Subam Papers Limited is all set to launch its Initial Public Offering (IPO) from September 30, 2024, to October 3, 2024. The company aims to raise ₹93.70 crores through a fresh issue of 61.64 lakh shares, priced between ₹144 and ₹152 per share. This Subam Papers IPO offers investors an opportunity to invest in a company focused on sustainable paper production, especially in the packaging sector. The IPO is generating significant buzz due to its affordable pricing and the company’s strong presence in the paper manufacturing sector. Below, we will dive deeper into the details of the Subam Papers IPO, including its subscription process, business overview, financials, and allotment status.

Subam Papers IPO Details

Here are the essential details of the Subam Papers IPO:

| IPO Feature | Details |

|---|---|

| IPO Open Date | September 30, 2024 |

| IPO Close Date | October 3, 2024 |

| Face Value | ₹10 per share |

| Price Band | ₹144 – ₹152 per share |

| Lot Size | 800 shares |

| Total Issue Size | ₹93.70 crores |

| Listing At | BSE SME |

| Minimum Investment | ₹1,21,600 (800 shares) |

| HNI Investment (2 lots) | ₹2,43,200 |

| Objective of Issue | Capex in subsidiary, corporate expenses |

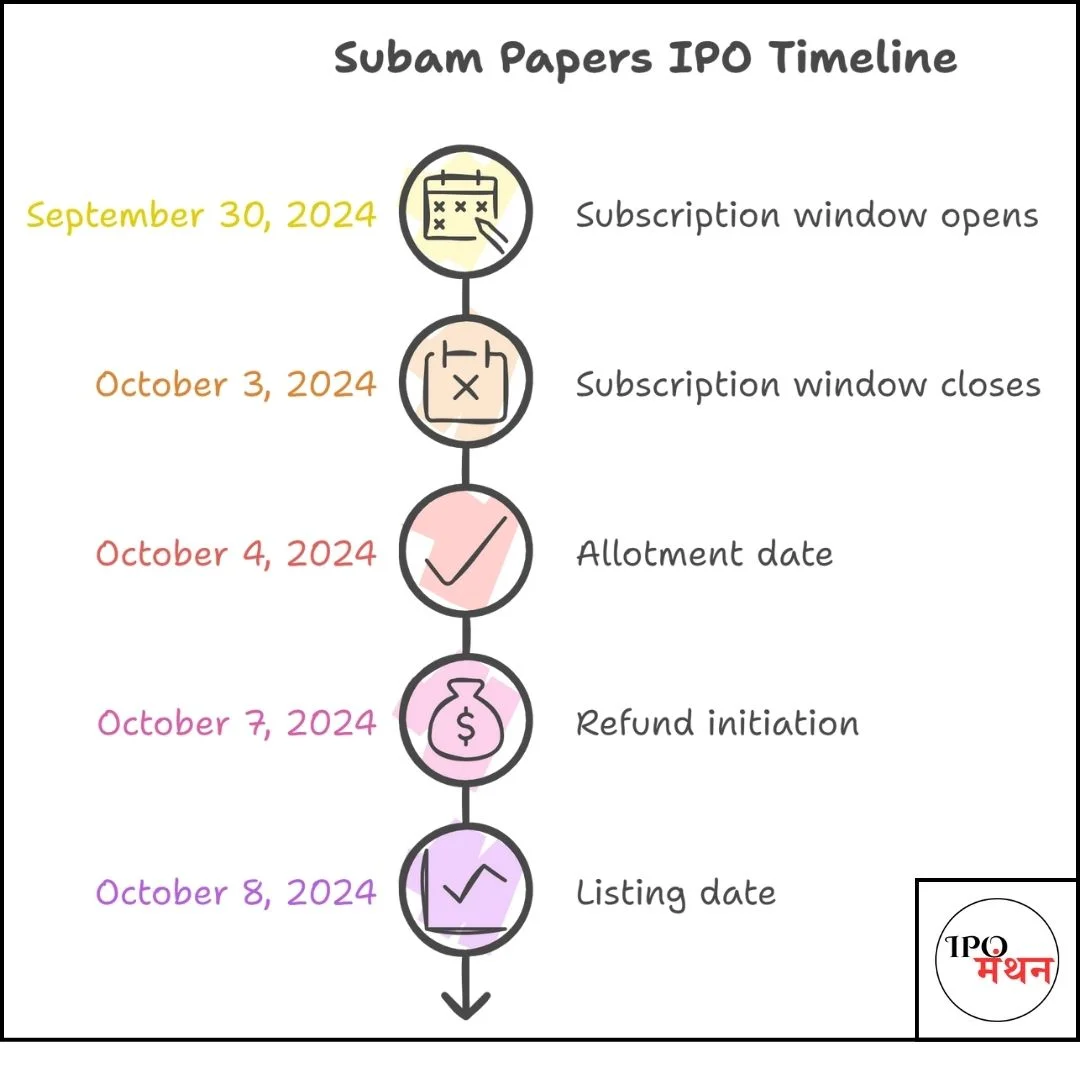

Subam Papers IPO Subscription Details

The subscription window for the Subam Papers IPO is from September 30, 2024, to October 3, 2024. Investors can apply through both online platforms or traditional brokers. Retail investors can buy a minimum of 800 shares per lot, while High-Net-Worth Individuals (HNIs) are required to invest in at least 2 lots, which amounts to ₹2,43,200.

