Waaree Energies, one of India’s largest solar module manufacturers, is generating strong interest in the market with its upcoming IPO and rapid growth in the renewable energy sector. Investors are eagerly anticipating the company’s share price trajectory following the IPO. This blog explores Waaree Energies share price targets for 2024, 2025, 2026, 2030, and 2040, along with insights into the factors driving these projections, including the company’s financials, market position, and potential growth in India’s clean energy sector. Here’s a detailed look at Waaree Energies’ share price targets.

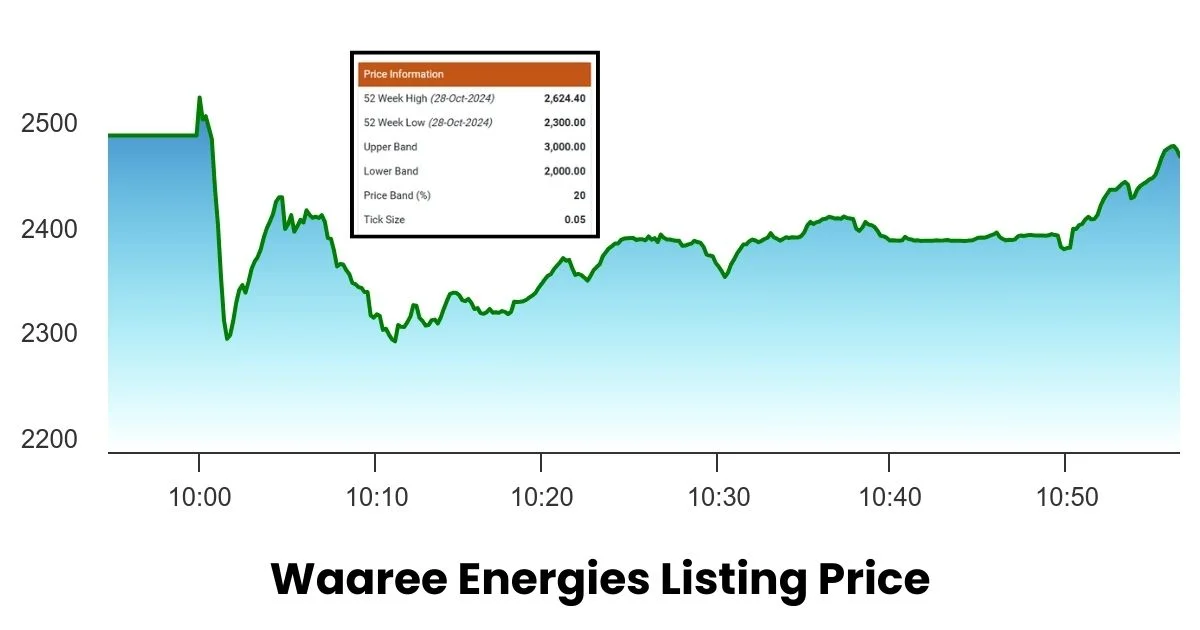

Waaree Energies Listing Price

Waaree Energies had a strong debut on the stock market on October 28, 2024, with its listing price set at Rs 2,500 on the National Stock Exchange (NSE), showing a 66.3% increase over the IPO price of Rs 1,503. On the Bombay Stock Exchange (BSE), the shares opened even higher at Rs 2,550, which is a 69.66% premium.

The IPO was highly successful, raising about Rs 4,321 crore and being oversubscribed 76.34 times, especially due to strong interest from institutional investors who subscribed 208.63 times their share. Despite this initial success, Waaree Energies listing price saw a slight drop of around 10%, falling to about Rs 2,294.50 as some investors chose to take profits.

