Rajesh Power Services Limited (RPSL) is preparing to launch its Initial Public Offering (IPO) on the SME platform of the Bombay Stock Exchange (BSE). This IPO represents an exciting opportunity for investors interested in the power infrastructure and renewable energy sectors. With strong financial performance and a focus on sustainability, Rajesh Power Services IPO GMP has already garnered significant interest in the market.

Rajesh Power Services IPO Details

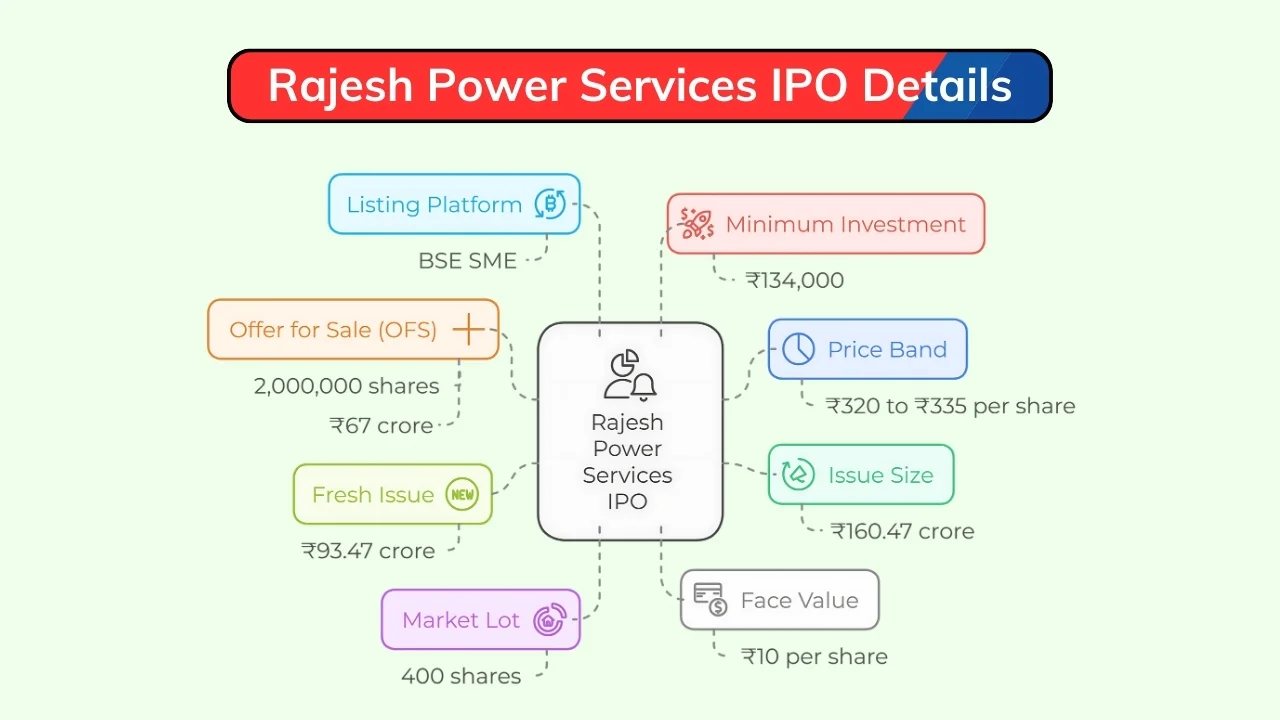

The IPO has a price band set between ₹320 and ₹335 per share. The total issue size is ₹160.47 crore, comprising ₹93.47 crore as a fresh issue and an Offer for Sale (OFS) of 2,000,000 shares worth ₹67 crore. The face value of the equity shares is ₹10 each. The market lot size for retail investors is 400 shares, which requires a minimum investment of ₹134,000.

| Parameter | Details |

|---|---|

| Price Band | ₹320 to ₹335 per share |

| Issue Size | ₹160.47 crore |

| Fresh Issue | ₹93.47 crore |

| Offer for Sale (OFS) | 2,000,000 shares |

| Market Lot | 400 shares |

| Face Value | ₹10 per share |

| Listing Platform | BSE SME |

| Minimum Investment | ₹134,000 |

Funds raised from the IPO will be used for renewable energy projects, equipment procurement, and research in green hydrogen.

Rajesh Power Services IPO Subscription

The subscription is divided into three categories. Retail investors are allocated 35% of the total issue, Qualified Institutional Buyers (QIBs) are allocated 50%, and Non-Institutional Investors (NIIs) are assigned 15%. Investors can apply for a minimum of 400 shares and in multiples thereof.

| Category | Percentage Allocation |

|---|---|

| Retail Investors | 35% |

| Qualified Institutional Buyers (QIB) | 50% |

| Non-Institutional Investors (NII) | 15% |

The IPO opens for subscription on November 25, 2024, and closes on November 27, 2024. The allotment will be finalized on November 28, with refunds initiated on November 29. Shares will be credited to investors’ Demat accounts on the same day.

