As India’s leading oil and natural gas company, ONGC plays a crucial role in the country’s energy landscape. With a strong commitment to domestic oil and gas production, ONGC has grown significantly since its establishment in 1956, becoming an integral part of India’s energy security. In recent years, ONGC’s share price has shown steady growth, reflecting its operational performance and strategic expansions in both traditional and renewable energy.Whether you’re watching for ONGC’ share price target tomorrow or interested in long-term projections, here’s an in-depth guide to ONGC’s potential future in the stock market.

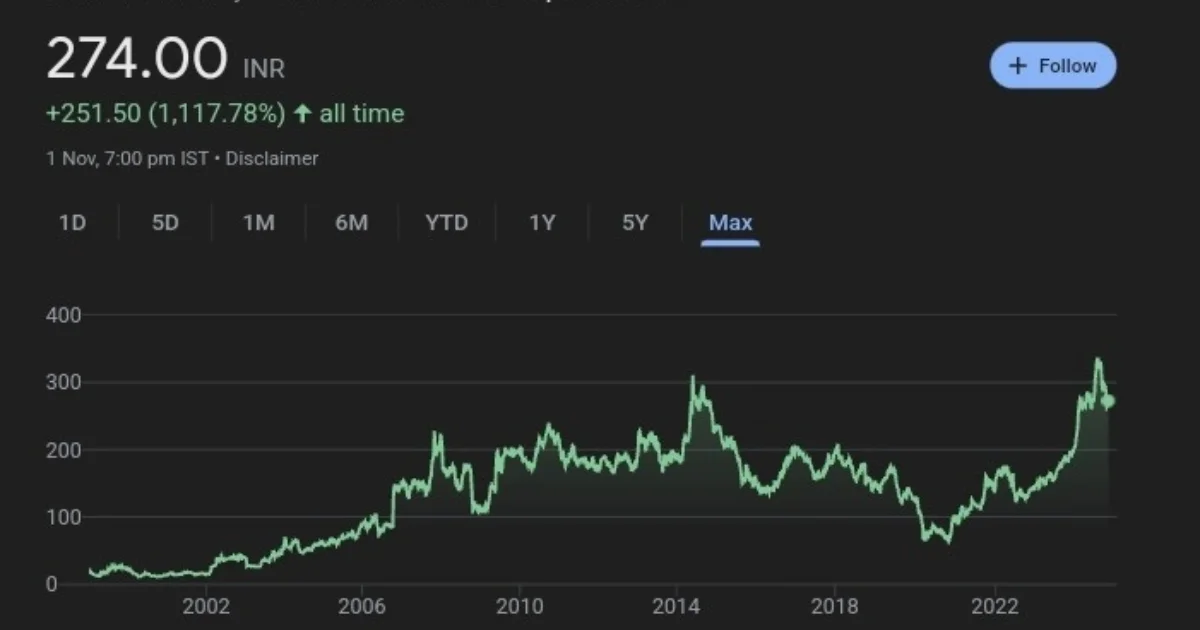

ONGC Share Price History

- 52-week high: ₹345

- 52-week low: ₹179.90

- Current Price: ₹283.30

- Market Capitalization: ₹3.67 lakh crore

- 1-Year Change: +51.54%

- 5-Year Return: +97.42%

ONGC’s share price history reflects strong investor confidence and highlights its role as a leader in the energy sector.

ONGC Share Price Target Overview

The ONGC share price target is influenced by various factors, including global oil prices, production levels, and ONGC’s ongoing investments in renewable energy. With significant government support and strategic initiatives in both hydrocarbons and renewables, ONGC is well-positioned for sustained growth in the coming years. Below, we explore ONGC’s share price targets month-by-month for each projected year.

ONGC Share Price Target 2024

| Month | Minimum Target (₹) | Maximum Target (₹) | Average Target (₹) |

|---|---|---|---|

| November | 355 | 375 | 365 |

| December | 360 | 380 | 370 |

In 2024, ONGC’s share price is projected to range between ₹355 and ₹380 by year-end. This target is supported by stable oil prices, increased production, and a consistent demand for oil and gas domestically and internationally.

