Sai Life Sciences, a leading Contract Research, Development, and Manufacturing Organization (CRDMO), has captured investor attention with its robust financial performance and global outreach. In this blog, we analyze the Sai Life Sciences share price target for 2025 to 2040, exploring its IPO details, business overview, financials, and peer comparison.

Sai Life Sciences Share Price

Sai Life Sciences started trading on the stock market on December 18, 2024. Its shares were listed at ₹650 on the NSE and ₹660 on the BSE, which is an 18.4% and 20.2% increase from the IPO price of ₹549.

Sai Life Sciences IPO Details

Sai Life Sciences launched its IPO with an issue price band of ₹522 to ₹549 per share. The IPO received a strong subscription rate of 10.26 times, driven by significant demand from institutional investors.

| Metric | Details |

|---|---|

| IPO Price Band | ₹522-₹549 |

| Listing Gains | 12% (₹60-₹65 GMP) |

| Subscription | 10.26 times |

The IPO proceeds were allocated toward debt reduction, capacity expansion, and general corporate purposes.

Sai Life Sciences Company Details

| Founded | 1999 |

|---|---|

| Headquarters | Hyderabad, India |

| Global Presence | USA, UK, Japan |

| Employees | 2,900+ |

Sai Life Sciences is a trusted partner to over 280 global pharmaceutical companies. It specializes in drug discovery, process development, and clinical manufacturing, ensuring high-quality and cost-effective solutions.

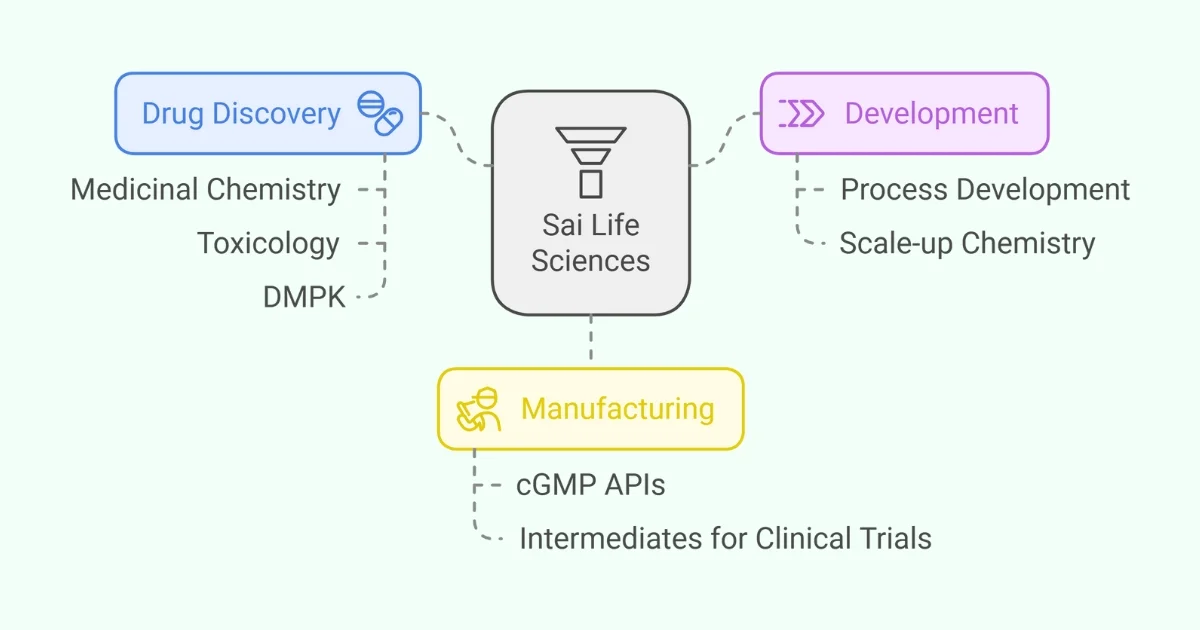

Sai Life Sciences Business Overview

| Category | Key Offerings |

|---|---|

| Drug Discovery | Medicinal chemistry, toxicology, DMPK |

| Development | Process development, scale-up chemistry |

| Manufacturing | cGMP APIs, intermediates for clinical trials |

The company operates an integrated model that spans the drug development lifecycle, with a focus on delivering innovative and sustainable solutions.

Sai Life Sciences Financials

| Metric | FY22 (₹ Cr.) | FY23 (₹ Cr.) | FY24 (₹ Cr.) |

|---|---|---|---|

| Revenue | 897.74 | 1,245.11 | 1,494.27 |

| Net Profit | 6.23 | 9.99 | 82.81 |

| Net Worth | 877.76 | 887.29 | 974.34 |

Sai Life Sciences has shown a remarkable 729% growth in net profit in FY24, supported by strong operational efficiency and a growing order book.

Sai Life Sciences Shareholding Pattern

| Category | Holding (%) |

|---|---|

| Promoters | 40.48 |

| Institutional Investors | 35.00 |

| Retail Investors | 15.00 |

The balanced shareholding pattern reflects confidence from institutional and retail investors, with promoters maintaining a significant stake.

