Niva Bupa Health Insurance Company is gearing up to launch its highly anticipated IPO. Known for its robust growth in the health insurance sector, Niva Bupa’s IPO is set to open soon, drawing significant attention from investors. Here’s a straightforward guide to understanding the Niva Bupa Health Insurance IPO GMP details, its business model, subscription timeline, and allotment updates.

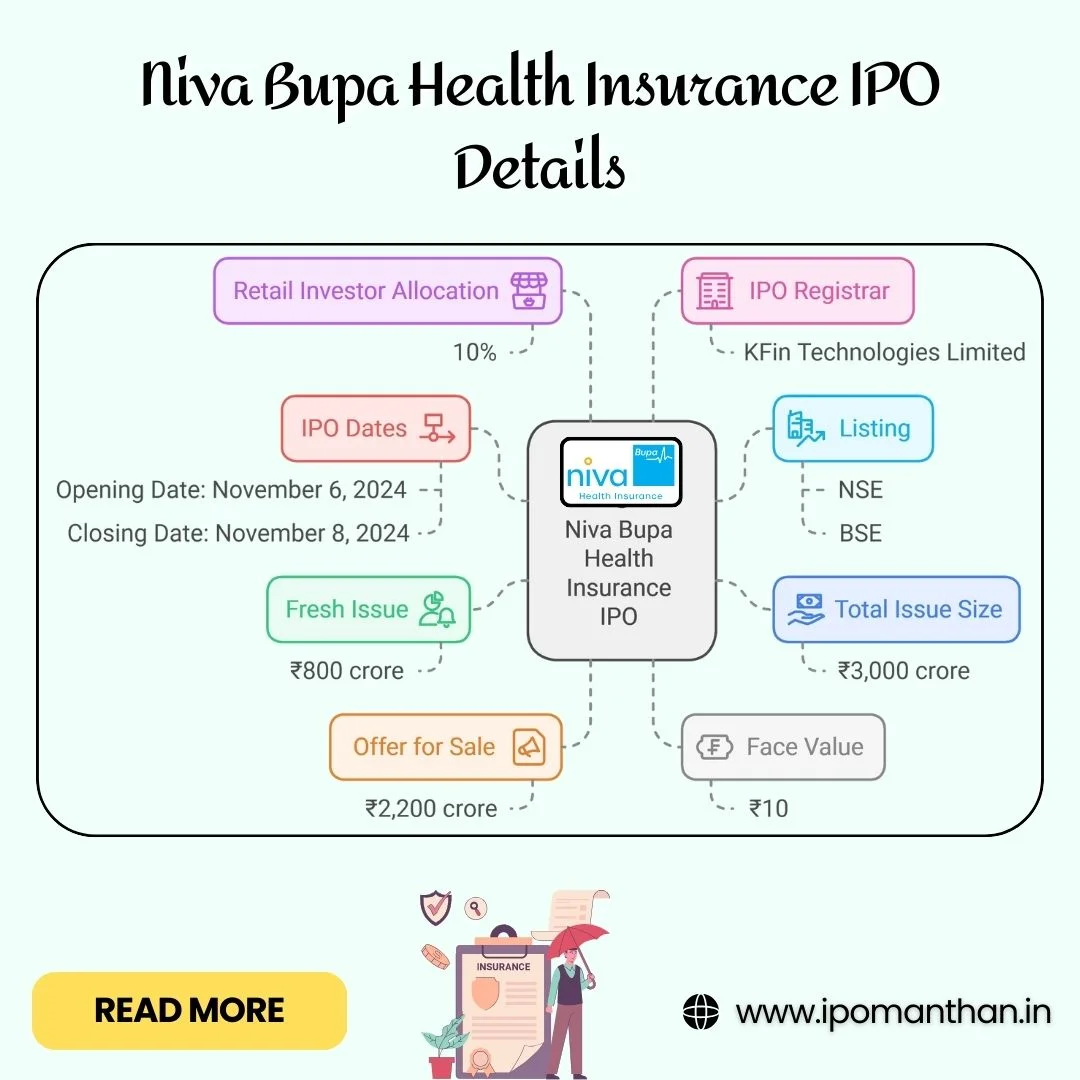

Niva Bupa Health Insurance IPO Details

The Niva Bupa Health Insurance IPO includes a mix of fresh issue and offer for sale (OFS) shares. Below is a table summarizing the key IPO details:

| IPO Component | Details |

|---|---|

| Total Issue Size | ₹3,000 crore |

| Fresh Issue | ₹800 crore |

| Offer for Sale | ₹2,200 crore |

| IPO Opening Date | November 6, 2024 |

| IPO Closing Date | November 8, 2024 |

| Face Value per Share | ₹10 |

| Retail Investor Allocation | 10% |

| Listing on | NSE, BSE |

| IPO Registrar | KFin Technologies Limited |

This issue size indicates a considerable opportunity for both retail and institutional investors to participate in the Niva Bupa Health Insurance IPO GMP with strong potential for growth.

