Rajputana Biodiesel Limited is gearing up to launch its Initial Public Offering (IPO) to raise ₹24.70 crores. This blog provides all essential details about the IPO, including subscription timelines, business insights, and financial highlights, along with the much-anticipated Rajputana Biodiesel IPO GMP.

Rajputana Biodiesel IPO Details

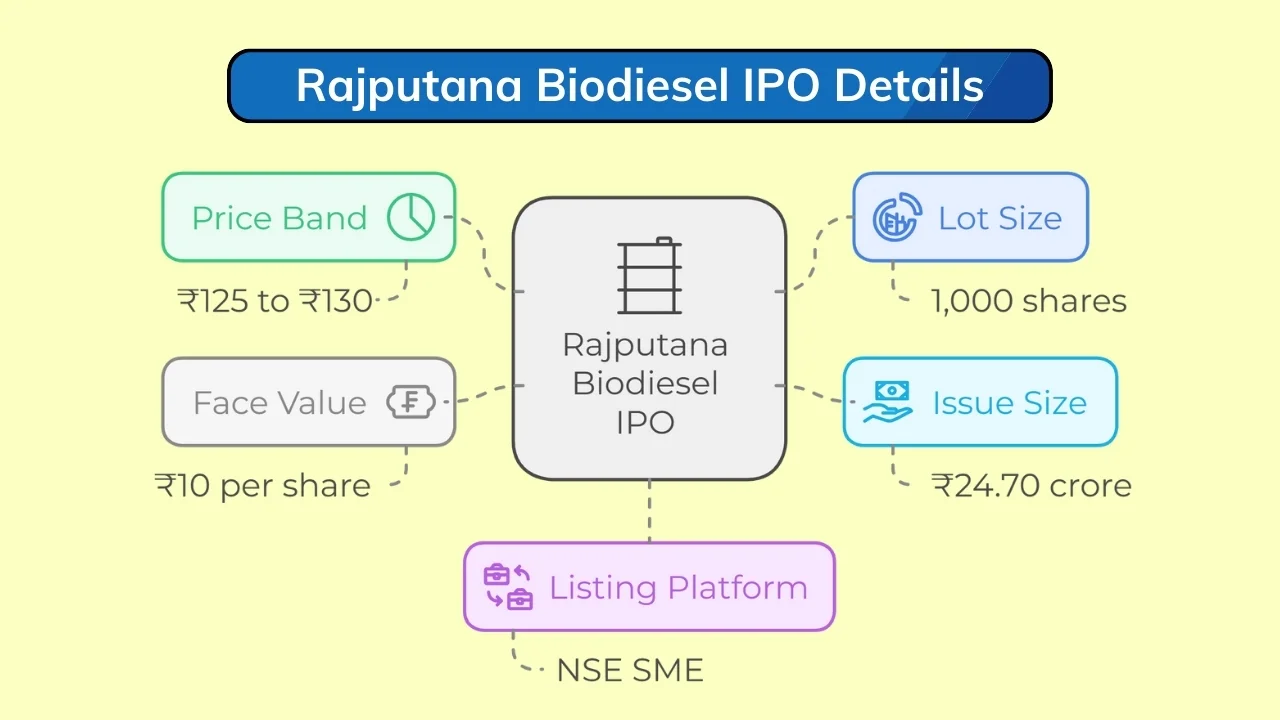

The IPO is set to open on November 26, 2024, and will close on November 28, 2024. The price band is fixed between ₹125 and ₹130 per equity share, and the lot size is 1,000 shares, requiring a minimum investment of ₹130,000. The IPO consists of a fresh issue of ₹24.70 crores and will be listed on the NSE SME platform.

| Details | Information |

|---|---|

| Price Band | ₹125 to ₹130 |

| Lot Size | 1,000 shares |

| Issue Size | ₹24.70 crore |

| Face Value | ₹10 per share |

| Listing Platform | NSE SME |

Key Dates:

- Basis of Allotment: November 29, 2024

- Refunds Initiation: November 29, 2024

- Credit to Demat Accounts: December 2, 2024

- Listing Date: December 3, 2024

Allocation Quotas:

- Retail Individual Investors (RII): 35%

- Qualified Institutional Buyers (QIB): 50%

- Non-Institutional Investors (NII): 15%

Rajputana Biodiesel IPO Subscription

The subscription for Rajputana Biodiesel IPO is structured to cater to different investor categories. Retail investors can apply for a minimum of one lot, while High Net-Worth Individuals (HNIs) can apply for two or more lots. The subscription period is short, so interested investors should ensure their applications are submitted during the given dates.

