Swiggy Limited is gearing up for its much-anticipated IPO opening from November 6 to November 8, 2024. The Swiggy IPO, aiming to raise ₹11,700 crores, is expected to be one of the biggest offerings in India this year. Investors are closely monitoring the Swiggy IPO GMP today, as it reflects strong market sentiment ahead of the public issue. This IPO presents a unique opportunity for those interested in India’s booming online food delivery and quick-commerce sectors.

Swiggy IPO Details

Here’s a quick look at the basic details of the Swiggy IPO:

| IPO Details | Description |

|---|---|

| IPO Dates | November 6 – November 8, 2024 |

| Price Band | ₹371 to ₹390 per share |

| Lot Size | 38 shares, ~₹14,820 minimum investment |

| Total Issue Size | ₹11,700 crores |

| Fresh Issue | ₹4,500 crores |

| Offer for Sale (OFS) | ₹7,250 crores |

| Listing Date | Expected on November 13, 2024 |

The IPO is split into a fresh issue of ₹4,500 crores and an offer for sale (OFS) of ₹7,250 crores. The funds from the fresh issue will be used to pay off borrowings, expand Swiggy’s quick commerce segment, and enhance technology infrastructure, among other uses.

Swiggy IPO Subscription Process

For those interested in investing in Swiggy, the IPO subscription process is straightforward. Investors need to apply in lots of 38 shares, amounting to a minimum investment of approximately ₹14,820.

Subscription Structure:

- Qualified Institutional Buyers (QIB): 75% of the total shares offered.

- Non-Institutional Investors (NII): 15% of the shares.

- Retail Individual Investors (RII): 10% of the shares.

Swiggy IPO GMP Today

One important factor to keep an eye on before investing in an IPO is its Grey Market Premium (GMP), which can offer insights into market sentiment. As of today, the Swiggy IPO GMP is reported to be approximately ₹20 per share. This means that in the grey market, Swiggy’s shares are trading at a premium, reflecting positive sentiment among investors ahead of the IPO opening.

The Swiggy IPO GMP today indicates that demand for Swiggy shares is strong, as investors are expecting significant returns from the company’s stock market debut. Monitoring the Swiggy IPO GMP today as the subscription dates approach will help investors understand how demand may impact the listing price.

Swiggy Business Overview

Founded in 2014, Swiggy Limited has grown to become one of India’s largest online food delivery platforms. Swiggy started by offering online food delivery but has since diversified into multiple services:

- Instamart: A quick-commerce platform for grocery and essential deliveries.

- Swiggy Genie: Same-day package delivery.

- Dineout: Restaurant reservation and dining-out services.

Swiggy operates a comprehensive logistics network, covering over 27,000 PIN codes and reaching 97% of India’s population, with a focus on Tier 2 and Tier 3 cities. This extensive reach allows Swiggy to serve a broad and diverse customer base.

Technology and Business Model

Swiggy relies on an asset-light, technology-driven model with over 317 leased facilities and 3,421 delivery centers. A significant portion of its operations is managed by a gig workforce, which helps control costs and streamline deliveries. In FY2024, Swiggy’s average delivery cost per order was recorded at ₹39.65, demonstrating efficient logistics and cost control.