Niva Bupa Health Insurance IPO Subscription

The Niva Bupa Health Insurance IPO subscription is open to various categories, including Qualified Institutional Buyers (QIB), Non-Institutional Investors (NII), Retail Individual Investors (RII), and employees:

- QIB: A certain portion is reserved for large institutional investors.

- NII: This segment caters to high-net-worth individuals.

- RII: Individual retail investors can apply for a minimum of one lot, though the exact lot size is yet to be announced.

- Employee Category: There may be a dedicated portion for eligible employees.

These subscription categories allow a wide range of investors to participate in the Niva Bupa Health Insurance IPO GMP.

Niva Bupa Health Insurance IPO GMP Today

As of today, the Niva Bupa Health Insurance IPO GMP is indicated to be ₹1 per share. GMP is often considered by investors to gauge the potential listing price versus the issue price, offering insights into market demand. Keep an eye on the latest updates, as GMP values might become available closer to the IPO opening date, potentially impacting investor sentiment.

Business Overview of Niva Bupa Health Insurance

Founded in 2008 as a joint venture between Bupa Group and Fettle Tone LLP, Niva Bupa Health Insurance has quickly become a key player in India’s standalone health insurance sector. Below are the highlights of its business:

- Product Range: Niva Bupa offers a variety of health insurance products, including family health plans, critical illness cover, and accident insurance, making it a versatile choice for customers.

- Digital Integration: Niva Bupa has embraced technology with its mobile app and website, simplifying policy management, digital consultations, and diagnostics.

- Market Share: With a 16.24% market share in the standalone health insurance industry, Niva Bupa has experienced an impressive Compound Annual Growth Rate (CAGR) of 41.37% in Gross Direct Written Premium Income (GDPI) over the past two years.

Niva Bupa’s digital-first approach is a critical factor in its growth trajectory, which also makes the Niva Bupa Health Insurance IPO GMP appealing for tech-savvy investors looking to invest in a modern, adaptable health insurance provider.