Rajputana Biodiesel IPO GMP Today

The Rajputana Biodiesel IPO GMP today for the Rajputana Biodiesel IPO currently stands at ₹120. This indicates strong investor interest and suggests that the shares may list at a significant premium. For instance, with an upper price band of ₹130, the expected listing price could be ₹250, reflecting potential gains of over (92.31%).

The GMP acts as an indicator of market sentiment and expected demand for the shares. However, it is not a guaranteed measure of listing performance.

Rajputana Biodiesel Business Overview

Established in 2016 and converted into a public company in 2024, Rajputana Biodiesel Limited specializes in biodiesel production from renewable sources like used cooking oil, animal fats, and vegetable oils. The company’s facility, located in Phulera, Rajasthan, spans 4,000 square meters and utilizes the transesterification process to create eco-friendly biodiesel with a low carbon footprint.

In addition to biodiesel, Rajputana produces:

- Glycerine: Used in pharmaceuticals and cosmetics.

- Fatty Acids: Utilized in soaps and detergents.

Market Position

Rajputana Biodiesel positions itself as a leader in the biofuel industry by focusing on sustainability, value addition, and flexible production processes. The company aims to expand its market reach both domestically and internationally as demand for renewable energy solutions grows.

Rajputana Biodiesel Financials

Rajputana Biodiesel has demonstrated significant financial growth, underscoring its strong position in the renewable energy sector.

Financial Highlights:

- FY 2024 Revenue: ₹53.68 crore (128% growth from FY 2023)

- FY 2024 PAT: ₹4.52 crore (168% growth from FY 2023)

- Earnings Per Share (EPS): ₹9.16 (FY 2024)

- Return on Net Worth (RoNW): 34.43% (FY 2024)

Revenue and Profitability Table:

| Metric | FY 2022 | FY 2023 | FY 2024 |

|---|---|---|---|

| Revenue (₹ Crores) | 17.46 | 23.54 | 53.68 |

| PAT (₹ Crores) | 0.20 | 1.69 | 4.52 |

| EPS (₹) | – | 5.34 | 9.16 |

The company plans to utilize IPO proceeds to fund:

- Expansion of its manufacturing facility.

- Working capital requirements.

- General corporate purposes.

Rajputana Biodiesel IPO Review

Strengths:

- High Growth Potential: Impressive revenue and PAT growth indicate strong operational performance.

- Sustainability Focus: The business aligns with global and national renewable energy goals.

- Experienced Management: Led by a skilled team with extensive knowledge in the biofuel sector.

Risks:

- Regulatory Challenges: Stringent government policies in the biofuel sector could pose compliance risks.

- Market Competition: Stiff competition from traditional fuels and alternative renewable energy sources.

- Dependency on Raw Materials: Availability of feedstocks like used cooking oil and animal fats could impact operations.

Despite the risks, the Rajputana Biodiesel IPO presents an attractive investment opportunity, especially for investors interested in the renewable energy space.

Rajputana Biodiesel IPO Allotment

The allotment process will follow the SEBI guidelines, ensuring fair distribution among retail, NII, and QIB categories. Key allotment dates include:

- Basis of Allotment: November 29, 2024

- Refund Initiation: November 29, 2024

- Demat Credit: December 2, 2024

- Listing Date: December 3, 2024

| Event | Date |

|---|---|

| Basis of Allotment | November 29, 2024 |

| Refund Initiation | November 29, 2024 |

| Demat Credit | December 2, 2024 |

| Listing Date | December 3, 2024 |

Rajputana Biodiesel IPO FAQs

What is the Rajputana Biodiesel IPO GMP?

The Rajputana Biodiesel IPO GMP today is ₹120, indicating strong investor demand.

What are the IPO dates?

The IPO opens on November 26, 2024, and closes on November 28, 2024.

What is the lot size and minimum investment?

The lot size is 1,000 shares, and the minimum investment is ₹130,000.

What is the purpose of the IPO?

Proceeds will be used for expanding the manufacturing facility, working capital, and general corporate purposes.

When will the shares be listed?

The shares will be listed on December 3, 2024, on the NSE SME platform.

What are the strengths of Rajputana Biodiesel?

Key strengths include robust financial growth, a focus on sustainability, and experienced management.

Conclusion

The Rajputana Biodiesel IPO GMP of ₹100 signals strong interest in the offering. With a promising business model in the renewable energy space, robust financials, and a clear growth strategy, the IPO presents a compelling opportunity. Investors should evaluate the risks and align their portfolios with their financial goals before subscribing.