steel Share Price Target 2025 To 2040

Below is the detailed month-wise JSW Steel share price target 2025 to 2040, considering both bullish and bearish scenarios.

JSW Steel Share Price Target 2025

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 1,950 | 1,700 |

| February | 1,970 | 1,720 |

| March | 1,980 | 1,730 |

| April | 1,990 | 1,750 |

| May | 2,000 | 1,760 |

| June | 2,000 | 1,800 |

| July | 2,020 | 1,820 |

| August | 2,050 | 1,850 |

| September | 2,100 | 1,870 |

| October | 2,150 | 1,880 |

| November | 2,170 | 1,890 |

| December | 2,188 | 1,900 |

JSW Steel Share Price Target 2026

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 2,200 | 1,950 |

| February | 2,230 | 1,970 |

| March | 2,250 | 1,980 |

| April | 2,300 | 2,000 |

| May | 2,400 | 2,100 |

| June | 2,500 | 2,200 |

| July | 2,600 | 2,300 |

| August | 2,700 | 2,400 |

| September | 2,750 | 2,500 |

| October | 2,770 | 2,550 |

| November | 2,780 | 2,600 |

| December | 2,790 | 2,630 |

JSW Steel Share Price Target 2027

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 3,000 | 2,500 |

| February | 3,050 | 2,550 |

| March | 3,100 | 2,600 |

| April | 3,150 | 2,650 |

| May | 3,200 | 2,700 |

| June | 3,250 | 2,750 |

| July | 3,280 | 2,770 |

| August | 3,290 | 2,780 |

| September | 3,300 | 2,800 |

| October | 3,310 | 2,820 |

| November | 3,320 | 2,830 |

| December | 3,290 | 2,800 |

JSW Steel Share Price Target 2028

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 3,500 | 3,000 |

| February | 3,550 | 3,050 |

| March | 3,600 | 3,100 |

| April | 3,650 | 3,150 |

| May | 3,700 | 3,200 |

| June | 3,750 | 3,250 |

| July | 3,780 | 3,270 |

| August | 3,800 | 3,280 |

| September | 3,830 | 3,300 |

| October | 3,850 | 3,320 |

| November | 3,860 | 3,330 |

| December | 3,870 | 3,340 |

JSW Steel Share Price Target 2029

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 4,000 | 3,500 |

| February | 4,050 | 3,550 |

| March | 4,100 | 3,600 |

| April | 4,150 | 3,650 |

| May | 4,200 | 3,700 |

| June | 4,300 | 3,750 |

| July | 4,400 | 3,800 |

| August | 4,450 | 3,850 |

| September | 4,480 | 3,870 |

| October | 4,500 | 3,880 |

| November | 4,490 | 3,870 |

| December | 4,500 | 3,900 |

JSW Steel Share Price Target 2030

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 4,800 | 4,200 |

| February | 4,850 | 4,250 |

| March | 4,900 | 4,300 |

| April | 4,950 | 4,350 |

| May | 5,000 | 4,400 |

| June | 5,050 | 4,450 |

| July | 5,100 | 4,500 |

| August | 5,150 | 4,550 |

| September | 5,200 | 4,600 |

| October | 5,250 | 4,650 |

| November | 5,300 | 4,700 |

| December | 5,350 | 4,750 |

JSW Steel Share Price Target 2040

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 10,000 | 8,500 |

| February | 10,500 | 9,000 |

| March | 11,000 | 9,500 |

| April | 11,500 | 10,000 |

| May | 12,000 | 10,500 |

| June | 12,500 | 11,000 |

| July | 13,000 | 11,500 |

| August | 13,500 | 12,000 |

| September | 14,000 | 12,500 |

| October | 14,500 | 13,000 |

| November | 14,800 | 13,200 |

| December | 15,000 | 13,500 |

JSW Steel Peer Comparison

| Company | Market Cap (₹ Cr.) | P/E Ratio | Dividend Yield (%) |

|---|---|---|---|

| JSW Steel | 1,90,000 | 38.51 | 0.91 |

| Tata Steel | 1,83,632 | 11.27 | 2.45 |

| Jindal Steel & Power | 95,357 | 18.64 | 0.21 |

JSW Steel leads in market cap and operational efficiency but trades at a higher P/E ratio compared to peers. Its premium valuation reflects investor confidence in its growth potential.

FAQs

Q1. What is the JSW Steel share price target for 2025?

The target ranges between ₹1,950 and ₹2,188 by December 2025.

Q2. Why is JSW Steel considered a strong investment?

JSW Steel’s strong operational framework, expanding production capacity, and market leadership position it as a preferred investment.

Q3. How does JSW Steel compare to Tata Steel?

While Tata Steel offers better dividend yields, JSW Steel’s consistent growth trajectory and operational excellence make it a formidable competitor.

Final Words

JSW Steel continues to lead the steel industry with its robust production capabilities and innovative strategies. The JSW Steel share price target projections highlight steady growth, making it a compelling option for long-term investors.