MobiKwik, a leading Indian financial technology company, has gained prominence with its digital wallet and payment solutions. This blog delves into the Mobikwik share price target for the years 2025 to 2040, along with insights into its IPO, business operations, financials, and market position.

One Mobikwik Share Price

One Mobikwik Systems Ltd had an impressive stock market debut on December 18, 2024. The shares opened at ₹442.25 on the BSE, a 58.51% premium over the IPO price of ₹279, and at ₹440 on the NSE, reflecting a 57.70% premium.

The stock continued to perform strongly throughout the day, closing at ₹530.30 on the BSE and ₹528 on the NSE, delivering nearly 90% gains from the issue price. The IPO was a major success, with an oversubscription of 119.38 times, highlighting the strong investor enthusiasm for the fintech sector.

One Mobikwik IPO Details

| Parameter | Details |

|---|---|

| IPO Size | ₹572 crore |

| Price Band | ₹265-₹279 per share |

| Lot Size | 53 shares (₹14,787) |

| Issue Type | 100% fresh issue |

| Subscription | 15.41 times (overall) |

| Allotment Date | December 16, 2024 |

| Listing Date | December 18, 2024 |

The IPO reflects strong demand, especially from retail investors, with funds aimed at supporting financial services growth and technology advancements.

One Mobikwik Company Details

| Founded | 2009 |

|---|---|

| Founders | Bipin Preet Singh and Upasana Taku |

| Headquarters | Gurugram, Haryana, India |

| Services | Digital wallet, UPI payments, loans, insurance, and investments |

| User Base | Over 156 million |

| Merchant Network | 4.1 million |

MobiKwik has positioned itself as a key player in India’s fintech ecosystem, leveraging technology to enhance accessibility and financial inclusion.

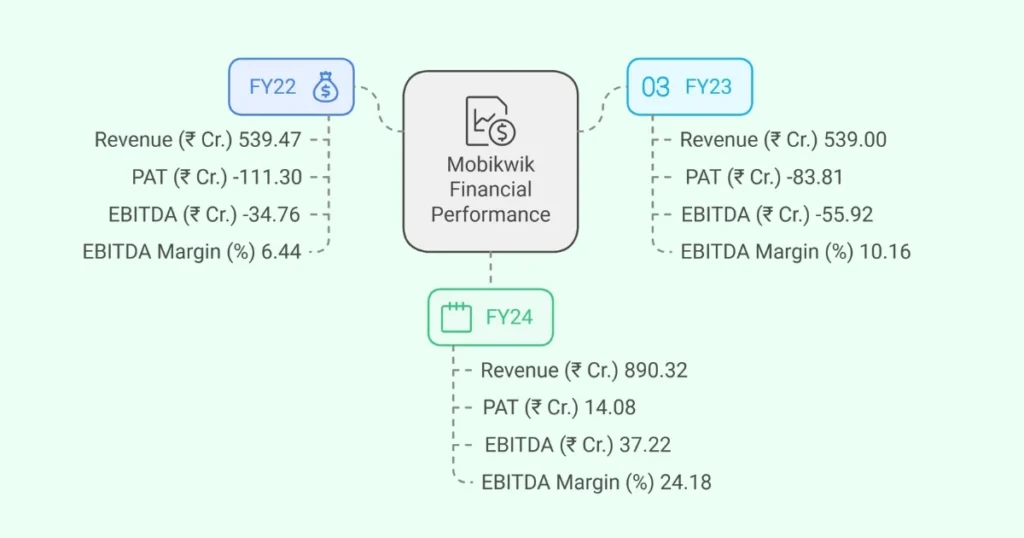

One Mobikwik Systems Financials

| Year | Revenue (₹ Cr.) | PAT (₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) |

|---|---|---|---|---|

| FY22 | 539.47 | -111.30 | -34.76 | -6.44 |

| FY23 | 539.00 | -83.81 | -55.92 | -10.16 |

| FY24 | 890.32 | 14.08 | 37.22 | 4.18 |

The company’s profitability in FY24 marks a significant turnaround, driven by expanding lending services and operational efficiencies.

Mobikwik Shareholding Pattern

| Category | Pre-IPO (%) | Post-IPO (%) |

|---|---|---|

| Promoters | 34.21 | 25.5 |

| Public Shareholding | 65.79 | 74.5 |

The IPO has diluted promoter holdings, increasing public participation and enhancing liquidity.

One Mobikwik Share Price Target 2025 to 2040

Below is a detailed month-wise One Mobikwik share price target for MobiKwik, considering both bullish and bearish projections.