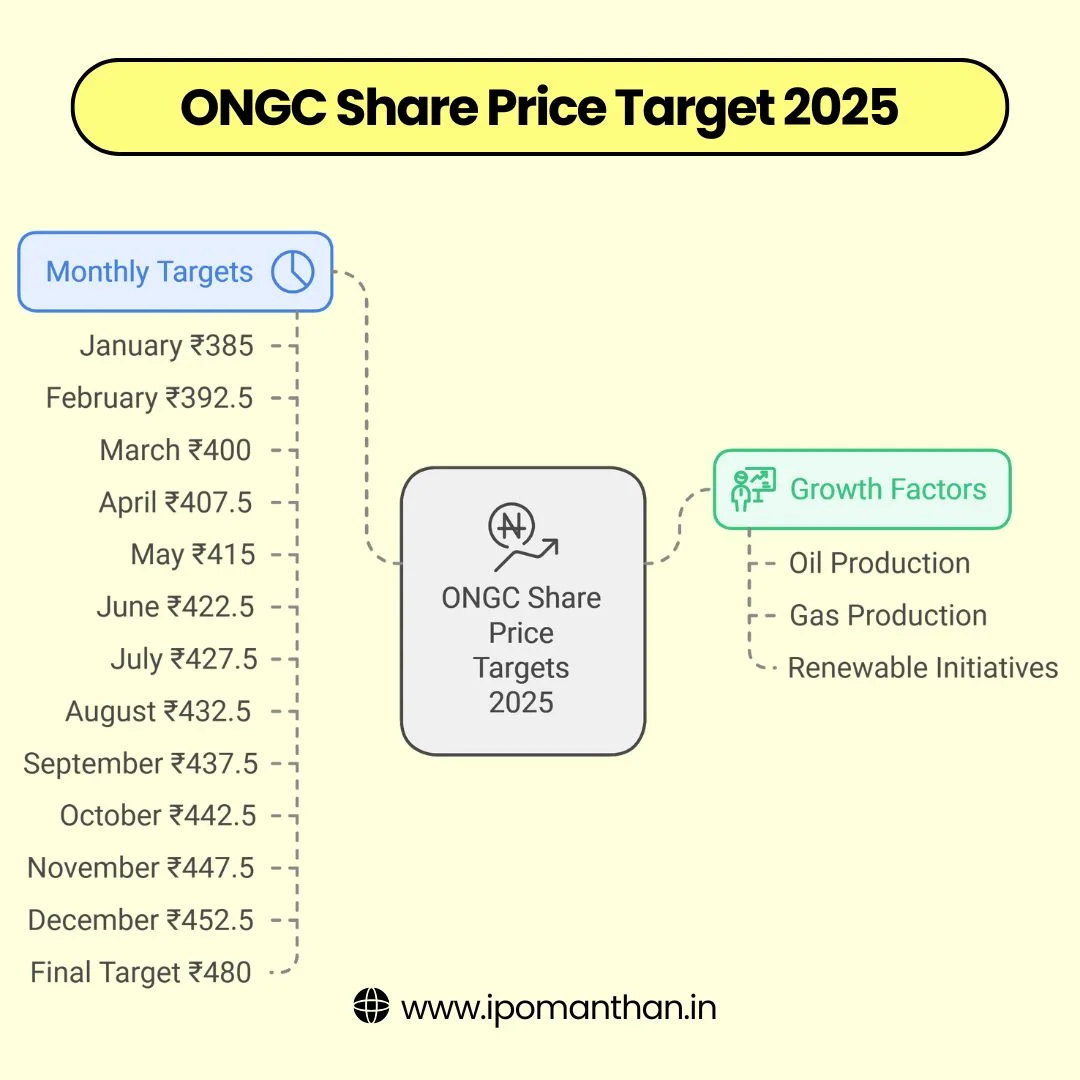

ONGC Share Price Target 2025

| Month | Minimum Target (₹) | Maximum Target (₹) | Average Target (₹) |

|---|---|---|---|

| January | 370 | 400 | 385 |

| February | 375 | 410 | 392.5 |

| March | 380 | 420 | 400 |

| April | 385 | 430 | 407.5 |

| May | 390 | 440 | 415 |

| June | 395 | 450 | 422.5 |

| July | 400 | 455 | 427.5 |

| August | 405 | 460 | 432.5 |

| September | 410 | 465 | 437.5 |

| October | 415 | 470 | 442.5 |

| November | 420 | 475 | 447.5 |

| December | 425 | 480 | 452.5 |

For 2025, ONGC’s share price target is projected to grow gradually each month, potentially reaching ₹480 by December as the company continues to expand in both oil and gas production and renewable initiatives.

