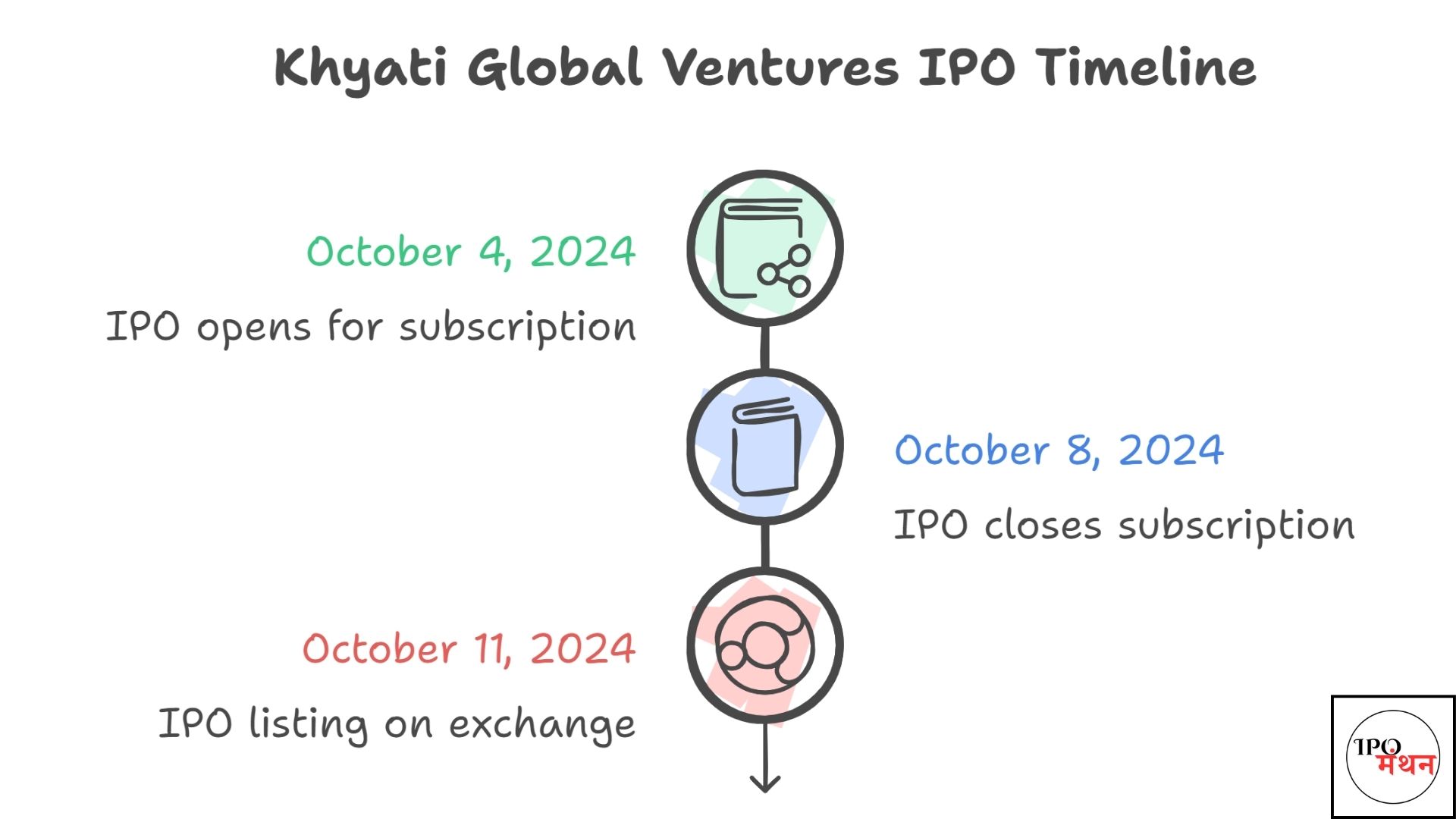

Khyati Global Ventures Limited is set to launch its much-anticipated Initial Public Offering (IPO) between October 4, 2024, and October 8, 2024. The IPO offers a unique opportunity for investors to be part of an expanding Fast-Moving Consumer Goods (FMCG) export company. Below, we will break down the Khyati Global Ventures IPO details, subscription status, grey market premium (GMP), business overview, financials, and other crucial information.

Khyati Global Ventures IPO Details

The Khyati Global Ventures IPO will open for subscription on October 4, 2024, and close on October 8, 2024. Here’s a snapshot of the key details:

| IPO Details | Values |

|---|---|

| Issue Price | ₹99 per share |

| Face Value | ₹10 per share |

| Total Issue Size | ₹18.30 crores |

| Total Shares Offered | 1,848,000 shares |

| Fresh Issue | 1,048,000 shares |

| Offer for Sale (OFS) | 800,000 shares |

| Minimum Lot Size | 1,200 shares |

| Minimum Investment | ₹118,800 |

| Listing Date | October 11, 2024 |

The IPO will be listed on the BSE SME, and the lot size requires a minimum investment of ₹118,800 for 1,200 shares. The total issue size is ₹18.30 crore, which includes both a fresh issue of ₹10.38 crore and an offer for sale worth ₹7.92 crore.