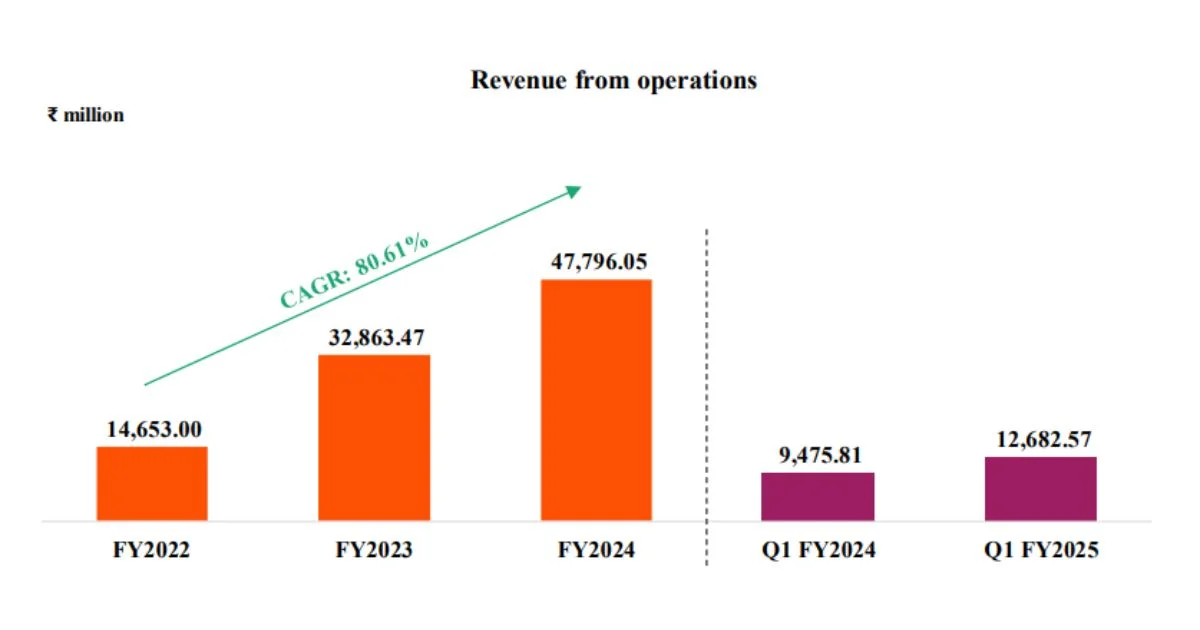

Swiggy’s Financials – Revenue and Profit Growth

Swiggy has reported significant financial growth in recent years. Here’s a snapshot of Swiggy’s performance for FY2024:

- Revenue from Operations: ₹11,634 crores, up 36% year-on-year.

- Net Loss: Reduced to ₹2,350 crores from ₹4,179 crores in FY2023.

- Cash Flow: Positive cash flow from operating activities, recorded at ₹1,312 crores in FY2024.

Swiggy has steadily increased revenue, particularly through its food delivery and quick-commerce services. While the company has yet to reach profitability, it has improved its financials by reducing operational costs and expanding high-growth segments like Instamart.

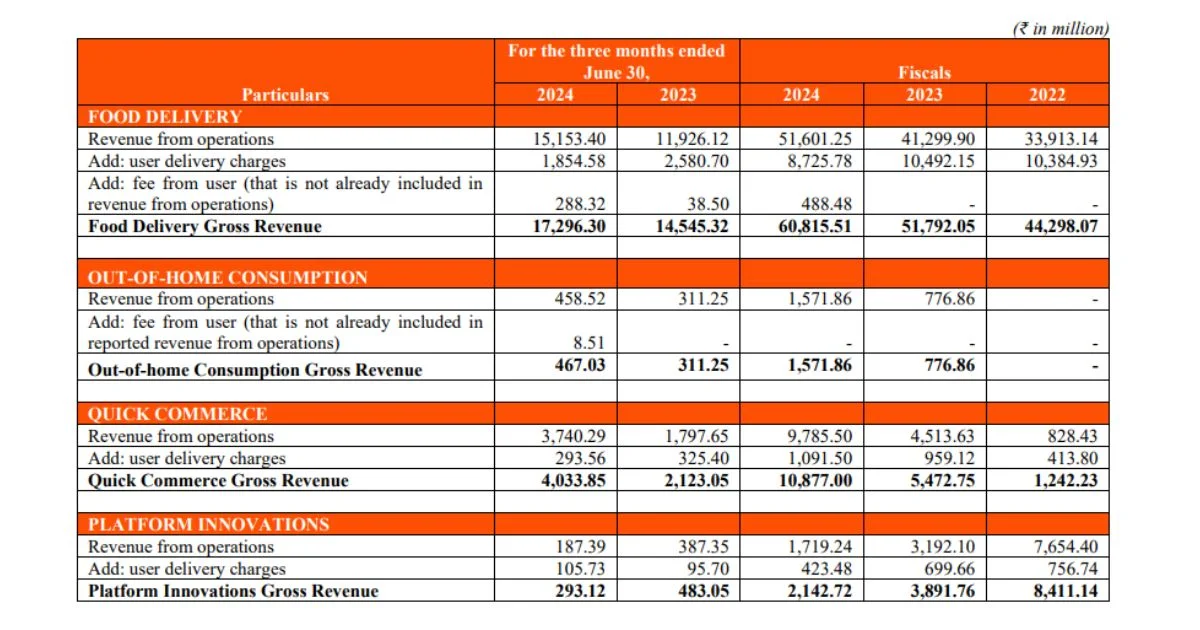

Revenue Breakdown

- Food Delivery: Contributed approximately ₹6,100 crores.

- Quick Commerce (Instamart): Generated around ₹1,100 crores.