Sai Life Sciences Share Price Target 2025 To 2040

Below is the detailed month-wise Sai Life Sciences share price target 2025 to 2040, considering both bullish and bearish scenarios.

Sai Life Sciences Share Price Target 2025

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 650 | 550 |

| February | 660 | 560 |

| March | 670 | 565 |

| April | 675 | 570 |

| May | 680 | 575 |

| June | 690 | 580 |

| July | 695 | 585 |

| August | 698 | 590 |

| September | 700 | 595 |

| October | 705 | 600 |

| November | 710 | 605 |

| December | 720 | 610 |

Sai Life Sciences Share Price Target 2026

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 800 | 680 |

| February | 820 | 690 |

| March | 835 | 700 |

| April | 840 | 710 |

| May | 850 | 720 |

| June | 860 | 730 |

| July | 870 | 740 |

| August | 880 | 750 |

| September | 890 | 760 |

| October | 895 | 770 |

| November | 898 | 780 |

| December | 900 | 790 |

Sai Life Sciences Share Price Target 2027

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 950 | 800 |

| February | 960 | 820 |

| March | 970 | 840 |

| April | 980 | 850 |

| May | 990 | 860 |

| June | 1,000 | 870 |

| July | 1,020 | 880 |

| August | 1,040 | 900 |

| September | 1,060 | 920 |

| October | 1,080 | 940 |

| November | 1,090 | 950 |

| December | 1,100 | 960 |

Sai Life Sciences Share Price Target 2028

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 1,200 | 950 |

| February | 1,220 | 970 |

| March | 1,240 | 990 |

| April | 1,260 | 1,000 |

| May | 1,280 | 1,020 |

| June | 1,300 | 1,040 |

| July | 1,320 | 1,050 |

| August | 1,340 | 1,070 |

| September | 1,360 | 1,080 |

| October | 1,380 | 1,100 |

| November | 1,390 | 1,120 |

| December | 1,400 | 1,140 |

Sai Life Sciences Share Price Target 2029

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 1,500 | 1,200 |

| February | 1,520 | 1,230 |

| March | 1,540 | 1,250 |

| April | 1,560 | 1,270 |

| May | 1,580 | 1,280 |

| June | 1,600 | 1,300 |

| July | 1,620 | 1,320 |

| August | 1,640 | 1,340 |

| September | 1,660 | 1,360 |

| October | 1,680 | 1,380 |

| November | 1,690 | 1,400 |

| December | 1,700 | 1,420 |

Sai Life Sciences Share Price Target 2030

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 2,000 | 1,500 |

| February | 2,100 | 1,550 |

| March | 2,200 | 1,600 |

| April | 2,300 | 1,700 |

| May | 2,400 | 1,750 |

| June | 2,500 | 1,800 |

| July | 2,600 | 1,850 |

| August | 2,700 | 1,900 |

| September | 2,800 | 2,000 |

| October | 2,900 | 2,100 |

| November | 3,000 | 2,200 |

| December | 3,100 | 2,300 |

Sai Life Sciences Share Price Target 2040

| Month | Bullish Price (₹) | Bearish Price (₹) |

|---|---|---|

| January | 5,000 | 4,000 |

| February | 5,200 | 4,200 |

| March | 5,400 | 4,400 |

| April | 5,600 | 4,600 |

| May | 5,800 | 4,800 |

| June | 6,000 | 5,000 |

| July | 6,200 | 5,200 |

| August | 6,400 | 5,400 |

| September | 6,600 | 5,600 |

| October | 6,800 | 5,800 |

| November | 7,000 | 6,000 |

| December | 7,200 | 6,200 |

Sai Life Sciences Peer Comparison

| Company | Market Cap (₹ Cr.) | Revenue (₹ Cr.) | EPS (₹) |

|---|---|---|---|

| Sai Life Sciences | 11,418.6 | 1,494.27 | 4.53 |

| Divi’s Laboratories | 16,255.6 | 7,845.00 | 60.27 |

| Syngene International | 37,281.0 | 5,608.00 | 12.69 |

Sai Life Sciences competes with larger players like Divi’s and Syngene, yet its rapid growth and innovative strategies make it a strong contender.

FAQs

1. What is the Sai Life Sciences share price target for 2025?

The target ranges between ₹650 and ₹700 by December 2025.

2. What drives Sai Life Sciences’ growth?

Its focus on drug discovery and manufacturing, backed by strategic global partnerships, contributes significantly to its growth.

3. How does Sai Life Sciences compare to peers?

While it is smaller than Divi’s Laboratories and Syngene, Sai Life Sciences exhibits faster revenue growth and expanding global footprints.

Final Words

Sai Life Sciences’ integrated business model, strong financials, and consistent growth position it as a compelling investment option. The Sai Life Sciences share price target projects steady appreciation, offering long-term potential for investors in the pharmaceutical sector.