The upcoming Neelam Linens and Garments IPO GMP has caught the attention of investors eager to participate in India’s growing textile market. This IPO offers a chance to join a company specializing in soft furnishings and garments. Here’s a simple breakdown of what you need to know, including key details, subscription information, GMP updates, company overview, financials, and FAQs.

Neelam Linens and Garments IPO Details

The Neelam Linens and Garments IPO opens for subscription on November 8, 2024, with a scheduled closing date of November 12, 2024. It is aimed at raising ₹13 crore through a fresh issue of shares priced between ₹20 and ₹24 per share. Investors will need to bid for a minimum of 6,000 shares (one lot), resulting in a minimum investment of ₹120,000 if bidding at the upper price band.

| Details | Neelam Linens and Garments IPO |

|---|---|

| IPO Opening Date | November 8, 2024 |

| IPO Closing Date | November 12, 2024 |

| Price Band | ₹20 to ₹24 per share |

| Lot Size | 6,000 shares |

| Minimum Investment | ₹120,000 |

| Total Issue Size | ₹13 crore |

| Tentative Listing Date | November 18, 2024 |

| Listing Exchange | NSE SME |

| Registrar | Purva Sharegistry |

Neelam Linens and Garments IPO Subscription

The IPO will be open for retail investors, Qualified Institutional Buyers (QIBs), and Non-Institutional Investors (NIIs). Allocation for these categories includes:

- QIBs: 50%

- NIIs: 15%

- Retail Investors: 35%

Investors can apply through their brokers or online trading platforms. Keep in mind that the minimum investment size is ₹120,000, so ensure your funds are ready before the subscription date.

Neelam Linens and Garments IPO GMP Today

The Neelam Linens and Garments IPO GMP (Grey Market Premium) is a reflection of investor sentiment, indicating the premium or discount at which shares are trading in the unofficial market. As of now, Neelam Linens and Garments IPO GMP is reported as ₹0, which means there’s no premium over the price band. This could be due to current market conditions or investor caution as they await more updates closer to the subscription date. Monitoring the Neelam Linens and Garments IPO GMP daily is advised, as it can provide insight into investor sentiment.

Business Overview

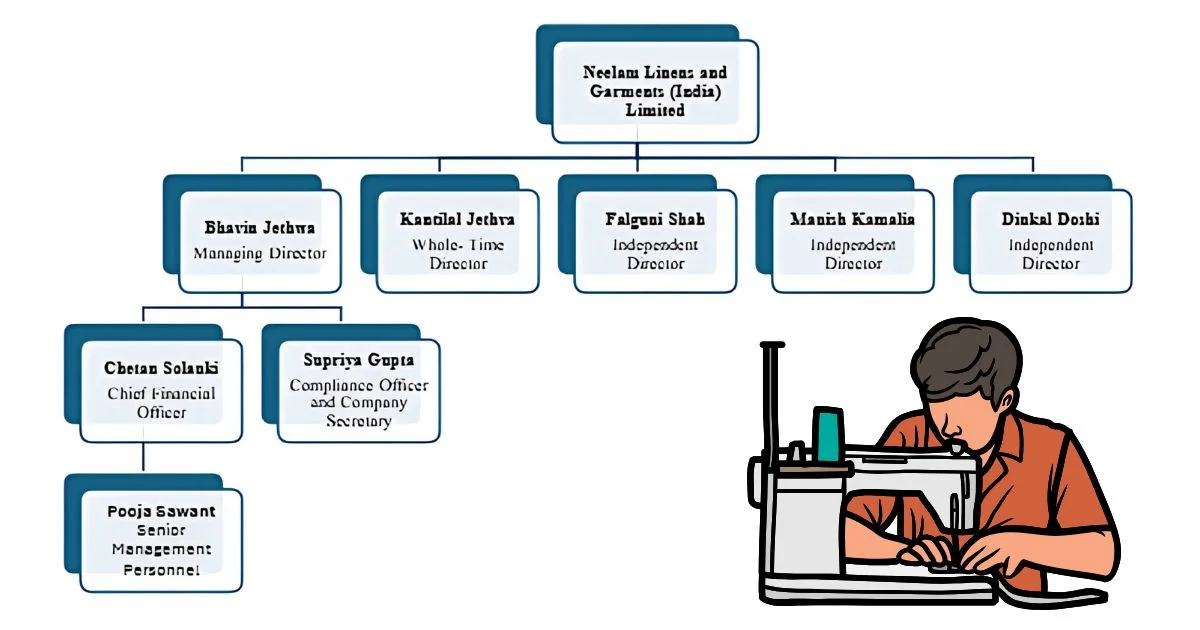

Founded in September 2010, Neelam Linens and Garments (India) Ltd has built a reputation in the textile industry. It produces a variety of soft furnishings and garments for both domestic and international clients, including bedsheets, pillow covers, towels, and rugs. Here’s a snapshot of the company’s product range and clientele:

- Product Range: Bedsheets, pillow covers, duvet covers, towels, rugs, and fashion apparel.

- Client Network: Major clients include Vijay Sales, Amazon, Meesho (domestic) and TJX, U.S. Polo Assn, Big Lots, Ocean State Job Lot (international).

The company operates two manufacturing units in Bhiwandi, Maharashtra, with a current production capacity of 4,000 units per day and plans to scale up to 6,000 units. This capacity expansion will be partially funded by the IPO proceeds.

Neelam Linens and Garments Financials

Despite some fluctuations in profit, Neelam Linens and Garments (India) Ltd has shown consistent growth in revenue over the past three years, reflecting its market potential and operational strength. Here’s a summary of their financial performance:

- Revenue:

- FY 2021: ₹80.18 crore

- FY 2022: ₹103.80 crore

- FY 2023: ₹105.41 crore

- Profit After Tax:

- FY 2021: ₹0.42 crore

- FY 2022: ₹2.99 crore

- FY 2023: ₹2.38 crore

The company has grown its total assets from ₹64.68 crore in FY2021 to ₹99.68 crore in FY2023, with Return on Equity (ROE) at 11.32% and Return on Capital Employed (ROCE) at 13.64%. Investors can assess these figures alongside the current Neelam Linens and Garments IPO GMP to gauge the company’s potential.

Neelam Linens and Garments IPO Review

The Neelam Linens and Garments IPO provides an opportunity to invest in a well-established SME in India’s expanding home textile market. The Indian market for soft home furnishings is anticipated to grow annually at around 12%, which bodes well for the company’s expansion plans. Proceeds from the IPO will fund the purchase of advanced embroidery machines, repay some of the company’s debt, and cover general corporate expenses.

While there’s potential for growth, prospective investors should consider the company’s reliance on debt and the recent dip in profits. Keeping an eye on the Neelam Linens and Garments IPO GMP in the days leading up to the listing date can also provide a snapshot of market expectations.

Neelam Linens and Garments IPO Allotment Details

The allotment process for the Neelam Linens and Garments IPO will follow this timeline:

| Event | Date |

|---|---|

| Basis of Allotment | November 13, 2024 |

| Refund Initiation | November 14, 2024 |

| Credit to Demat Accounts | November 14, 2024 |

| IPO Listing Date | November 18, 2024 |

After November 13, investors can check their allotment status through the registrar’s website, Purva Sharegistry, by entering their PAN number, application number, or Demat ID.

Neelam Linens and Garments IPO FAQs

1. What is the price band for the IPO?

Neelam Linens and Garments Limited’s IPO price band is ₹20 to ₹24 per share.

2. When is the IPO open for subscription?

Neelam Linens and Garments Ltd IPO is open for subscription from November 8 to November 12, 2024.

3. What is the minimum investment required?

The Minimum investment required for Neelam Linens and Garments IPO is ₹120,000 (at the upper price band for one lot of 6,000 shares).

4. What is the IPO’s total issue size?

Neelam Linens and Garments IPO’s total issue size is ₹13 crore.

5. What is the current Neelam Linens and Garments IPO GMP?

As of now, the Neelam Linens and Garments IPO GMP is ₹0.

6. When will the shares be allotted?

The Neelam Linens and Garments IPO allotment date is November 13, 2024.

7. When will the IPO be listed on the exchange?

Expected listing date is November 18, 2024, on the NSE SME.

Conclusion

The Neelam Linens and Garments IPO offers an intriguing chance to invest in a growing textile company. With a strong operational base, established clientele, and strategic growth plans, Neelam Linens and Garments is poised to leverage the expanding home furnishings market in India. Investors should weigh the pros and cons, track the Neelam Linens and Garments IPO GMP, and make informed decisions based on the company’s financial performance, competitive advantages, and overall market outlook.