One Mobikwik Share Price Target 2025

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 475 | 450 |

| February | 485 | 460 |

| March | 495 | 470 |

| April | 510 | 480 |

| May | 525 | 490 |

| June | 540 | 500 |

| July | 555 | 515 |

| August | 570 | 530 |

| September | 585 | 545 |

| October | 600 | 560 |

| November | 625 | 575 |

| December | 650 | 600 |

One Mobikwik Share Price Target 2026

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 670 | 630 |

| February | 685 | 645 |

| March | 700 | 660 |

| April | 720 | 680 |

| May | 740 | 700 |

| June | 760 | 720 |

| July | 780 | 740 |

| August | 800 | 760 |

| September | 820 | 780 |

| October | 840 | 800 |

| November | 860 | 820 |

| December | 880 | 840 |

One Mobikwik Share Price Target 2027

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 910 | 860 |

| February | 930 | 880 |

| March | 950 | 900 |

| April | 975 | 920 |

| May | 1,000 | 940 |

| June | 1,030 | 970 |

| July | 1,060 | 1,000 |

| August | 1,090 | 1,030 |

| September | 1,120 | 1,060 |

| October | 1,150 | 1,090 |

| November | 1,180 | 1,120 |

| December | 1,200 | 1,150 |

One Mobikwik Share Price Target 2028

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 1,240 | 1,190 |

| February | 1,260 | 1,210 |

| March | 1,280 | 1,230 |

| April | 1,310 | 1,250 |

| May | 1,340 | 1,280 |

| June | 1,370 | 1,300 |

| July | 1,400 | 1,330 |

| August | 1,430 | 1,360 |

| September | 1,460 | 1,390 |

| October | 1,490 | 1,420 |

| November | 1,520 | 1,450 |

| December | 1,550 | 1,480 |

One Mobikwik Share Price Target 2029

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 1,600 | 1,500 |

| February | 1,630 | 1,530 |

| March | 1,660 | 1,560 |

| April | 1,690 | 1,590 |

| May | 1,720 | 1,620 |

| June | 1,750 | 1,650 |

| July | 1,780 | 1,680 |

| August | 1,810 | 1,710 |

| September | 1,840 | 1,740 |

| October | 1,870 | 1,770 |

| November | 1,900 | 1,800 |

| December | 1,950 | 1,850 |

One Mobikwik Share Price Target 2030

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 2,000 | 1,900 |

| February | 2,050 | 1,950 |

| March | 2,100 | 2,000 |

| April | 2,150 | 2,050 |

| May | 2,200 | 2,100 |

| June | 2,250 | 2,150 |

| July | 2,300 | 2,200 |

| August | 2,350 | 2,250 |

| September | 2,400 | 2,300 |

| October | 2,450 | 2,350 |

| November | 2,500 | 2,400 |

| December | 2,550 | 2,450 |

One Mobikwik Share Price Target 2040

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 4,500 | 4,200 |

| February | 4,600 | 4,300 |

| March | 4,700 | 4,400 |

| April | 4,800 | 4,500 |

| May | 4,900 | 4,600 |

| June | 5,000 | 4,700 |

| July | 5,100 | 4,800 |

| August | 5,200 | 4,900 |

| September | 5,300 | 5,000 |

| October | 5,400 | 5,100 |

| November | 5,500 | 5,200 |

| December | 5,600 | 5,300 |

The Mobikwik Share Price Target reflects a consistent upward trajectory, with significant long-term growth potential fueled by its strong position in the Indian fintech ecosystem.

Mobikwik Peer Comparison

| Company | Revenue (₹ Cr.) | Profit/Loss (₹ Cr.) | Market Cap (₹ Cr.) |

|---|---|---|---|

| Mobikwik | 890.32 | 14.08 | 2,295.45 (Post Issue) |

| Paytm | 9,978 | -1,422 | 60,331 |

| PhonePe | – | – | – |

| Airtel Payments Bank | – | – | – |

Mobikwik’s profitability and focused growth strategy set it apart from competitors like Paytm, which continues to report losses.

FAQs

1. What is the Mobikwik share price target for 2025?

The target ranges between ₹260 and ₹425 by December 2025.

2. How does Mobikwik compare to Paytm?

Mobikwik has achieved profitability, unlike Paytm, and has a smaller yet rapidly growing user base.

3. What drives Mobikwik’s growth?

Key drivers include its lending services, innovative financial products, and expanding merchant network.

Final Words

Mobikwik has positioned itself as a strong contender in India’s fintech space, focusing on profitability and user-centric innovations. The Mobikwik share price target projections highlight steady growth, making it a promising option for long-term investors.