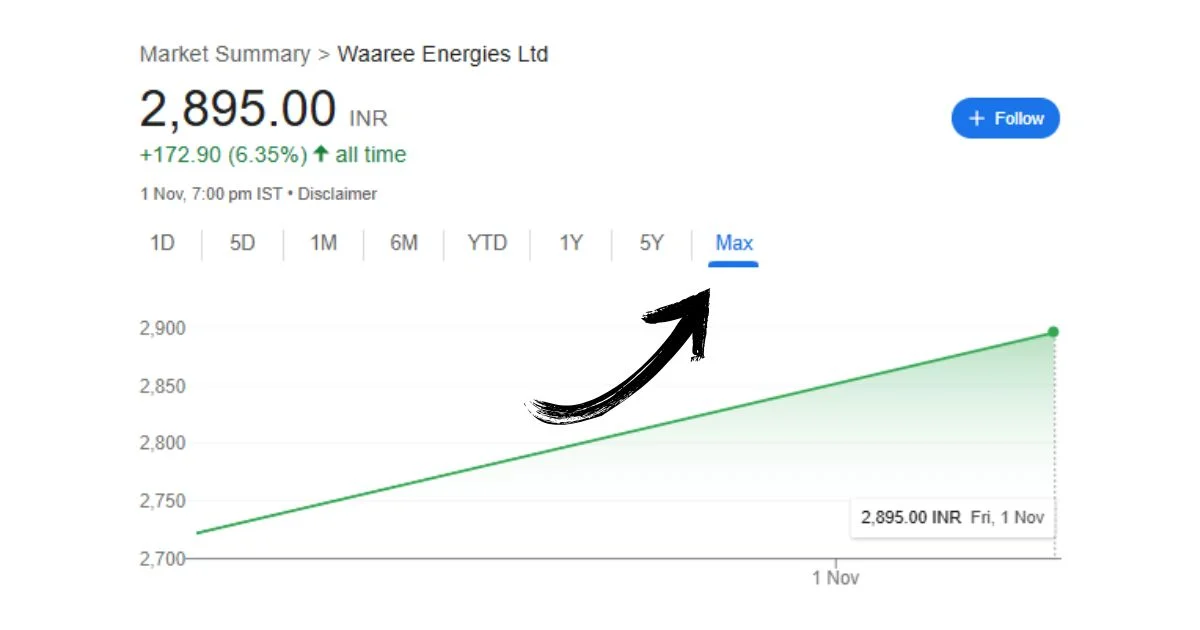

Waaree Energies Share Price History

Waaree Energies Ltd, a prominent name in the renewable energy sector, has shown remarkable price movements since its recent IPO on October 28, 2024, where it debuted with an impressive 56% gain on the first trading day. This strong performance has caught investor attention, driven by the company’s potential in a fast-growing industry. Over recent months, Waaree’s stock has achieved both significant highs and lows:

- Lifetime High: ₹3,568.80, reflecting a 46.95% increase in a recent session.

These fluctuations underscore both investor enthusiasm and the volatility characteristic of the renewable energy market.

Waaree Energies Share Price Target: Overview and Projections

The “Waaree Energies share price target” for upcoming years is shaped by its strategic initiatives, impressive financials, and the demand for renewable energy solutions.

| Year | Min Price Target | Max Price Target |

|---|---|---|

| 2024 (Nov-Dec) | ₹1,470 | ₹3,000 |

| 2025 | ₹2,500 | ₹3,500 |

| 2026 | ₹1,270 | ₹4,644 |

| 2030 | ₹1,420 | ₹9,495 |

| 2040 | ₹8,000 | ₹8,500 |

Waaree Energies Share Price Target 2024

With the IPO opening on October 21, 2024, Waaree Energies’ share price is expected to see significant gains by the end of 2024, as indicated by its Grey Market Premium (GMP) and the IPO price range.

- IPO Price Range: ₹1,427 to ₹1,503

- GMP: ₹1,470 (reflecting high demand)