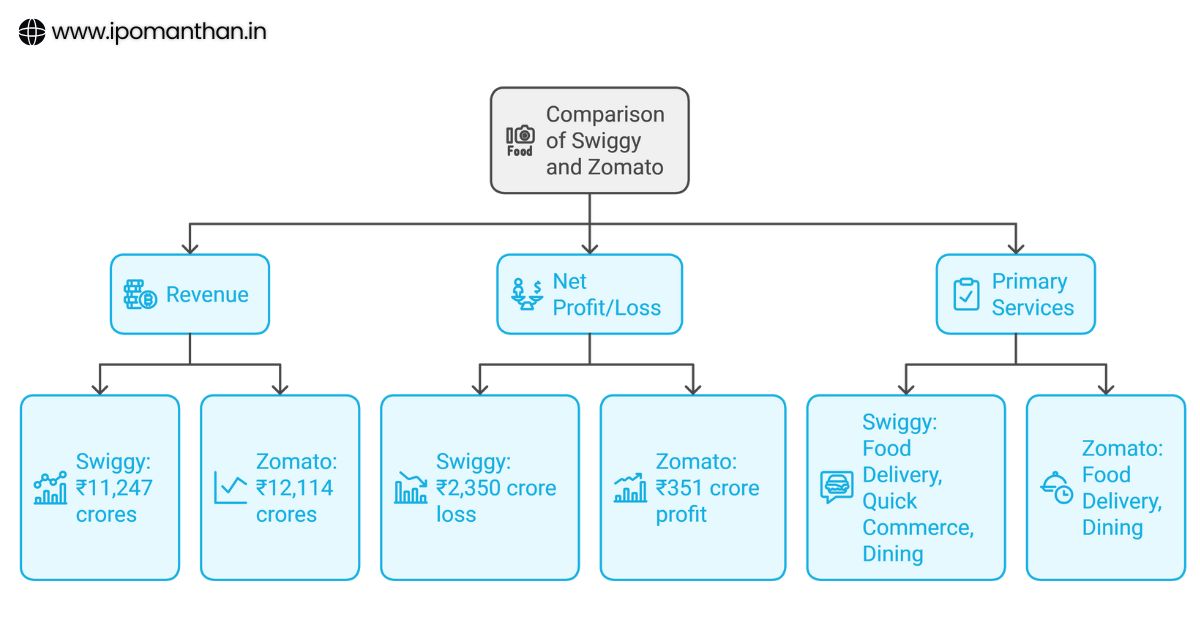

Comparing Swiggy with Zomato

Swiggy faces stiff competition from Zomato, another major player in India’s food delivery market. Here’s how Swiggy stacks up against Zomato:

| Metric | Swiggy (FY2024) | Zomato (FY2024) |

|---|---|---|

| Revenue | ₹11,247 crores | ₹12,114 crores |

| Net Profit/Loss | ₹2,350 crore loss | ₹351 crore profit |

| Primary Services | Food Delivery, Quick Commerce, Dining | Food Delivery, Dining |

Zomato achieved profitability in FY2024, posting a net profit of ₹351 crores, while Swiggy has focused on reducing its losses. This comparison highlights Zomato’s advantage in profitability, although Swiggy’s growing quick-commerce and grocery segment (Instamart) gives it a unique market position.

Swiggy IPO Review – Is it a Good Investment?

Swiggy’s IPO presents an opportunity for investors to participate in India’s growing food delivery and quick-commerce markets. The Swiggy IPO GMP today reflects positive sentiment, but here are some factors to consider:

Strengths

- Large and Growing User Base: Swiggy has a vast logistics network and reach, especially in Tier 2+ cities.

- Diverse Offerings: The introduction of Instamart and Genie has diversified Swiggy’s revenue streams beyond food delivery.

- Improving Financials: Significant reduction in losses indicates a positive trend toward profitability.

Risks

- Intense Competition: Strong competition from Zomato and new entrants.

- Operational Challenges: High dependency on delivery partners and complex logistics.

- Profitability Concerns: Swiggy is still not profitable, which might deter some risk-averse investors.

Swiggy IPO Allotment Process

Swiggy’s IPO allotment is divided into three categories:

- QIBs (75%): Reserved for institutional investors.

- NII (15%): Allocated for non-institutional investors.

- Retail Investors (10%): For individual retail investors.

Important Dates:

- IPO Subscription Period: November 6 – November 8, 2024.

- Allotment Date: Expected on November 11, 2024.

- Credit to Demat Accounts: By November 12, 2024.

- Listing Date: Anticipated on November 13, 2024.

To check allotment status, investors can visit the BSE/NSE websites using their PAN or application number after the allotment date.

FAQs – Swiggy IPO GMP Today, Allotment, and More

1. What is the Swiggy IPO GMP today?

- The Swiggy IPO GMP today is approximately ₹20 per share, reflecting positive market sentiment.

2. What is the minimum investment in the Swiggy IPO?

- Investors need to invest a minimum of ₹14,820 for one lot (38 shares).

3. How will Swiggy use the funds from the IPO?

- The proceeds will be used for debt repayment, expanding Swiggy’s dark store network for quick commerce, technology investments, and general corporate purposes.

4. Can I apply through UPI?

- Yes, retail investors can apply through UPI-based platforms or brokerage apps.

5. Is Swiggy’s business model sustainable?

- Swiggy’s diversified services and growing demand for quick commerce and food delivery suggest long-term potential. However, profitability remains a focus area.

6. How does Swiggy’s valuation compare with Zomato?

- Swiggy is expected to be valued at approximately $11.2 billion, while Zomato has shown strong profitability, giving it a favorable market position.

7. How can I check my allotment status?

- Allotment status can be checked on the BSE/NSE websites using the application number and PAN.

8. What are the risks of investing in the Swiggy IPO?

- Major risks include competition from Zomato, high operational costs, and current net losses.

Conclusion

Swiggy’s IPO is generating considerable interest, and with the Swiggy IPO GMP today indicating positive demand, this IPO could be an attractive opportunity for

investors looking to tap into India’s expanding digital economy. However, with profitability concerns and stiff competition, investors should consider their risk tolerance before investing.