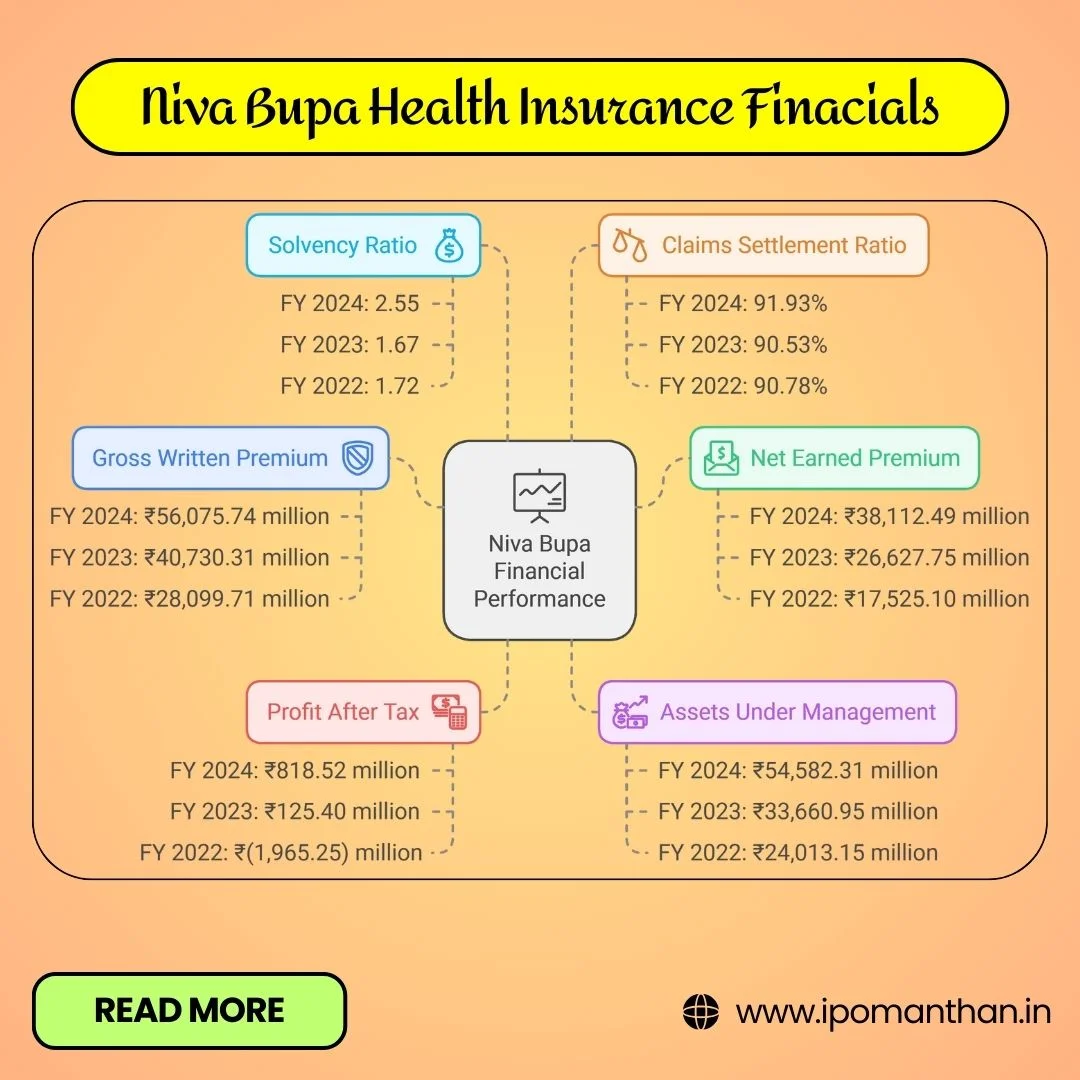

Niva Bupa Health Insurance IPO Financials

Niva Bupa’s recent financial performance reflects both growth and stability. Here’s a quick summary:

| Metric | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Gross Written Premium (GWP) | ₹56,075.74 million | ₹40,730.31 million | ₹28,099.71 million |

| Net Earned Premium | ₹38,112.49 million | ₹26,627.75 million | ₹17,525.10 million |

| Profit After Tax (PAT) | ₹818.52 million | ₹125.40 million | ₹(1,965.25) million |

| Assets Under Management | ₹54,582.31 million | ₹33,660.95 million | ₹24,013.15 million |

| Solvency Ratio | 2.55 | 1.67 | 1.72 |

| Claims Settlement Ratio | 91.93% | 90.53% | 90.78% |

The financial data paints a promising picture for Niva Bupa, especially given its improved claims settlement ratio and healthy solvency ratio, supporting a solid business case for the Niva Bupa Health Insurance IPO GMP.

Review of Niva Bupa Health Insurance IPO GMP and Future Prospects

The Niva Bupa Health Insurance IPO GMP is attracting positive market interest, given the company’s:

- Strong Growth Rate: With GDPI showing a CAGR of 41.37%, Niva Bupa outpaces its industry counterparts.

- Digital Innovation: Nearly all policies (99.95%) are digitized, showing operational efficiency.

- High Claims Settlement Ratio: At 91.93%, Niva Bupa demonstrates effective claims processing.

- Solid Promoter Support: Backed by the globally recognized Bupa Group.

While the company’s growth potential and tech integration make the Niva Bupa Health Insurance IPO GMP an attractive prospect, investors should also note challenges such as reliance on the health insurance market and regulatory uncertainties.

Niva Bupa Health Insurance IPO Allotment and Listing Timeline

Here are the key dates for the Niva Bupa Health Insurance IPO allotment and listing:

| Event | Date |

|---|---|

| IPO Opening Date | November 6, 2024 |

| IPO Closing Date | November 8, 2024 |

| Basis of Allotment Finalization | November 11, 2024 |

| Initiation of Refunds | November 12, 2024 |

| Credit of Shares to Demat Accounts | November 12, 2024 |

| Listing Date on NSE and BSE | November 13, 2024 |

Once allotted, investors can monitor the Niva Bupa Health Insurance IPO GMP closely to estimate the listing performance on the NSE and BSE.

FAQs on Niva Bupa Health Insurance IPO GMP and Subscription

- What is the total issue size of the Niva Bupa IPO?

The IPO size is ₹3,000 crore, including a fresh issue of ₹800 crore and an offer for sale of ₹2,200 crore. - What is the face value of Niva Bupa shares?

Each share carries a face value of ₹10. - What is the allotment date for the IPO?

The allotment finalization is scheduled for November 11, 2024. - Where can I check the allotment status?

Investors can check on KFin Technologies’ website by entering their PAN and selecting the IPO name. - How do I apply for the IPO?

You can apply via your broker’s platform using UPI or by submitting a physical form. - What percentage of shares is allocated to retail investors?

Retail investors have a 10% allocation in the IPO. - How can I track the Niva Bupa Health Insurance IPO GMP today?

Keep an eye on financial news websites and grey market platforms closer to the listing date for real-time GMP updates. - What is the purpose of the IPO funds?

Funds will enhance capital structure, boost solvency, and address general corporate needs. - Can retail investors apply for multiple lots?

Yes, but only one application per PAN is allowed. - Is there a Grey Market Premium (GMP) for the IPO?

As of today, Niva Bupa Health Insurance IPO GMP is ₹1 per share.

Niva Bupa Health Insurance’s IPO is poised to capture investor interest due to its solid financial track record and rapid growth. For anyone considering investment, tracking the Niva Bupa Health Insurance IPO GMP provides helpful insights as the company enters the public market.