Vishal Mega Mart, one of India’s leading retail chains, is all set to launch its highly anticipated Initial Public Offering (IPO). The IPO aims to raise significant capital, and Vishal Mega Mart IPO GMP has generated substantial interest among investors. Here’s everything you need to know about the Vishal Mega Mart IPO.

Vishal Mega Mart IPO Details

| Key IPO Details | Information |

|---|---|

| Issue Size | ₹8,000 crore (OFS) |

| Price Band | ₹74 to ₹78 per share |

| Lot Size | 190 shares |

| Minimum Investment | ₹14,820 |

| Market Cap Post-IPO | ₹35,168 crore |

| Listing Exchanges | BSE, NSE |

The entire issue is an Offer for Sale (OFS), with Samayat Services LLP, the promoter group, diluting their stake.

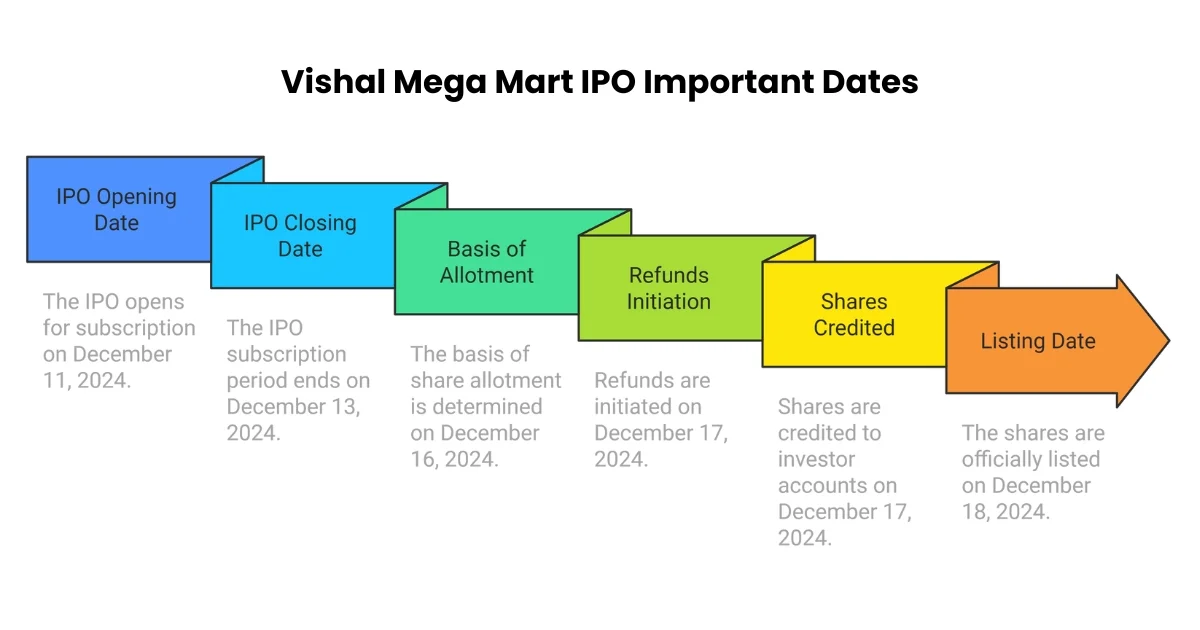

Vishal Mega Mart IPO Important Dates

| Event | Date |

|---|---|

| IPO Opening Date | December 11, 2024 |

| IPO Closing Date | December 13, 2024 |

| Basis of Allotment | December 16, 2024 |

| Refunds Initiation | December 17, 2024 |

| Shares Credited | December 17, 2024 |

| Listing Date | December 18, 2024 |

Vishal Mega Mart IPO Subscription Details

The IPO has a well-defined allocation structure.

| Investor Category | Percentage Allocation | Amount (₹ Cr) |

|---|---|---|

| Qualified Institutional Buyers (QIBs) | 50% | ₹4,000 crore |

| Non-Institutional Investors (NIIs) | 15% | ₹1,200 crore |

| Retail Individual Investors (RIIs) | 35% | ₹2,800 crore |

Retail investors can apply for a maximum of 13 lots, totaling ₹1,92,660.