ONGC Share Price Target 2026

| Month | Minimum Target (₹) | Maximum Target (₹) | Average Target (₹) |

|---|---|---|---|

| January | 430 | 500 | 465 |

| February | 435 | 510 | 472.5 |

| March | 440 | 520 | 480 |

| April | 445 | 530 | 487.5 |

| May | 450 | 540 | 495 |

| June | 455 | 550 | 502.5 |

| July | 460 | 560 | 510 |

| August | 465 | 570 | 517.5 |

| September | 470 | 580 | 525 |

| October | 475 | 590 | 532.5 |

| November | 480 | 600 | 540 |

| December | 485 | 610 | 547.5 |

By 2026, ONGC’s share price is forecasted to hit a maximum of ₹610 by December. This projection reflects ONGC’s expected growth in natural gas and renewable energy production, as well as its technological advancements.

ONGC Share Price Target 2030

| Month | Minimum Target (₹) | Maximum Target (₹) | Average Target (₹) |

|---|---|---|---|

| January | 700 | 900 | 800 |

| February | 710 | 915 | 812.5 |

| March | 720 | 930 | 825 |

| April | 730 | 945 | 837.5 |

| May | 740 | 960 | 850 |

| June | 750 | 975 | 862.5 |

| July | 760 | 990 | 875 |

| August | 770 | 1005 | 887.5 |

| September | 780 | 1020 | 900 |

| October | 790 | 1035 | 912.5 |

| November | 800 | 1050 | 925 |

| December | 810 | 1065 | 937.5 |

For 2030, analysts expect ONGC’s share price to potentially reach ₹1065 by December. This optimistic target is based on the company’s plans for growth in renewable energy, expanding its global presence, and continued production advancements.

ONGC Share Price Target 2040

| Month | Minimum Target (₹) | Maximum Target (₹) | Average Target (₹) |

|---|---|---|---|

| January | 5000 | 5500 | 5250 |

| February | 5050 | 5600 | 5325 |

| March | 5100 | 5700 | 5400 |

| April | 5150 | 5800 | 5475 |

| May | 5200 | 5900 | 5550 |

| June | 5250 | 6000 | 5625 |

| July | 5300 | 6100 | 5700 |

| August | 5350 | 6200 | 5775 |

| September | 5400 | 6300 | 5850 |

| October | 5500 | 6400 | 5950 |

| November | 5600 | 6500 | 6050 |

| December | 5700 | 6600 | 6150 |

For 2040, the ONGC share price target could reach as high as ₹6600 by December. This forecast aligns with expectations of substantial growth in both traditional and renewable energy, coupled with ONGC’s expanding infrastructure investments and technological advancements.

ONGC’s Financial Performance

ONGC’s financial performance over recent years underscores its strong market position and steady growth:

- Revenue (FY 2024): ₹603,669 crore

- Net Profit (FY 2024): ₹49,221 crore

- Earnings Per Share (EPS) FY 2024: ₹39.13

- Revenue Growth: A decrease of 5.74% in FY 2024 from FY 2023

Despite revenue fluctuations, ONGC’s profit growth reflects improved operational efficiency and favorable market conditions.

FAQs on ONGC Share Price Targets

Q1: What is the ONGC share price target tomorrow?

A1: While the ONGC share price target tomorrow will depend on market trends, ONGC’s consistent growth outlook makes it a promising short-term investment.

Q2: What is the ONGC share price target for 2025?

A2: In 2025, ONGC’s share price target ranges from ₹370 in January to ₹480 by December, driven by its expansion in energy production.

Q3: What is the projected ONGC share price target for 2040?

A3: By 2040, ONGC’s share price could potentially reach ₹6600, based on the company’s continued advancements and diversification into renewables.

Whether you’re looking at ONGC share price target predictions for tomorrow or for the coming decades, ONGC’s strong growth