- Listing Date: October 28, 2024

| Month | Min Target | Max Target |

|---|---|---|

| November | ₹1,470 | ₹2,500 |

| December | ₹1,800 | ₹3,000 |

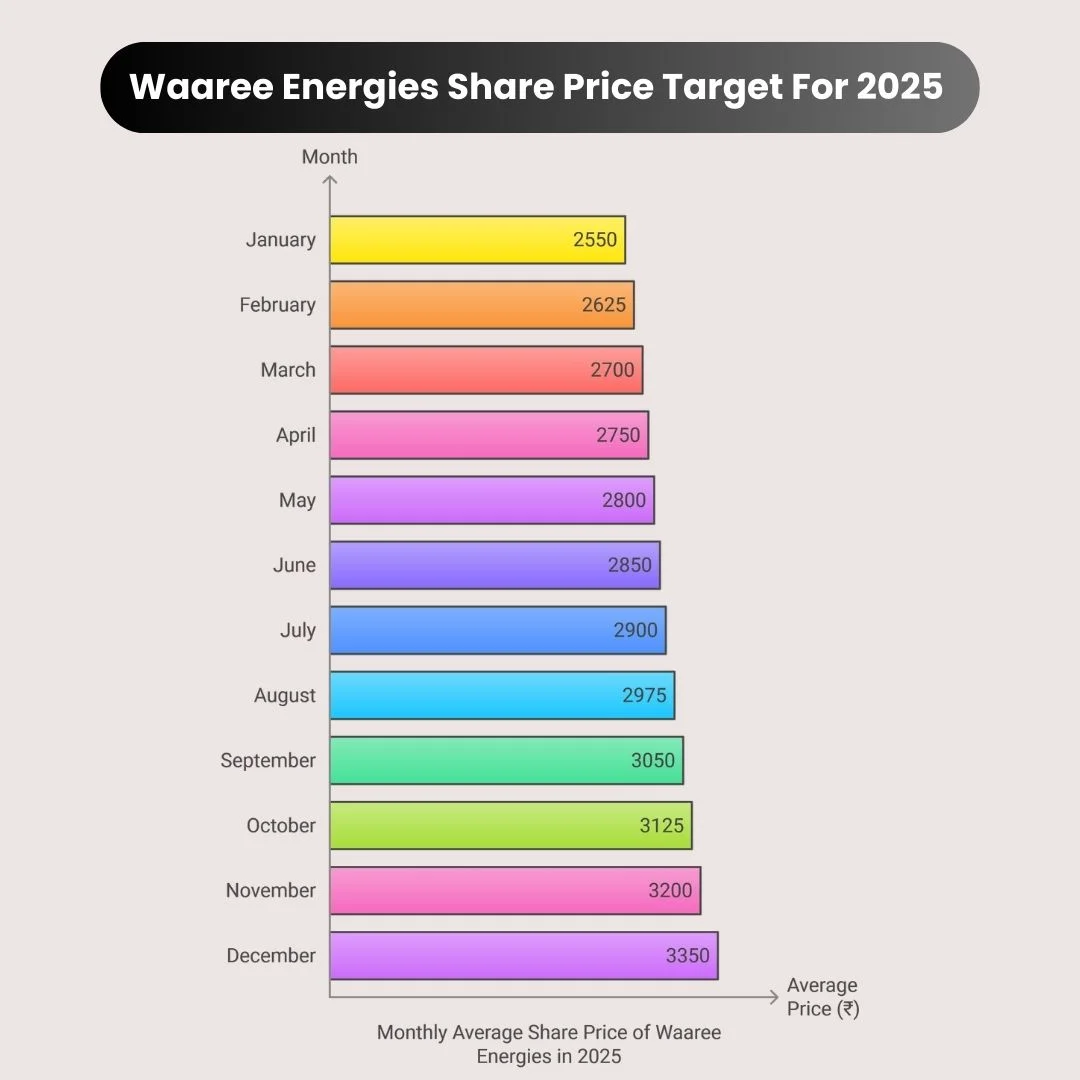

Waaree Energies Share Price Target 2025

For 2025, Waaree share price is projected to benefit from ongoing growth in India’s renewable energy sector, government policies favoring solar energy, and increased production capacity.