Rajesh Power Services IPO GMP Today

The Rajesh Power Services IPO GMP Today is ₹98 per share. This suggests a potential listing price of ₹433 per share, translating to a listing gain of around 29.25% at the upper price band.

| GMP | Listing Price Estimate | Expected Gains |

|---|---|---|

| ₹98 per share | ₹433 per share | ~29.25%% |

The Rajesh Power Services IPO GMP reflects strong investor demand and positive sentiment surrounding the company’s growth potential.

Rajesh Power Services Business Overview

Rajesh Power Services Limited, established in 1971, specializes in providing end-to-end solutions for both renewable and non-renewable energy projects. Its offerings include solar power plant development, green hydrogen research, and conventional power infrastructure such as transmission lines and substations.

| Business Segment | Details |

|---|---|

| Renewable Energy | Solar power projects, turnkey solutions, green hydrogen research |

| Non-Renewable Services | EHV transmission lines, substations, underground distribution systems |

| Clients | State utilities, Reliance Industries, GIFT City Gujarat |

The company’s operations are aligned with India’s commitment to renewable energy and infrastructure development.

Rajesh Power Services Financials

Rajesh Power Services has demonstrated robust financial performance in recent years. In FY24, the company reported a revenue of ₹284.96 crore and a Profit After Tax (PAT) of ₹26.02 crore, reflecting a 285% increase in profits compared to FY23. For the first half of FY25, the company achieved revenue of ₹317.03 crore and a PAT of ₹28.54 crore.

| Year | Revenue (₹ Crore) | PAT (₹ Crore) | EBITDA Margin (%) |

|---|---|---|---|

| FY22 | ₹146.80 | ₹3.44 | 7.51 |

| FY23 | ₹207.18 | ₹6.75 | 6.75 |

| FY24 | ₹284.96 | ₹26.02 | 11.91 |

| H1 FY25 | ₹317.03 | ₹28.54 | 12.19 |

Key financial ratios, such as an Earnings Per Share (EPS) of ₹17.10 and a Return on Net Worth (RoNW) of 30.87%, further underline the company’s profitability and strong operational metrics.

| Metric | Value |

|---|---|

| Earnings Per Share (EPS) | ₹17.10 |

| Return on Net Worth (RoNW) | 30.87% |

| Debt-to-Equity Ratio | 0.75 |

Peer Comparison

When compared with its industry peers, Rajesh Power Services demonstrates strong financial performance, particularly in revenue growth and profitability.

| Company | Revenue (₹ Crore) | PAT (₹ Crore) | EBITDA Margin (%) |

|---|---|---|---|

| Rajesh Power Services | ₹284.96 | ₹26.02 | 11.91 |

| Advait Infratech | ₹238.00 | ₹24.00 | 16.81 |

| Viviana Power Tech | ₹90.42 | ₹8.48 | 16.52 |

Rajesh Power Services IPO Review

Strengths

The company’s diversified portfolio, covering both renewable and conventional power infrastructure, positions it well in a growing market. Its established reputation and extensive client base add to its strengths.

Risks

Heavy reliance on government contracts and competitive bidding poses risks. Additionally, project delays due to supply chain disruptions could impact performance.

Rajesh Power Services IPO Allotment

Investors can expect the allotment process to proceed as follows:

| Event | Date |

|---|---|

| Basis of Allotment | November 28, 2024 |

| Refund Initiation | November 29, 2024 |

| Shares Credited to Demat | November 29, 2024 |

| Listing Date | December 2, 2024 |

The shares will be listed on the BSE SME platform, providing a significant opportunity for early investors.

FAQs

What is the Rajesh Power Services IPO GMP Today?

The Rajesh Power Services IPO GMP Today is ₹98 per share, suggesting strong demand and potential listing gains.

What is the minimum investment required?

The minimum investment is ₹134,000 for one lot of 400 shares.

What is the listing platform?

The shares will be listed on the BSE SME platform.

What is the purpose of the IPO?

The funds will be utilized for solar power plant development, equipment procurement, and green hydrogen research.

How does the company compare with its peers?

Rajesh Power Services demonstrates competitive EBITDA margins and higher revenue growth compared to its industry peers.

Conclusion

The Rajesh Power Services IPO GMP highlights significant market interest, with anticipated listing gains and a promising growth trajectory. With its focus on renewable energy, diversified offerings, and strong financials, the IPO is an attractive opportunity for investors. While risks exist in terms of dependency on government contracts and project execution, the company’s potential in India’s evolving energy landscape makes it a compelling investment choice.