The Paramount Dye Tec IPO is set to open soon, offering investors an exciting opportunity to participate in a growing company within the textile sector. This blog will break down all the essential details about the IPO, from subscription timelines to the financial health of the company.

Paramount Dye Tec IPO Details

The Paramount Dye Tec IPO is raising funds through a fresh issue of equity shares. The proceeds from this offering will primarily be used to set up new manufacturing facilities, reduce debt, and cover general corporate expenses.

| IPO Details | Information |

|---|---|

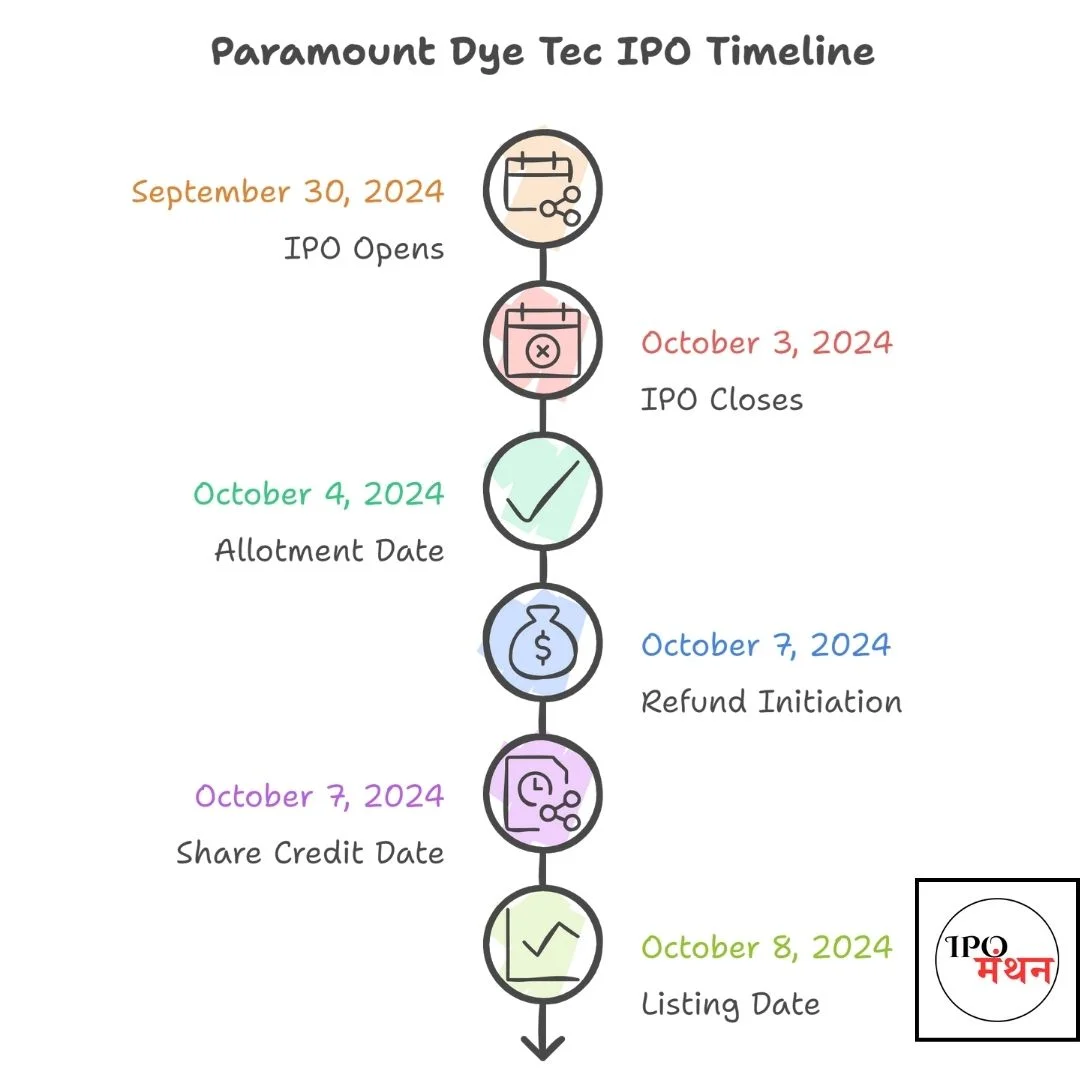

| IPO Open Date | September 30, 2024 |

| IPO Close Date | October 3, 2024 |

| Allotment Date | October 4, 2024 |

| Refund Initiation | October 7, 2024 |

| Share Credit Date | October 7, 2024 |

| Listing Date | October 8, 2024 |

| Price Band | ₹111 to ₹117 per share |

| Lot Size | 1,200 shares (₹140,400 per lot) |

| Total Issue Size | ₹28.43 crores |

| Minimum Investment | ₹140,400 (for one lot) |

Subscription Details

The Paramount Dye Tec IPO subscription window will be open from September 30 to October 3, 2024. Here’s what you need to know about the subscription process:

| Investor Category | Allocation Percentage |

|---|---|

| Retail Investors | 35% |

| Qualified Institutional Buyers (QIB) | 50% |

| Non-Institutional Investors (NII) | 15% |

Retail investors can subscribe to a minimum of one lot, which consists of 1,200 shares. High Net-worth Individuals (HNIs) are required to subscribe to at least two lots, amounting to 2,400 shares.

Paramount Dye Tec IPO GMP Today

As of today, the Grey Market Premium (GMP) for the Paramount Dye Tec IPO stands at ₹5. However, as the IPO date approaches, this figure may change based on market sentiment and investor interest.

Business Overview

Paramount Dye Tec Limited was established in 2014 and has since positioned itself as a leading player in the textile industry, focusing on sustainability. The company manufactures yarns by recycling synthetic waste fibers, catering primarily to the B2B segment.

Core Business Operations

- Products: The company’s main offerings include acrylic, polyester, nylon, wool, hand-knitting yarn, and various blends.

- Manufacturing Facilities: Paramount Dye Tec operates two plants in Punjab, India, which adhere to ISO 9001:2015 and Good Manufacturing Practices (GMP).

The company’s sustainable business model has allowed it to tap into a growing demand for environmentally friendly products in the textile sector.

Financial Performance

The financials of Paramount Dye Tec Limited show promising growth. The company has managed to significantly increase its revenue and profitability over the last two years.

| Financial Year | Total Revenue (₹ Crores) | Profit After Tax (₹ Crores) |

|---|---|---|

| FY 2024 | 23.68 | 3.54 |

| FY 2023 | 4.60 | 3.16 |

| FY 2022 | 2.37 | 0.16 |

Key Financial Metrics

- Return on Equity (ROE): 11.68%

- Return on Capital Employed (ROCE): 16.53%

- Debt to Equity Ratio: 0.54

- Net Worth: ₹30.32 crore (as of March 31, 2024)

The company’s growing profitability, along with its focus on sustainability, positions it well for long-term success in the textile sector.

Paramount Dye Tec IPO Review

Investors considering the Paramount Dye Tec IPO should weigh the company’s strong financial performance against the risks associated with its business model. Some of the pros include:

- Sustainability Focus: The use of recycled synthetic fibers makes the company attractive to environmentally conscious investors.

- Strong Financial Growth: The company’s revenue and profit have seen significant growth, with a marked increase in net income between FY22 and FY24.

However, there are also challenges:

- Customer Dependence: The company relies on a limited number of customers, with the top 10 clients contributing to a large portion of revenue.

- Market Risks: Fluctuations in raw material prices and regulatory changes could impact the company’s profitability.

Paramount Dye Tec IPO Allotment Status

If you apply for the Paramount Dye Tec IPO, you can check your allotment status once it is finalized on October 4, 2024. Here’s how to check your allotment:

- Visit the registrar’s website (Bigshare Services Pvt Ltd).

- Select “Paramount Dye Tec IPO” from the dropdown menu.

- Enter your PAN number, application number, or DP Client ID.

- Click “Submit” to view your allotment status.

Shares will be credited to successful applicants by October 7, 2024, and those who do not receive allotments will have their refunds initiated on the same date.

FAQs on Paramount Dye Tec IPO

What are the dates for the Paramount Dye Tec IPO?

The IPO opens on September 30, 2024, and closes on October 3, 2024.

What is the price range for the IPO?

The price band is set at ₹111 to ₹117 per equity share.

What is the lot size for retail investors?

Retail investors must subscribe to a minimum of one lot, consisting of 1,200 shares.

How can I check my allotment status?

You can check your allotment status on the registrar’s website by entering your application details.

What is the Grey Market Premium (GMP) for the IPO?

As of today, the GMP is ₹5.

Conclusion

The Paramount Dye Tec IPO offers a unique opportunity to invest in a company with strong financials and a commitment to sustainability. However, investors should be aware of the risks involved, including customer dependence and market volatility. With the IPO subscription opening on September 30, 2024, this is an IPO to watch closely.

hank you for reading and staying informed about the Paramount Dye Tec IPO!