| Month | Min Target | Max Target |

|---|---|---|

| January | ₹2,500 | ₹2,600 |

| February | ₹2,550 | ₹2,700 |

| March | ₹2,600 | ₹2,800 |

| April | ₹2,650 | ₹2,850 |

| May | ₹2,700 | ₹2,900 |

| June | ₹2,750 | ₹2,950 |

| July | ₹2,800 | ₹3,000 |

| August | ₹2,850 | ₹3,100 |

| September | ₹2,900 | ₹3,200 |

| October | ₹3,000 | ₹3,250 |

| November | ₹3,100 | ₹3,300 |

| December | ₹3,200 | ₹3,500 |

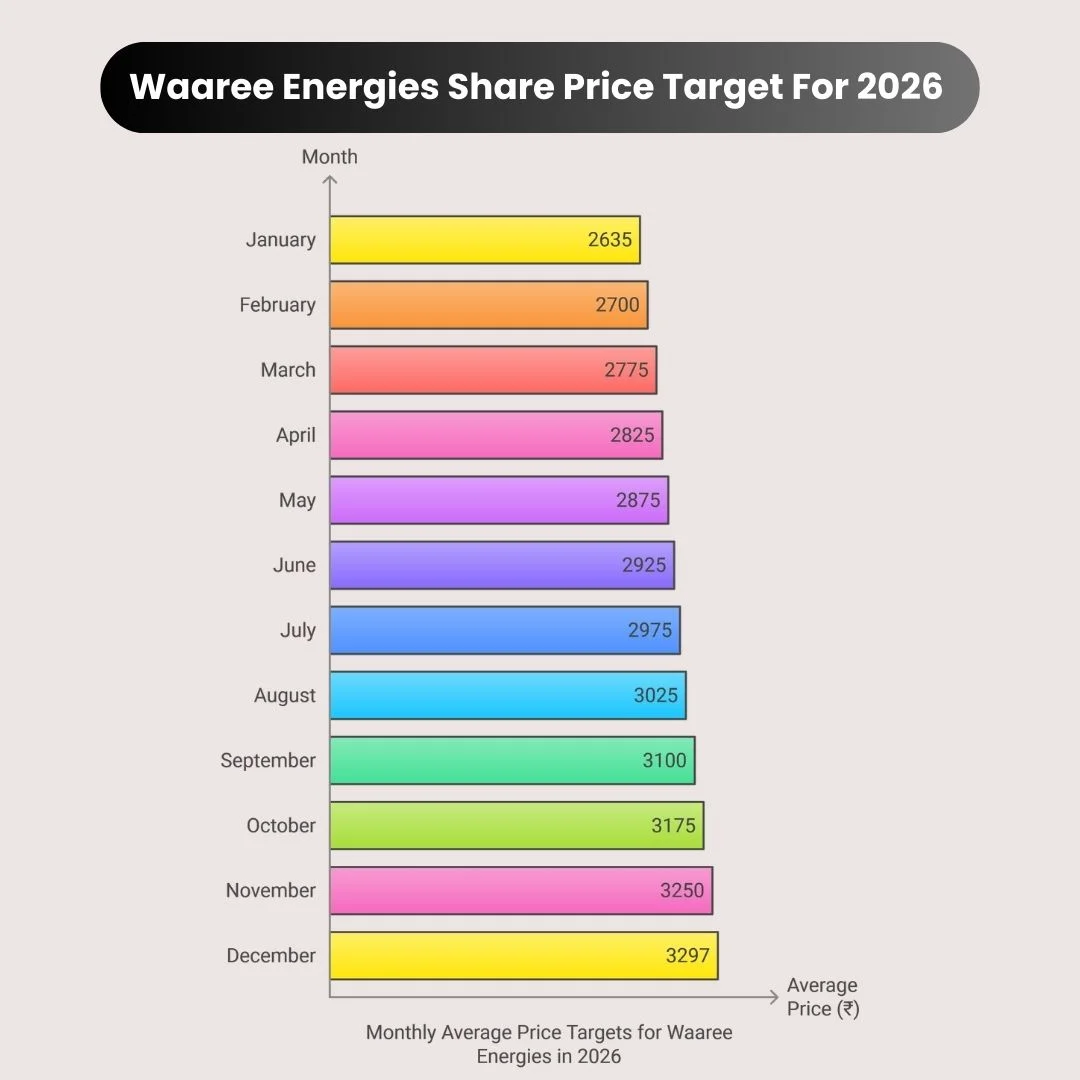

Waaree Energies Share Price Target 2026

For 2026, Waaree Energies’ price target is driven by its financial growth, technological advancements, and increasing demand for renewable energy.