Vishal Mega Mart IPO GMP Today

Vishal Mega Mart IPO GMP Today is ₹20. This suggests a potential listing premium of approximately 25.64% over the upper price band of ₹78. Vishal Mega Mart IPO GMP indicates strong investor sentiment, reflecting optimism about the IPO’s performance.

Vishal Mega Mart Business Overview

Vishal Mega Mart is a pioneer in the organized retail space in India, catering primarily to Tier-II and Tier-III cities.

- Founded: 2001

- Operational Reach: 645 stores in 414 cities across 28 states and two union territories.

- Customer Base: Serves nearly 945 million customers annually.

Product Portfolio:

- Apparel: Affordable clothing for men, women, and children.

- FMCG: Groceries, personal care items, and household essentials.

- General Merchandise: Kitchenware, furniture, and home décor.

- Private Labels: Offers in-house brands for higher margins and affordability.

Vishal Mega Mart Financials

The company’s financial growth has been consistent over the years.

| Metric | FY 2022 | FY 2023 | FY 2024 | H1 FY 2025 |

|---|---|---|---|---|

| Revenue (₹ Cr) | 5,588.52 | 7,618.89 | 8,911.94 | 5,032.51 |

| PAT (₹ Cr) | 202.77 | 321.27 | 461.94 | 254.13 |

| EBITDA (₹ Cr) | 803.68 | 1,148.60 | 1,248.60 | 668.03 |

| Net Worth (₹ Cr) | 48,499.33 | 51,808.38 | 56,465.92 | 59,237.40 |

Key financial ratios highlight operational efficiency:

- ROCE: 29.77% (H1 FY 2025), reflecting effective capital utilization.

- EBITDA Margin: Approximately 14%, indicating cost efficiency.

Vishal Mega Mart IPO Review

Strengths:

- A vast retail network covering underpenetrated markets in Tier-II and Tier-III cities.

- Diverse product range catering to value-conscious customers.

- Strong private-label offerings boosting profitability.

- Consistent financial performance with robust revenue growth.

Risks:

- Rising competition from e-commerce platforms.

- High dependency on third-party suppliers for key product categories.

Valuation: The price-to-earnings (P/E) ratio is approximately 76.13x, reflecting a premium valuation that aligns with its market dominance and growth potential.

Vishal Mega Mart IPO Allotment

Allotment will follow a proportional basis for retail investors and discretionary allocation for institutional investors.

Allotment Timeline:

- Basis of Allotment Finalized: December 16, 2024

- Refunds Initiation: December 17, 2024

- Shares Credited to Demat Accounts: December 17, 2024

- Listing on Exchanges: December 18, 2024

FAQs

What is the price band for Vishal Mega Mart IPO?

₹74 to ₹78 per share.

What is the Vishal Mega Mart IPO GMP today?

The Vishal Mega Mart IPO GMP Today is ₹20 as of December 11, 2024.

What is the minimum investment required?

₹14,820 for one lot (190 shares).

When will the shares be listed?

Shares will be listed on December 18, 2024.

How can I apply for the IPO?

Applications can be submitted through ASBA-enabled banks or broker platforms.

Who are the promoters of Vishal Mega Mart?

Samayat Services LLP, holding 96.46% pre-IPO.

What are the financial highlights?

Revenue for FY 2024 was ₹8,911.94 crore, with a PAT of ₹461.94 crore.

What is the allocation breakdown?

QIBs: 50%, NIIs: 15%, RIIs: 35%.

What is the maximum retail investment allowed?

₹1,92,660 for 13 lots (2,470 shares).

What are the IPO proceeds used for?

Since it is an OFS, proceeds will go to the selling shareholders.

Conclusion

The Vishal Mega Mart IPO presents an opportunity to invest in one of India’s leading retail chains with a strong presence in Tier-II and Tier-III cities. Its financial growth, robust operational reach, and promising Vishal Mega Mart IPO GMP make it an attractive choice for investors. However, risks such as rising competition and supplier dependency should be weighed before investing.