Key Dates for Subscription:

| Subscription Dates | Details |

|---|---|

| Open Date | September 30, 2024 |

| Close Date | October 3, 2024 |

| Allotment Date | October 4, 2024 |

| Refund Initiation | October 7, 2024 |

| Listing Date | October 8, 2024 |

The IPO has garnered attention, especially among retail investors who are looking for affordable yet lucrative investment opportunities.

GMP Today for Subam Papers IPO

The Grey Market Premium (GMP) is an essential indicator that helps investors predict the potential listing price of a stock. The Subam Papers IPO GMP today is ₹25 showing a slight premium, indicating positive sentiment from the market. However, as always, GMP is volatile and should not be the sole criterion for making investment decisions.

Business Overview of Subam Papers Limited

Subam Papers Limited, established in 2004, is a major manufacturer of Kraft paper and Duplex boards. The company is committed to sustainable production practices by utilizing waste paper as raw material, thus avoiding wood pulp. The focus on eco-friendly paper products positions Subam Papers as a key player in the paper and packaging industries, which are seeing growth due to increased demand from FMCG, e-commerce, and textiles sectors.

Business Highlights:

- Specializes in Kraft paper and Duplex boards

- Uses 100% waste paper as raw material

- Located in Tamil Nadu, offering strategic advantages

- Strong clientele base, with over 1,000 customers in multiple sectors

The company’s sustainable approach and increasing demand for packaging materials due to e-commerce expansion make the Subam Papers IPO an appealing prospect for many investors.

Financials of Subam Papers Limited

The financial health of Subam Papers plays a crucial role in evaluating the Subam Papers IPO. Here are the key financial metrics as of March 31, 2024:

| Financial Metric | Value (₹ Lakhs) |

|---|---|

| Revenue | ₹49,697.31 |

| Net Profit | ₹3,341.80 |

| Total Assets | ₹46,046.10 |

| Revenue Growth | -3% YoY |

| Net Profit Growth | +12,574% YoY |

The company has seen a remarkable 12,574% increase in net profit despite a slight revenue decline of 3% from the previous fiscal year. The company’s financials underscore its ability to manage its costs efficiently while boosting profitability.

Subam Papers IPO Review

Based on its sustainable business model and strong financials, the Subam Papers IPO looks promising. The company’s ability to generate profit in a cost-sensitive industry like paper manufacturing indicates operational efficiency. Additionally, its focus on environmental sustainability by using recycled waste paper resonates well with the global trend towards green production.

However, investors should be aware of the potential risks, including:

- Raw Material Price Fluctuations: Dependence on waste paper prices can impact profit margins

- Geographic Concentration: Operations are largely concentrated in Tamil Nadu, posing regional risks

- Market Competition: Intense competition in the paper industry can pressure pricing

Subam Papers IPO Allotment Status

Once the subscription window closes on October 3, 2024, the allotment process will begin. Investors can check the status of their allotment by visiting the official registrar’s website, Bigshare Services Private Limited, or the BSE website.

Steps to Check Allotment Status:

- Visit the registrar’s website or BSE website

- Select the “Subam Papers IPO” from the dropdown list

- Enter your Application Number or PAN

- Click “Submit” to view the status

Frequently Asked Questions (FAQs)

1. What is the Subam Papers IPO?

The Subam Papers IPO is a public offering of 61.64 lakh shares, aiming to raise ₹93.70 crores at a price band of ₹144 – ₹152 per share.

2. What is the listing date for Subam Papers IPO?

The shares of Subam Papers are expected to be listed on the BSE SME on October 8, 2024.

3. What is the minimum investment required for Subam Papers IPO?

Retail investors are required to invest a minimum of ₹1,21,600 for one lot, which consists of 800 shares.

4. What are the objectives of the Subam Papers IPO?

The primary objectives are:

- Investment in the company’s subsidiary for capital expenditure (₹75 crores)

- General corporate purposes (₹18.70 crores)

5. How can I check the allotment status for Subam Papers IPO?

You can check the allotment status by visiting Bigshare Services Private Limited or the BSE website. Enter your Application Number, PAN, or DP Client ID to check the status.

6. What sectors does Subam Papers serve?

The company provides paper products to sectors such as FMCG, e-commerce, textiles, and pharmaceuticals.

Conclusion

The Subam Papers IPO presents an exciting opportunity for investors seeking exposure to the paper and packaging industry. With its eco-friendly approach, strong financials, and commitment to sustainability, Subam Papers is well-positioned to grow in a market increasingly focused on sustainable products. Investors should carefully weigh the company’s growth potential and the risks associated with raw material costs and competition before making a decision. Keep an eye on the GMP to gauge market sentiment and prepare for the allotment process once the subscription period concludes.

Thank you for reading and staying informed about the Subam Papers IPO!