| Month | Min Target | Max Target |

|---|---|---|

| January | ₹1,270 | ₹4,000 |

| February | ₹1,300 | ₹4,100 |

| March | ₹1,350 | ₹4,200 |

| April | ₹1,400 | ₹4,250 |

| May | ₹1,450 | ₹4,300 |

| June | ₹1,500 | ₹4,350 |

| July | ₹1,550 | ₹4,400 |

| August | ₹1,600 | ₹4,450 |

| September | ₹1,700 | ₹4,500 |

| October | ₹1,800 | ₹4,550 |

| November | ₹1,900 | ₹4,600 |

| December | ₹1,950 | ₹4,644 |

Waaree Energies Share Price Target 2030

In 2030, Waaree Energies is positioned to capitalize on India’s goal to add substantial solar capacity by this year. Its share price target reflects both conservative and optimistic growth estimates.

| Month | Min Target | Max Target |

|---|---|---|

| January | ₹1,420 | ₹6,500 |

| February | ₹1,500 | ₹6,800 |

| March | ₹1,550 | ₹7,000 |

| April | ₹1,600 | ₹7,200 |

| May | ₹1,700 | ₹7,400 |

| June | ₹1,800 | ₹7,600 |

| July | ₹1,900 | ₹7,800 |

| August | ₹2,000 | ₹8,000 |

| September | ₹2,100 | ₹8,200 |

| October | ₹2,200 | ₹8,500 |

| November | ₹2,300 | ₹9,000 |

| December | ₹2,400 | ₹9,495 |

Waaree Energies Share Price Target 2040

The 2040 targets for Waaree Energies assume it successfully scales operations, leverages technological advancements, and benefits from favorable government policies.

| Month | Min Target | Max Target |

|---|---|---|

| January | ₹8,000 | ₹8,100 |

| February | ₹8,050 | ₹8,150 |

| March | ₹8,100 | ₹8,200 |

| April | ₹8,150 | ₹8,300 |

| May | ₹8,200 | ₹8,350 |

| June | ₹8,250 | ₹8,400 |

| July | ₹8,300 | ₹8,450 |

| August | ₹8,350 | ₹8,500 |

| September | ₹8,400 | ₹8,550 |

| October | ₹8,450 | ₹8,600 |

| November | ₹8,500 | ₹8,650 |

| December | ₹8,500 | ₹8,700 |

Factors Influencing Waaree Energies Share Price Targets

IPO Performance: Strong demand reflected in the GMP and projected listing gains signal high investor interest.

Financial Performance: Consistent revenue and profit growth, with revenue increasing from ₹2,854.3 crore in FY 2022 to ₹11,397.6 crore in FY 2024, supports positive future performance.

Market Position: Waaree’s role as a leading solar module manufacturer in India provides a strong market advantage.

Technological Edge: Innovations in solar module technology (e.g., TopCon) and backward integration to increase production capacity ensure continued growth.

Government Policies: Supportive government initiatives are likely to benefit the company as India pushes for renewable energy adoption.

Waaree Energies Business Overview

Waaree Energies offers a full range of solar solutions, including solar panel manufacturing, EPC (Engineering, Procurement, and Construction) services, and operations and maintenance. The company’s products reach over 68 countries, and it holds major contracts with large clients, reflecting its strong international presence and robust financial position. Waaree is strategically expanding production capacity to meet the rising demand for renewable energy solutions in India and globally.

FAQs

1. What is Waaree Energies’ share price target for 2024?

For November and December 2024, Waaree Energies’ share price target is between ₹1,470 and ₹3,000.

2. What is the projected share price for Waaree Energies in 2025?

Waaree Energies’ share price target for 2025 ranges from ₹2,500 to ₹3,500, with month-wise growth potential.

3. Will Waaree Energies reach ₹4,000 by 2026?

Yes, Waaree Energies’ price target suggests it could reach up to ₹4,644 by December 2026.

4. What is the share price target for Waaree Energies in 2030?

In 2030, Waaree Energies’ share price is projected between ₹1,420 and ₹9,495, with month-wise growth in this range.

5. Could Waaree Energies hit ₹8,500 by 2040?

By December 2040, Waaree Energies’ share price target is between ₹8

,000 and ₹8,500, assuming stable growth.

Disclaimer

All projections provided here are speculative and based on current market trends, company performance, and industry analysis. Investors are advised to do thorough research or consult a financial advisor before making any investment decisions.