Khyati Global Ventures IPO Subscription Status

As the IPO progresses, the subscription status becomes a key indicator of investor interest across different categories. As of now, the Khyati Global Ventures IPO subscription status is as follows:

| Investor Category | Subscription Status |

|---|---|

| Qualified Institutional Buyers (QIB) | 0.00x |

| Retail Individual Investors (RII) | 16.53 times |

| Non-Institutional Investors (NII) | 3.35 times |

Retail investors have shown significant interest with a subscription of 16.53 times, while QIBs have subscribed at 0.00x. However, 3.35 times have been recorded yet from non-institutional investors.

Khyati Global Ventures IPO GMP Today

As of now, there is no Grey Market Premium (GMP) available for the Khyati Global Ventures IPO. Investors should keep an eye on the grey market in the days leading up to the IPO listing to gauge market sentiment.

Khyati Global Ventures Business Overview

Khyati Global Ventures Limited operates in the FMCG sector as an exporter and re-packager of a diverse range of products. They cater to wholesalers and supermarket importers worldwide, providing both food and non-food FMCG products. Here’s an overview of their business model:

| Product Categories | Details |

|---|---|

| Food Stuffs | Staples like flour, spices, grains, and pulses |

| Non-Food FMCG | Everyday consumer essentials |

| Household Products | Cleaning and utility items |

| Festive Handicrafts | Items for festivals and traditional crafts |

| Pharmaceutical Products | Essential medicines and healthcare items |

The company serves over 40 countries, and their strategy revolves around sourcing directly from manufacturers to maintain high-quality standards and competitive pricing. They also provide private labeling services, which allow clients to sell products under their own brand names.

Financial Performance of Khyati Global Ventures

Khyati Global Ventures has shown strong financial growth in recent years. Below is a table summarizing their key financial performance metrics:

| Particulars | 30th June 2024 | FY24 | FY23 | FY22 |

|---|---|---|---|---|

| Revenue (₹ in Lakhs) | 2,716.92 | 10,464.09 | 9,617.14 | 9,362.70 |

| Profit After Tax (₹ in Lakhs) | 94.67 | 253.19 | 205.66 | 149.66 |

| Net Worth (₹ in Lakhs) | 1,773.02 | 1,188.19 | 935.00 | 729.35 |

| Total Assets (₹ in Lakhs) | 4,911.62 | 5,275.97 | 3,458.90 | 3,468.13 |

The company reported revenues of ₹10,464.09 lakhs for FY24, marking an increase of about 11.8% over FY22. Similarly, their Profit After Tax (PAT) has grown from ₹149.66 lakhs in FY22 to ₹253.19 lakhs in FY24.

Khyati Global Ventures IPO Review

The Khyati Global Ventures IPO offers an attractive opportunity for investors looking to invest in a well-established FMCG exporter. Here’s a brief review of the key aspects:

Strengths:

- Diverse Product Portfolio: Khyati Global Ventures offers a wide range of food, non-food FMCG, and household products.

- Strong Financials: With steady growth in revenue and profits, the company has demonstrated its financial stability.

- Brand Relationships: The company works with renowned Indian brands like Haldiram’s, Colgate, and Unilever, enhancing its market credibility.

Weaknesses:

- Debt Levels: The company’s debt-to-equity ratio of 1.02 might raise some concerns among investors.

- Competitive FMCG Sector: The highly competitive nature of the FMCG market may impact the company’s profit margins.

Khyati Global Ventures IPO Allotment Status

The allotment status of the Khyati Global Ventures IPO will be finalized on October 9, 2024. Below are the key dates related to the allotment process:

| Allotment Events | Date |

|---|---|

| IPO Allotment Date | October 9, 2024 |

| Refund Initiation | October 10, 2024 |

| Shares Credited to Demat | October 10, 2024 |

| Expected Listing Date | October 11, 2024 |

Once the allotment is finalized, investors can check their allotment status on the registrar’s website or through various financial news portals.

FAQs About Khyati Global Ventures IPO

Here are some frequently asked questions (FAQs) about the Khyati Global Ventures IPO:

1. What is the issue price of the Khyati Global Ventures IPO?

The issue price of the Khyati Global Ventures IPO is ₹99 per share.

2. When will the IPO open for subscription?

The IPO will open for subscription on October 4, 2024, and will close on October 8, 2024.

3. What is the lot size for the IPO?

The lot size is 1,200 shares, requiring a minimum investment of ₹118,800.

4. When will the shares be listed?

The shares are expected to be listed on October 11, 2024 on the BSE SME.

5. What are the risks associated with the IPO?

Investors should be mindful of the company’s debt levels and the competitive nature of the FMCG market.

Conclusion

The Khyati Global Ventures IPO provides an excellent investment opportunity in the expanding FMCG export sector. With a diversified product range, strong financial growth, and established market relationships, Khyati Global Ventures appears well-positioned for future success. However, potential investors should carefully evaluate the risks, especially in relation to the company’s debt levels and competition. Keep an eye on the grey market for any updates on the GMP as the IPO date approaches.

Thank you for reading and staying informed about the Khyati Global Ventures IPO!